Red Lobster 2014 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2014 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

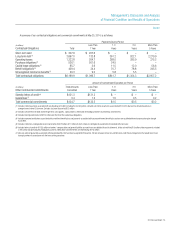

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Darden

8 Darden Restaurants, Inc.

SALES

Sales from continuing operations were $6.29 billion in fiscal 2014,

$5.92 billion in fiscal 2013 and $5.33 billion in fiscal 2012. The 6.2 percent

increase in sales from continuing operations for fiscal 2014 was driven by

the addition of 70 net new company-owned restaurants, a 1.6 percent

blended same-restaurant sales increase for The Capital Grille, Bahama Breeze,

Seasons 52, Eddie V’s and Yard House, and a 2.7 percent same-restaurant

sales increase for LongHorn Steakhouse, partially offset by a 3.4 percent

same-restaurant sales decrease for Olive Garden.

Olive Garden’s sales of $3.64 billion in fiscal 2014 were 1.1 percent

below fiscal 2013, driven primarily by a U.S. same-restaurant sales decrease

of 3.4 percent partially offset by revenue from nine net new restaurants. The

decrease in U.S. same-restaurant sales resulted from a 4.2 percent decrease

in same-restaurant guest counts partially offset by a 0.8 percent increase in

average check. Average annual sales per restaurant for Olive Garden were

$4.4 million in fiscal 2014 compared to $4.6 million in fiscal 2013.

LongHorn Steakhouse’s sales of $1.38 billion in fiscal 2014 were

12.4 percent above fiscal 2013, driven primarily by revenue from 34 net new

restaurants combined with a same-restaurant sales increase of 2.7 percent.

The increase in same-restaurant sales resulted from a 0.3 percent increase

in same-restaurant guest counts combined with a 2.4 percent increase in

average guest check. Average annual sales per restaurant for LongHorn

Steakhouse were $3.1 million in fiscal 2014 compared to $3.0 million in

fiscal 2013.

In total, The Capital Grille, Bahama Breeze, Seasons 52, Eddie V’s

and Yard House generated sales of $1.23 billion in fiscal 2014, which were

25.2 percent above fiscal 2013, primarily driven by the incremental sales

from 27 net new restaurants since the end of fiscal 2013 in addition to the

40 Yard House restaurants acquired in the second quarter of fiscal 2013.

Sales growth also reflected same-restaurant sales increases of 3.4 percent

at The Capital Grille, 4.1 percent at Bahama Breeze, 1.1 percent at Eddie V’s

and 0.3 percent at Yard House, and a same-restaurant sales decrease of

2.2 percent at Seasons 52. Average annual sales per restaurant for

The Capital Grille were $7.1 million in fiscal 2014 compared to $7.0 million

in fiscal 2013. Average annual sales per restaurant for Bahama Breeze were

$5.6 million in fiscal 2014 compared to $5.5 million in fiscal 2013. Average

annual sales per restaurant for Seasons 52 were $5.7 million in fiscal 2014

compared to $6.2 million in fiscal 2013. Average annual sales per restaurant

for Eddie V’s were $6.0 million in fiscal 2014 compared to $5.8 million in

fiscal 2013. Average annual sales per restaurant for Yard House were

$8.2 million in fiscal 2014 and fiscal 2013.

The 11.1 percent increase in sales from continuing operations for fiscal

2013 was driven by the addition of 102 net new company-owned restaurants

plus the addition of 40 Yard House purchased restaurants, a 2.1 percent

blended same-restaurant sales increase for The Capital Grille, Bahama

Breeze and Seasons 52, and a 1.2 percent same-restaurant sales increase

for LongHorn Steakhouse partially offset by a 1.5 percent same-restaurant

sales decrease for Olive Garden.

Olive Garden’s sales of $3.68 billion in fiscal 2013 were 2.9 percent

above fiscal 2012, driven primarily by revenue from 36 net new restaurants

partially offset by a U.S. same-restaurant sales decrease of 1.5 percent. The

decrease in U.S. same-restaurant sales resulted from a 2.8 percent decrease

in same-restaurant guest counts partially offset by a 1.3 percent increase in

average check. Average annual sales per restaurant for Olive Garden were

$4.6 million in fiscal 2013 compared to $4.7 million in fiscal 2012.

