Qantas 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

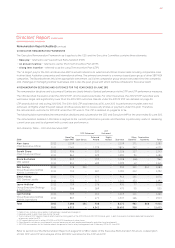

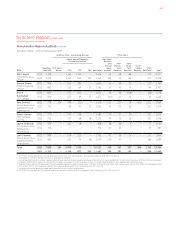

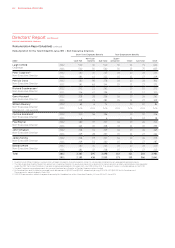

FOR THE YEAR ENDED 30 JUNE 2012

Directors’ Report continued

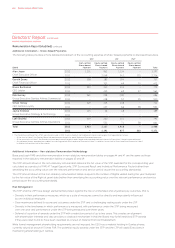

Annual Incentive

also referred

to as the Short

Term Incentive

Plan or STIP

(continued)

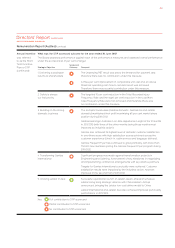

With safety as the first priority, the Board retains an overriding discretion to scale down the STIP (or reduce it to

zero) in the event of a material aviation safety incident. Any such decision would be made in light of the specific

circumstances and following the recommendation of the Safety, Health, Environment and Security Committee.

Additional descriptions of STIP scorecard measures

Underlying PBT

The Underlying PBT target is based on the annual financial budget. Underlying PBT is the primary reporting

measure used by the Board of Directors and Executive Committee for the purpose of assessing the performance

of the Group. The objective of measuring and reporting Underlying PBT is to provide a meaningful and consistent

representation of the underlying performance of the Group. For reasons of commercial sensitivity the annual

target is not disclosed.

Underlying PBT is derived by adjusting Statutory PBT for the impacts of AASB 139: Financial Instruments:

Recognition and Measurement which relate to other reporting periods and identifying certain other items

which are not included in Underlying PBT. Items not included in Underlying PBT primarily result from major

transformational/restructuring initiatives, transactions involving investments and impairment of assets outside

the ordinary course of business.

Underlying Unit Cost

Underlying Unit Cost remains an area of focus across the business and as a result, the STIP scorecard includes

a unit cost target (based on the annual financial budget).

Underlying Unit Cost performance is calculated as net underlying expenditure (excluding fuel and Frequent Flyer

change in accounting estimate) divided by the Group’s ASKs. Net underlying expenditure is derived from total

passenger revenue less Underlying PBT. To ensure the measure focuses on the underlying operating activities

and efficiencies, the measure excludes the impact of fuel price changes and restructuring charges.

Operating Cash Flow to Net Debt

The inclusion of the operating cash flow to net debt measure reflects the Group’s goal of maintaining the

competitive advantage provided by an investment grade credit rating. The measure is calculated as the

Group’s operating cash flow divided by the Group’s net debt. The Group’s net debt includes interest bearing

liabilities net of cash and off balance sheet non-cancellable operating leases.

People Safety

The targets at a Group level involve reducing the Total Recorded Injury Frequency Rate by 10 per cent on the

2010/2011 result and also reducing the Lost Work Case Frequency Rate by eight per cent of our employees.

Punctuality

Punctuality is measured against on-time departures and arrivals targets. Individual punctuality targets

are set for Qantas domestic, Qantas international, Jetstar domestic, Jetstar international and Jetstar Asia.

Customer Service - NPS

Customer Service is measured against NPS targets. This is a survey based measure of the willingness

of customers to promote the services of the company (Qantas and Jetstar in this case) in preference

to its direct competitors. Individual NPS targets are set for Qantas domestic, Qantas international,

Jetstar domestic, Jetstar international and Jetstar Asia.

Remuneration Report (Audited) continued

QANTAS ANNUAL REPORT 2012052