Red Lobster 2014 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2014 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

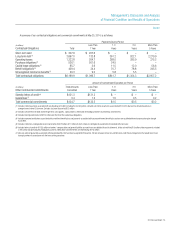

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Darden

18 Darden Restaurants, Inc.

QUANTITATIVE AND QUALITATIVE DISCLOSURES

ABOUT MARKET RISK

We are exposed to a variety of market risks, including fluctuations in interest

rates, foreign currency exchange rates, compensation and commodity prices.

To manage this exposure, we periodically enter into interest rate and foreign

currency exchange instruments, equity forwards and commodity instruments

for other than trading purposes (see Notes 1 and 10 to our consolidated

financial statements, in Part II, Item 8 of this report, incorporated herein

by reference).

We use the variance/covariance method to measure value at risk,

over time horizons ranging from one week to one year, at the 95 percent

confidence level. At May 25, 2014, our potential losses in future net earnings

resulting from changes in foreign currency exchange rate instruments,

commodity instruments, equity forwards and floating rate debt interest rate

exposures were approximately $41.3 million over a period of one year

(including the impact of the interest rate swap agreements discussed in

Note 10 to our consolidated financial statements in Part II, Item 8 of this

report, incorporated herein by reference). The value at risk from an increase

in the fair value of all of our long-term fixed rate debt, over a period of one

year, was approximately $151.3 million. The fair value of our long-term debt

during fiscal 2014 averaged $2.54 billion, with a high of $2.66 billion and

a low of $2.46 billion. Our interest rate risk management objective is to limit

the impact of interest rate changes on earnings and cash flows by targeting

an appropriate mix of variable and fixed rate debt.

APPLICATION OF NEW ACCOUNTING STANDARDS

In May 2014, the FASB issued Accounting Standards Update (ASU) 2014-09,

Revenue from Contracts with Customers (Topic 606). This update provides a

comprehensive new revenue recognition model that requires a company to

recognize revenue to depict the transfer of goods or services to a customer

at an amount that reflects the consideration it expects to receive in exchange

for those goods or services. The guidance also requires additional disclosure

about the nature, amount, timing and uncertainty of revenue and cash flows

arising from customer contracts. This update is effective for annual and

interim periods beginning after December 15, 2016, which will require us to

adopt these provisions in the first quarter of fiscal 2018. Early application is

not permitted. This update permits the use of either the retrospective or

cumulative effect transition method. We are evaluating the effect this guidance

will have on our consolidated financial statements and related disclosures.

We have not yet selected a transition method nor have we determined the

effect of the standard on our ongoing financial reporting.

In April 2014, the FASB issued ASU No. 2014-08, Presentation of

Financial Statements (Topic 205) and Property, Plant and Equipment

(Topic 360), Reporting Discontinued Operations and Disclosures of Disposals

of Components of an Entity. This update modifies the requirements for

reporting discontinued operations. Under the amendments in ASU 2014-08,

the definition of discontinued operation has been modified to only include

those disposals of an entity that represent a strategic shift that has (or will

have) a major effect on an entity’s operations and financial results. This

update also expands the disclosure requirements for disposals that meet

the definition of a discontinued operation and requires entities to disclose

information about disposals of individually significant components that do

not meet the definition of discontinued operations. This update is effective

for annual and interim periods beginning after December 15, 2014, which

will require us to adopt these provisions in the first quarter of fiscal 2016.

We are evaluating the effect this guidance will have on our consolidated

financial statements and related disclosures.

In July 2013, the FASB issued ASU 2013-11, Income Taxes (Topic 740),

Presentation of an Unrecognized Tax Benefit When a Net Operating Loss

Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists. The

objective of this update is to eliminate the diversity in practice in the presen-

tation of unrecognized tax benefits when a net operating loss carryforward,

a similar tax loss, or a tax credit carryforward exists. Under this guidance, an

unrecognized tax benefit, or a portion of an unrecognized tax benefit, should

be presented in the financial statements as a reduction to a deferred tax

asset for a net operating loss carryforward, a similar tax loss, or a tax credit

carryforward, except in certain circumstances. This update does not require

any new recurring disclosures and is effective for annual and interim periods

beginning after December 15, 2013, which will require us to adopt these

provisions in the first quarter of fiscal 2015. We do not believe adoption of

this new guidance will have a significant impact on our consolidated

financial statements.