Qantas 2012 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2012 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156

|

|

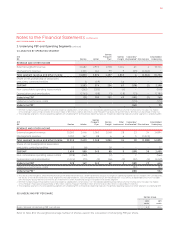

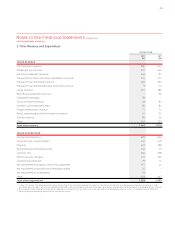

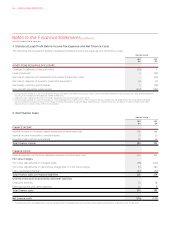

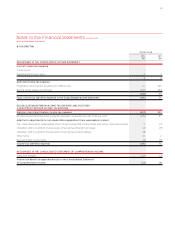

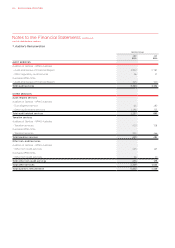

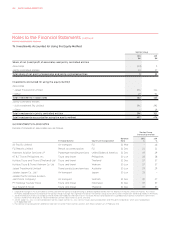

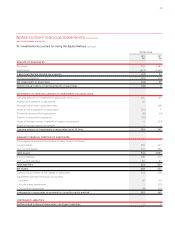

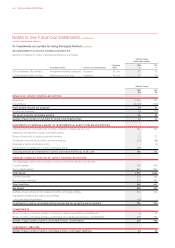

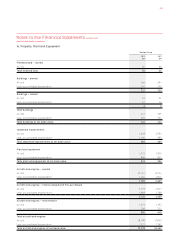

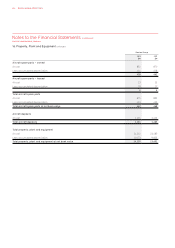

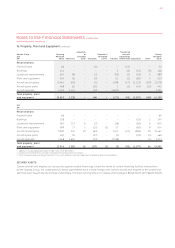

FOR THE YEAR ENDED 30 JUNE 2012

Notes to the Financial Statements continued

Qantas Group

2012

$M

2011

$M

RECOGNISED IN THE CONSOLIDATED INCOME STATEMENT

Current income tax expense

Current year – –

Adjustments for prior year

Deferred income tax expense

Origination and reversal of temporary differences

Benefit of tax losses recognised () ()

()

Total income tax (benefit)/expense in the Consolidated Income Statement ()

RECONCILIATION BETWEEN INCOME TAX EXPENSE AND STATUTORY

LOSS/PROFIT BEFORE INCOME TAX EXPENSE

Statutory (loss)/profit before income tax expense ()

Income tax (benefit)/expense using the domestic corporate tax rate of per cent ()

Add/(less) adjustments for non-deductible expenditure/(non-assessable income):

Non-deductible/(non-assessable) share of net loss/(profit) of associates and jointly controlled entities ()

Utilisation and recognition of previously unrecognised foreign tax losses () ()

Utilisation and recognition of previously unrecognised capital losses () –

Other items

Over provision in prior year () ()

Income tax (benefit)/expense ()

RECOGNISED IN THE CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Cash flow hedges () ()

Income tax benefit recognised directly in the Consolidated Statement

of Comprehensive Income () ()

6. Income Tax

087