Red Lobster 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Darden

Darden Restaurants, Inc. 2013 Annual Report 39

NOTE 1

SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES

OPERATIONS AND PRINCIPLES OF

CONSOLIDATION

The accompanying consolidated financial statements include the operations of

Darden Restaurants, Inc. and its wholly owned subsidiaries (Darden, the Company,

we, us or our). We own and operate the Olive Garden®, Red Lobster®, LongHorn

Steakhouse®, The Capital Grille®, Yard House®, Bahama Breeze®, Seasons 52®,

Eddie V’s Prime Seafood® and Wildfish Seafood Grille® restaurant brands located

in the United States and Canada. Through subsidiaries, we own and operate all

of our restaurants in the United States and Canada, except for three restaurants

located in Central Florida and three restaurants in California that are owned jointly

by us and third parties, and managed by us, and five franchised restaurants in

Puerto Rico. We also have area development and franchise agreements with

unaffiliated operators to develop and operate our brands in Japan, the Middle East

and Latin America. Pursuant to these agreements, as of May 26, 2013, 37 franchised

restaurants were in operation in Japan, the Middle East, Puerto Rico and Mexico.

All significant inter-company balances and transactions have been eliminated

in consolidation.

BASIS OF PRESENTATION

On August 29, 2012, we completed the acquisition of Yard House USA, Inc.

(Yard House) for $585.0 million in cash. The acquired operations of Yard House

included 40 restaurants that are included in the results of operations in our

consolidated financial statements from the date of acquisition.

The assets and liabilities of Yard House were recorded at their respective

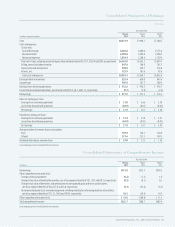

fair values as of the date of acquisition. The following table summarizes the

final allocation of the purchase price as of May 26, 2013:

(in millions)

Final

Current assets $ 16.0

Buildings and equipment 152.2

Trademark 109.3

Other assets 9.8

Goodwill 369.8

Total assets acquired $657.1

Current liabilities 40.8

Other liabilities 31.3

Total liabilities assumed $ 72.1

Net assets acquired $585.0

The excess of the purchase price over the aggregate fair value of net assets

acquired was allocated to goodwill. Of the $369.8 million recorded as goodwill,

$37.9 million is expected to be deductible for tax purposes. The portion of the

purchase price attributable to goodwill represents benefits expected as a result

of the acquisition, including sales and unit growth opportunities in addition to

supply-chain and administrative cost synergies. The trademark has an indefinite

life based on the expected use of the asset and the regulatory and economic

environment within which it is being used. The trademark represents a highly

respected brand with positive connotations and we intend to cultivate and protect

the use of this brand. Goodwill and indefinite-lived trademarks are not amortized

but are reviewed annually for impairment or more frequently if indicators of

impairment exist. Buildings and equipment will be depreciated over a period of

7 months to 21 years. Other assets and liabilities include values associated with

favorable and unfavorable market leases that will be amortized over a weighted-

average period of 16 years.

As a result of the acquisition and related integration efforts, we incurred

expenses of approximately $12.3 million (net of tax) during the fiscal year ended

May 26, 2013 which are included in restaurant expenses, selling, general and

administrative expenses and depreciation expense in our consolidated statements

of earnings. Pro-forma financial information for the combined entities for periods

prior to the acquisition is not presented due to the immaterial impact of the

financial results of Yard House on our consolidated financial statements.

During fiscal 2007 and 2008 we closed or sold all Smokey Bones Barbeque &

Grill (Smokey Bones) and Rocky River Grillhouse restaurants and we closed nine

Bahama Breeze restaurants. These restaurants and their related activities have

been classified as discontinued operations. Therefore, for fiscal 2013, 2012 and

2011, all impairment losses and disposal costs, gains and losses on disposition

attributable to these restaurants have been aggregated in a single caption entitled

“Losses from discontinued operations, net of tax benefit” on the accompanying

consolidated statements of earnings.

Unless otherwise noted, amounts and disclosures throughout these notes

to consolidated financial statements relate to our continuing operations.

FISCAL YEAR

We operate on a 52/53 week fiscal year, which ends on the last Sunday in May.

Fiscal 2013, 2012 and 2011 consisted of 52 weeks of operation.

USE OF ESTIMATES

We prepare our consolidated financial statements in conformity with U.S.

generally accepted accounting principles. The preparation of these financial

statements requires us to make estimates and assumptions that affect the

reported amounts of assets and liabilities and disclosure of contingent assets

and liabilities at the date of the financial statements, and the reported amounts

of sales and expenses during the reporting period. Actual results could differ

from those estimates.

CASH EQUIVALENTS

Cash equivalents include highly liquid investments such as U.S. Treasury bills,

taxable municipal bonds and money market funds that have an original maturity

of three months or less. Amounts receivable from credit card companies are

also considered cash equivalents because they are both short term and highly

liquid in nature and are typically converted to cash within three days of the

sales transaction.