Red Lobster 2013 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2013 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Darden

Darden Restaurants, Inc. 2013 Annual Report 55

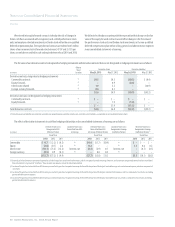

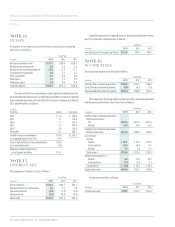

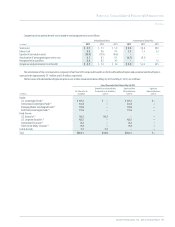

The following table is a reconciliation of the U.S. statutory income tax rate

to the effective income tax rate from continuing operations included in the

accompanying consolidated statements of earnings:

Fiscal Year

2013 2012 2011

U.S. statutory rate 35.0% 35.0% 35.0%

State and local income taxes,

net of federal tax benefits 1.6 2.5 1.8

Benefit of federal income tax credits (12.9) (11.1) (8.3)

Other, net (2.7) (1.1) (2.4)

Effective income tax rate 21.0% 25.3% 26.1%

As of May 26, 2013, we had estimated current prepaid state income taxes

of $6.4 million, which is included on our accompanying consolidated balance

sheets as prepaid income taxes, and estimated current federal income taxes

payable of $16.5 million, which is included on our accompanying consolidated

balance sheets as accrued income taxes.

As of May 26, 2013, we had unrecognized tax benefits of $29.9 million,

which represents the aggregate tax effect of the differences between tax return

positions and benefits recognized in our consolidated financial statements, all

of which would favorably affect the effective tax rate if resolved in our favor.

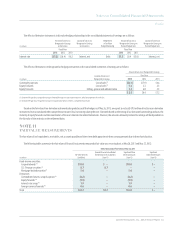

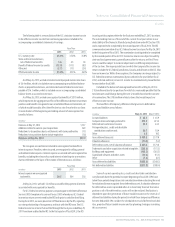

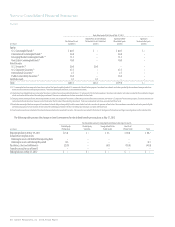

A reconciliation of the beginning and ending amount of unrecognized tax

benefits follows:

(in millions)

Balances at May 27, 2012 $15.7

Additions related to current-year tax positions 16.9

Reductions to tax positions due to settlements with taxing authorities (1.1)

Reductions to tax positions due to statute expiration (1.6)

Balances at May 26, 2013 $29.9

We recognize accrued interest related to unrecognized tax benefits in

interest expense. Penalties, when incurred, are recognized in selling, general

and administrative expense. Interest expense associated with unrecognized tax

benefits, excluding the release of accrued interest related to prior year matters

due to settlement or the lapse of the statute of limitations was as follows:

Fiscal Year

(in millions)

2013 2012 2011

Interest expense on unrecognized

tax benefits $0.5 $0.4 $1.6

At May 26, 2013, we had $1.2 million accrued for the payment of interest

associated with unrecognized tax benefits.

For U.S. federal income tax purposes, we participate in the Internal Revenue

Service’s (IRS) Compliance Assurance Process (CAP) whereby our U.S. federal

income tax returns are reviewed by the IRS both prior to and after their filing.

During fiscal 2013, we were placed on CAP Maintenance by the IRS, signaling

our strong relationship of transparency and trust with the IRS team. The U.S.

federal income tax returns that we filed through the fiscal year ended May 29,

2011 have been audited by the IRS. In the first quarter of fiscal 2013, the IRS

issued a partial acceptance letter for the fiscal year ended May 27, 2012 tax return.

The outstanding item as of the end of the current fiscal year relates to our

deductibility of the Domestic Manufacturing Deduction under IRC Section 199,

and is expected to be completed by the second quarter of fiscal 2014. The IRS

commenced examination of our U.S. federal income tax returns for May 26, 2013

in the first quarter of fiscal 2013. The examination is anticipated to be completed

by the second quarter of fiscal 2015. Income tax returns are subject to audit by

state and local governments, generally years after the returns are filed. These

returns could be subject to material adjustments or differing interpretations

of the tax laws. The major jurisdictions in which the Company files income tax

returns include the U.S. federal jurisdiction, Canada, and all states in the U.S. that

have an income tax. With a few exceptions, the Company is no longer subject to

U.S. federal income tax examinations by tax authorities for years before fiscal

2012, and state and local, or non-U.S. income tax examinations by tax authorities

for years before fiscal 2009.

Included in the balance of unrecognized tax benefits at May 26, 2013 is

$18.6 million related to tax positions for which it is reasonably possible that the

total amounts could change during the next 12 months based on the outcome

of examinations. The $18.6 million relates to items that would impact our

effective income tax rate.

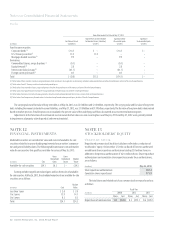

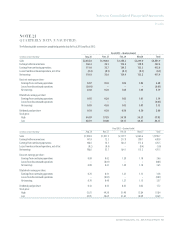

The tax effects of temporary differences that give rise to deferred tax

assets and liabilities are as follows:

(in millions)

May 26, 2013 May 27, 2012

Accrued liabilities $ 85.5 $ 65.9

Compensation and employee benefits 212.9 221.2

Deferred rent and interest income 83.3 61.3

Net operating loss, credit and charitable

contribution carryforwards 50.7 18.4

Other 6.8 10.2

Gross deferred tax assets $ 439.2 $ 377.0

Valuation allowance (15.4) (5.2)

Deferred tax assets, net of valuation allowance $ 423.8 $ 371.8

Trademarks and other acquisition related intangibles (205.6) (175.3)

Buildings and equipment (403.2) (363.3)

Capitalized software and other assets (19.4) (15.1)

Other (7.4) (6.5)

Gross deferred tax liabilities $(635.6) $(560.2)

Net deferred tax liabilities $(211.8) $(188.4)

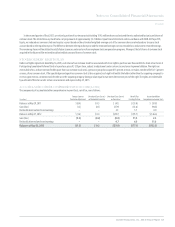

Some of our net operating loss, credit and charitable contribution

carryforwards have the potential to expire beginning in fiscal 2014. We have

taken these potential expirations into consideration when evaluating the need

for valuation allowances against these deferred tax assets. A valuation allowance

for deferred tax assets is provided when it is more likely than not that some

portion or all of the deferred tax assets will not be realized. Realization is

dependent upon the generation of future taxable income or the reversal of

deferred tax liabilities during the periods in which those temporary differences

become deductible. We consider the scheduled reversal of deferred tax liabil-

ities, projected future taxable income and tax planning strategies in making

this assessment.