Red Lobster 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Darden

44 Darden Restaurants, Inc. 2013 Annual Report

the fair value of employee investments in our non-qualified deferred compensation

plan and certain commodity futures contracts to economically hedge changes in

the value of certain inventory purchases, for which we have not applied hedge

accounting. All derivatives are recognized on the balance sheet at fair value. For

those derivative instruments for which we intend to elect hedge accounting, on

the date the derivative contract is entered into, we document all relationships

between hedging instruments and hedged items, as well as our risk-management

objective and strategy for undertaking the various hedge transactions. This process

includes linking all derivatives designated as cash flow hedges to specific assets

and liabilities on the consolidated balance sheet or to specific forecasted transac-

tions. We also formally assess, both at the hedge’s inception and on an ongoing

basis, whether the derivatives used in hedging transactions are highly effective

in offsetting changes in cash flows of hedged items.

To the extent our derivatives are effective in offsetting the variability of the

hedged cash flows, and otherwise meet the cash flow hedge accounting criteria

required by Topic 815 of the FASB ASC, changes in the derivatives’ fair value are

not included in current earnings but are included in accumulated other compre-

hensive income (loss), net of tax. These changes in fair value will be reclassified

into earnings at the time of the forecasted transaction. Ineffectiveness measured

in the hedging relationship is recorded currently in earnings in the period in which

it occurs. To the extent our derivatives are effective in mitigating changes in fair

value, and otherwise meet the fair value hedge accounting criteria required by

Topic 815 of the FASB ASC, gains and losses in the derivatives’ fair value are

included in current earnings, as are the gains and losses of the related hedged item.

To the extent the hedge accounting criteria are not met, the derivative contracts

are utilized as economic hedges and changes in the fair value of such contracts

are recorded currently in earnings in the period in which they occur. Cash flows

relatedtoderivativesareincludedinoperatingactivities.SeeNote10–Derivative

Instruments and Hedging Activities for additional information.

LEASES

For operating leases, we recognize rent expense on a straight-line basis over the

expected lease term, including cancelable option periods where failure to exercise

the options would result in an economic penalty to the Company.

Differences between amounts paid and amounts expensed are recorded as

deferred rent. Capital leases are recorded as an asset and an obligation at an

amount equal to the present value of the minimum lease payments during the

lease term. Within the provisions of certain of our leases, there are rent holidays

and escalations in payments over the base lease term, as well as renewal periods.

The effects of the holidays and escalations have been reflected in rent expense

on a straight-line basis over the expected lease term, which includes cancelable

option periods where failure to exercise such options would result in an economic

penalty to the Company. The lease term commences on the date when we have

the right to control the use of the leased property, which is typically before rent

payments are due under the terms of the lease. Many of our leases have renewal

periods totaling 5 to 20 years, exercisable at our option and require payment of

property taxes, insurance and maintenance costs in addition to the rent payments.

The consolidated financial statements reflect the same lease term for amortizing

leasehold improvements as we use to determine capital versus operating lease

classifications and in calculating straight-line rent expense for each restaurant.

Percentage rent expense is generally based on sales levels and is accrued at the

point in time we determine that it is probable that such sales levels will be achieved.

Amortization expense related to capital leases is included in depreciation and

amortization expense in our consolidated statements of earnings. Landlord

allowances are recorded based on contractual terms and are included in accounts

receivable, net and as a deferred rent liability and amortized as a reduction of

rent expense on a straight-line basis over the expected lease term.

PRE-OPENING EXPENSES

Non-capital expenditures associated with opening new restaurants are expensed

as incurred.

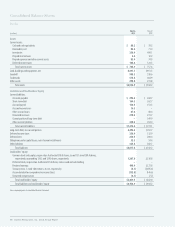

ADVERTISING

Production costs of commercials are charged to operations in the fiscal period

the advertising is first aired. The costs of programming and other advertising,

promotion and marketing programs are charged to operations in the fiscal

period incurred. Advertising expense related to continuing operations, included

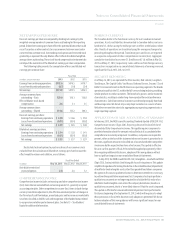

in selling, general and administrative expenses was as follows:

Fiscal Year

(in millions)

2013 2012 2011

Advertising expense $409.2 $357.2 $340.2

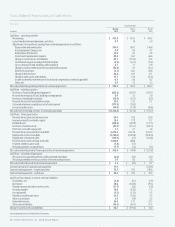

STOCK-BASED COMPENSATION

We recognize the cost of employee service received in exchange for awards of equity

instruments based on the grant date fair value of those awards. We utilize the

Black-Scholes option pricing model to estimate the fair value of stock option awards.

We recognize compensation expense on a straight-line basis over the employee

service period for awards granted. The dividend yield has been estimated based

upon our historical results and expectations for changes in dividend rates. The

expected volatility was determined using historical stock prices. The risk-free

interest rate was the rate available on zero coupon U.S. government obligations

with a term approximating the expected life of each grant. The expected life was

estimated based on the exercise history of previous grants, taking into consideration

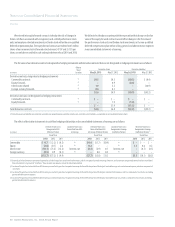

the remaining contractual period for outstanding awards. The weighted-average

fair value of non-qualified stock options and the related assumptions used in the

Black-Scholes model to record stock-based compensation are as follows:

Stock Options

Granted in Fiscal Year

2013 2012 2011

Weighted-average fair value $12.22 $14.31 $12.88

Dividend yield 4.0% 3.5% 3.0%

Expected volatility of stock 39.7% 39.4% 39.1%

Risk-free interest rate 0.8% 2.1% 2.2%

Expected option life (in years) 6.5 6.5 6.7