Red Lobster 2014 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2014 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Darden

2014 Annual Report 9

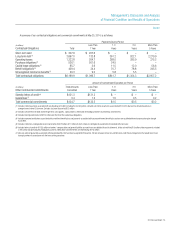

Selling, general and administrative expenses increased $38.1 million,

or 6.1 percent, from $625.4 million in fiscal 2013 to $663.5 million in fiscal

2014. Selling, general and administrative expenses increased $85.3 million,

or 15.8 percent, from $540.1 million in fiscal 2012 to $625.4 million in fiscal

2013. As a percent of sales, selling, general and administrative expenses

increased from fiscal 2013 to fiscal 2014 primarily as a result of the costs

related to implementation of the strategic action plan and workforce reductions

mentioned above, partially offset by sales leverage. As a percent of sales,

selling, general and administrative expenses increased from fiscal 2012

to fiscal 2013 primarily due to higher media costs and acquisition and

integration costs associated with the Yard House acquisition, partially offset

by sales leverage.

Depreciation and amortization expense increased $26.1 million, or

9.4 percent, from $278.3 million in fiscal 2013 to $304.4 million in fiscal

2014. Depreciation and amortization expense increased $37.0 million, or

15.3 percent, from $241.3 million in fiscal 2012 to $278.3 million in fiscal

2013. As a percent of sales, depreciation and amortization expense increased

in fiscal 2014 and fiscal 2013 primarily due to an increase in depreciable

assets related to new restaurants and remodel activities.

Net interest expense increased $8.3 million, or 6.6 percent, from

$126.0 million in fiscal 2013 to $134.3 million in fiscal 2014. Net interest

expense increased $23.9 million, or 23.4 percent, from $102.1 million in

fiscal 2012 to $126.0 million in fiscal 2013. As a percent of sales, net interest

expense was flat in fiscal 2014 compared to fiscal 2013. As a percent of

sales, net interest expense increased in fiscal 2013 compared to fiscal 2012

due to higher average debt balances in fiscal 2013, principally driven by the

acquisition of Yard House.

INCOME TAXES

The effective income tax rates for fiscal 2014, 2013 and 2012 for continuing

operations were (4.9) percent, 13.4 percent and 21.4 percent, respectively.

The decrease in our effective rate for fiscal 2014 compared to fiscal 2013

is primarily due to an increase in the impact of certain tax credits on lower

earnings before income taxes and a favorable adjustment related to the

deduction of ESOP dividends for the current and prior years, partially offset

by the impact of market-driven changes in the value of our trust-owned life

insurance that are excluded for tax purposes. The decrease in our effective

rate for fiscal 2013 compared to fiscal 2012 is primarily attributable to an

increase in the impact of FICA tax credits for employee reported tips on lower

earnings before income taxes and the tax impact of market-driven changes

in the value of our trust-owned life insurance that are excluded for tax

purposes, partially offset by a decrease in federal income tax credits related

to the HIRE Act.

The effective income tax rates for fiscal 2014, 2013 and 2012 for

discontinued operations were 23.9 percent, 29.4 percent and 30.2 percent,

respectively. The decrease in the effective rate for fiscal 2014 compared

to fiscal 2013 and for fiscal 2013 compared to fiscal 2012 is primarily due

to an increase in the impact of certain tax credits on lower earnings before

income taxes.

NET EARNINGS AND NET EARNINGS PER SHARE

FROM CONTINUING OPERATIONS

Net earnings from continuing operations for fiscal 2014 were $183.2 million

($1.38 per diluted share) compared with net earnings from continuing

operations for fiscal 2013 of $237.3 million ($1.80 per diluted share) and

net earnings from continuing operations for fiscal 2012 of $279.2 million

($2.10 per diluted share).

Net earnings from continuing operations for fiscal 2014 decreased

22.8 percent and diluted net earnings per share from continuing operations

decreased 23.3 percent compared with fiscal 2013, primarily due to higher

food and beverage costs and restaurant expenses as a percent of sales,

partially offset by increased sales and a lower effective income tax rate. Our

diluted net earnings per share from continuing operations for fiscal 2014

were adversely impacted by approximately $0.23, comprised of approxi-

mately $0.10 due to legal, financial advisory and other costs related to

implementation of the strategic action plan announced in December 2013,

approximately $0.08 due to asset impairment charges and approximately

$0.05 due to costs associated with our September 2013 workforce reduction.

Net earnings from continuing operations for fiscal 2013 decreased

15.0 percent and diluted net earnings per share from continuing operations

decreased 14.3 percent compared with fiscal 2012 primarily due to higher

selling, general and administrative expenses, restaurant expenses, depre-

ciation and amortization expenses and net interest expense as a percent of

sales, partially offset by increased sales and a lower effective income tax rate.

Costs associated with the Yard House acquisition adversely affected diluted

net earnings per share from continuing operations by approximately $0.09.

EARNINGS FROM DISCONTINUED OPERATIONS

Red Lobster’s sales of $2.46 billion in fiscal 2014 were 6.2 percent below

fiscal 2013, driven primarily by a U.S. same-restaurant sales decrease of

6.0 percent, partially offset by revenue from one net new restaurant. The

decrease in U.S. same-restaurant sales resulted from a 9.3 percent decrease

in same-restaurant guest counts, partially offset by a 3.3 percent increase in

average guest check. Average annual sales per restaurant for Red Lobster

were $3.5 million in fiscal 2014 compared to $3.7 million in fiscal 2013.

Red Lobster’s sales of $2.62 billion in fiscal 2013 were 1.7 percent

below fiscal 2012, driven primarily by a U.S. same-restaurant sales decrease

of 2.2 percent partially offset by revenue from one net new restaurant. The

decrease in U.S. same-restaurant sales resulted from a 1.8 percent decrease

in same-restaurant guest counts combined with a 0.4 percent decrease in

average guest check. Average annual sales per restaurant for Red Lobster

were $3.7 million in fiscal 2013 compared to $3.8 million in fiscal 2012.

On an after-tax basis, earnings from discontinued operations for fiscal

2014 were $103.0 million ($0.77 per diluted share) compared with earnings

from discontinued operations for fiscal 2013 of $174.6 million ($1.33 per

diluted share) and fiscal 2012 of $196.3 million ($1.47 per diluted share).

The decrease in earnings from discontinued operations in fiscal 2014 and

fiscal 2013 was primarily driven by a decrease in sales and overall perfor-

mance at Red Lobster in addition to separation-related costs (approximately

$0.10 per diluted share) and impairments recorded for the two closed

synergy locations (approximately $0.04 per diluted share).

SEASONALITY

Our sales volumes fluctuate seasonally. Typically, our average sales per

restaurant are highest in the spring and winter, followed by the summer, and

lowest in the fall. Holidays, changes in the economy, severe weather and

similar conditions may impact sales volumes seasonally in some operating

regions. Because of the seasonality of our business, results for any quarter

are not necessarily indicative of the results that may be achieved for the full

fiscal year.