LongHorn Steakhouse’s sales of $1.23 billion in fiscal 2013 were

10.3 percent above fiscal 2012, driven primarily by revenue from 44 net new

restaurants combined with a same-restaurant sales increase of 1.2 percent.

The increase in same-restaurant sales resulted from a 1.1 percent increase

in same-restaurant guest counts combined with a 0.1 percent increase in

average guest check. Average annual sales per restaurant for LongHorn

Steakhouse were $3.0 million in fiscal 2013 and fiscal 2012.

In total, The Capital Grille, Bahama Breeze, Seasons 52, Eddie V’s and

Yard House generated sales of $986.4 million in fiscal 2013, which were

58.3 percent above fiscal 2012, primarily driven by the Yard House acquisi-

tion. Additionally, Seasons 52 added eight new restaurants, Yard House

added four new restaurants, The Capital Grille added three new restaurants,

Bahama Breeze added three new restaurants, and Eddie V’s added one new

restaurant. Sales growth also reflected same-restaurant sales increases of

3.3 percent at The Capital Grille, 1.2 percent at Seasons 52 and 0.2 percent

at Bahama Breeze. Average annual sales per restaurant for The Capital Grille

were $7.0 million in fiscal 2013 compared to $6.8 million in fiscal 2012.

Average annual sales per restaurant for Bahama Breeze were $5.5 million in

fiscal 2013 compared to $5.6 million in fiscal 2012. Average annual sales

per restaurant for Seasons 52 were $6.2 million in fiscal 2013 compared to

$6.4 million in fiscal 2012. Average annual sales per restaurant for Eddie V’s

were $5.8 million in fiscal 2013 compared to $5.9 million in fiscal 2012.

COSTS AND EXPENSES

Total costs and expenses from continuing operations were $6.11 billion in

fiscal 2014, $5.65 billion in fiscal 2013 and $4.97 billion in fiscal 2012. As

a percent of sales, total costs and expenses from continuing operations were

97.2 percent in fiscal 2014, 95.4 percent in fiscal 2013 and 93.3 percent

in fiscal 2012.

Food and beverage costs increased $148.6 million, or 8.5 percent,

from $1.74 billion in fiscal 2013 to $1.89 billion in fiscal 2014. Food and

beverage costs increased $189.9 million, or 12.2 percent, from $1.55 billion

in fiscal 2012 to $1.74 billion in fiscal 2013. As a percent of sales, food and

beverage costs increased from fiscal 2013 to fiscal 2014 primarily as a

result of food cost inflation partially offset by pricing. As a percent of sales,

food and beverage costs increased from fiscal 2012 to fiscal 2013 primarily

as a result of food cost inflation and unfavorable menu-mix, partially offset

by pricing.

Restaurant labor costs increased $125.0 million, or 6.6 percent, from

$1.89 billion in fiscal 2013 to $2.02 billion in fiscal 2014. Restaurant labor

costs increased $209.0 million, or 12.4 percent, from $1.68 billion in fiscal

2012 to $1.89 billion in fiscal 2013. As a percent of sales, restaurant labor

costs increased in fiscal 2014 primarily as a result of wage-rate inflation and

decreased labor efficiency, partially offset by sales leverage. As a percent

of sales, restaurant labor costs increased in fiscal 2013 primarily as a result

of decreased labor efficiency and wage-rate inflation.

Restaurant expenses (which include utilities, repairs and maintenance,

credit card, lease, property tax, workers’ compensation, new restaurant

pre-opening and other restaurant-level operating expenses) increased

$100.3 million, or 10.2 percent, from $980.4 million in fiscal 2013 to

$1.08 billion in fiscal 2014. Restaurant expenses increased $129.4 million,

or 15.2 percent, from $851.0 million in fiscal 2012 to $980.4 million in

fiscal 2013. As a percent of sales, restaurant expenses increased in fiscal

2014 as compared to fiscal 2013 due to an increase in rent expense and

higher repairs and maintenance expenses. As a percent of sales, restaurant

expenses increased in fiscal 2013 as compared to fiscal 2012 primarily as a

result of Yard House’s higher restaurant expenses as a percentage of sales

compared to our consolidated average prior to the acquisition. Additionally,

restaurant expenses as a percentage of sales increased due to lost sales

leverage, partially offset by lower utilities expenses.