Red Lobster 2013 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2013 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Darden

30 Darden Restaurants, Inc. 2013 Annual Report

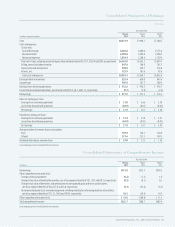

FINANCIAL CONDITION

Our total current assets were $764.9 million at May 26, 2013, compared with

$757.6 million at May 27, 2012. The increase was primarily due to an increase in

cash and cash equivalents, and an increase in deferred income taxes related to

current period activity of taxable timing differences, partially offset by lower

inventory levels related to the timing of inventory purchases.

Our total current liabilities were $1.42 billion at May 26, 2013, compared with

$1.77 billion at May 27, 2012. The decrease was primarily due to the repayment

of $350.0 million of long-term debt during fiscal 2013 which was included in

current liabilities as current portion of long-term debt at May 27, 2012 and a

decrease in short-term debt, partially offset by an increase in unearned revenues

associated with gift card sales in excess of current-period redemptions and an

increase in accounts payable.

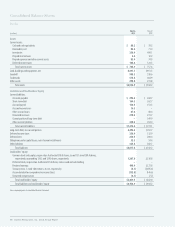

QUANTITATIVE AND QUALITATIVE DISCLOSURES

ABOUT MARKET RISK

We are exposed to a variety of market risks, including fluctuations in interest

rates, foreign currency exchange rates, compensation and commodity prices. To

manage this exposure, we periodically enter into interest rate and foreign currency

exchange instruments, equity forwards and commodity instruments for other

than trading purposes (see Notes 1 and 10 to our consolidated financial statements,

in Part II, Item 8 of this report, incorporated herein by reference).

We use the variance/covariance method to measure value at risk, over time

horizons ranging from one week to one year, at the 95 percent confidence level.

At May 26, 2013, our potential losses in future net earnings resulting from changes

in foreign currency exchange rate instruments, commodity instruments, equity

forwards and floating rate debt interest rate exposures were approximately

$47.4 million over a period of one year (including the impact of the interest rate

swap agreements discussed in Note 10 to our consolidated financial statements

in Part II, Item 8 of this report, incorporated herein by reference). The value at

risk from an increase in the fair value of all of our long-term fixed rate debt, over

a period of one year, was approximately $160.7 million. The fair value of our long-

term debt during fiscal 2013 averaged $2.41 billion, with a high of $2.79 billion

and a low of $1.98 billion. Our interest rate risk management objective is to limit

the impact of interest rate changes on earnings and cash flows by targeting an

appropriate mix of variable and fixed rate debt.

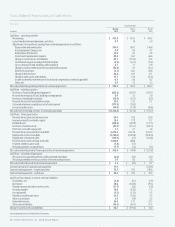

APPLICATION OF NEW ACCOUNTING STANDARDS

In February 2013, the FASB issued Accounting Standards Update (ASU) 2013-02,

Comprehensive Income (Topic 220), Reporting Amounts Reclassified Out of

Accumulated Other Comprehensive Income. This update requires companies to

provide information about the amounts reclassified out of accumulated other

comprehensive income by component. In addition, companies are required to

present, either on the face of the statement where net income is presented or in

the notes, significant amounts reclassified out of accumulated other comprehen-

sive income by the respective line items of net income. This update is effective

for us in our first quarter of fiscal 2014 and will be applied prospectively. Other

than requiring additional disclosures, adoption of this new guidance will not

have a significant impact on our consolidated financial statements.

InJuly2012,theFASBissuedASU2012-02,Intangibles–GoodwillandOther

(Topic 350), Testing Indefinite Lived Intangible Assets for Impairment. This update

simplifies the guidance for testing the decline in the realizable value (impairment)

of indefinite-lived intangible assets other than goodwill and allows companies

the option to first assess qualitative factors to determine whether it is necessary

to perform the quantitative impairment test. Companies electing to perform a

qualitative assessment are no longer required to calculate the fair value of an

indefinite-lived intangible asset unless the company determines, based on a

qualitative assessment, that it is “more likely than not” that the asset is impaired.

This update is effective for annual and interim impairment tests performed in

fiscal years beginning after September 15, 2012, which will require us to adopt

theseprovisionsinfiscal2014;however,earlyadoptionispermitted.Wedonot

believe adoption of this new guidance will have a significant impact on our

consolidated financial statements.