Qantas 2012 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2012 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

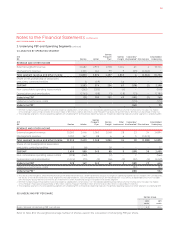

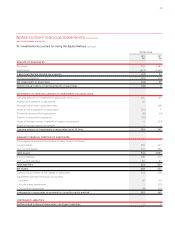

FOR THE YEAR ENDED 30 JUNE 2012

Notes to the Financial Statements continued

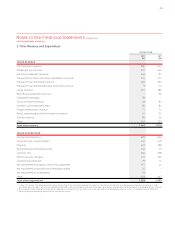

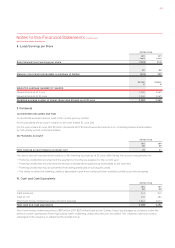

The reconciliation of Underlying PBT to Statutory (loss)/profit before tax is detailed in the table below.

Qantas Group

2012

$M

2011

$M

Underlying PBT

Ineffectiveness and non-designated derivatives relating to other reporting periods

Include current year derivative mark-to-market movements relating

to underlying exposures in future years () ()

Include current year derivative mark-to-market movements relating

to capital expenditure () ()

Exclude prior years’ derivative mark-to-market movements relating

to underlying exposures in the current year

Exclude adjustment to depreciation expense relating to excluded

capital expenditure mark-to-market movements

Include ineffective and non-designated derivatives relating to other

reporting periods affecting net finance costs () ()

() ()

Other items not included in Underlying PBT

Qantas International Transformation

Net impairment of property, plant and equipment1() –

Redundancies and restructuring2() –

Impairment of goodwill3() –

Write down of inventory () –

() –

Other

Redundancies and restructuring () ()

Net impairment of property, plant and equipment1– ()

Net loss on disposal of investments and other transaction costs4– ()

Impairment of investments () –

Legal provisions5 ()

() ()

() ()

Statutory (loss)/profit before income tax expense ()

1 As disclosed in Note 3, net impairment of property, plant and equipment for the year ended 30 June 2012 was $157 million (2011: $44 million), of which $147 million (2011: $34 million)

is presented as an item not included in Underlying PBT.

2 As disclosed in Note 3, redundancies and restructuring for the year ended 30 June 2012 was $206 million (2011: $44 million), of which $203 million (2011: $28 million) is presented as

other items not included in Underlying PBT.

3 As disclosed in Note 3, net impairment of goodwill and intangible assets for the year ended 30 June 2012 was $20 million (2011: $nil), of which $18 million (2011: $nil) is presented

as other items not included in Underlying PBT.

4 During the year ended 30 June 2011 the Qantas Group disposed of its investments in Harvey Holidays Pty Ltd and DPEX Group, resulting in a gain of $9 million. Additionally,

the Group deconsolidated Jetset Travelworld Group as a result of the merger of Jetset Travelworld Group with Stella Travel Services, resulting in a loss of $29 million.

5 Legal provisions represent provisions for freight regulatory fines and third party class actions.

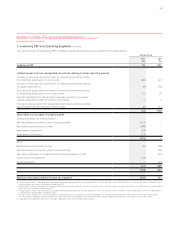

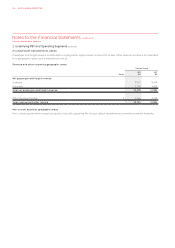

2. Underlying PBT and Operating Segments continued

083