Qantas 2012 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2012 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

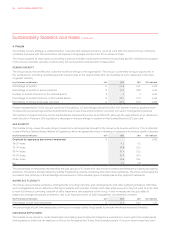

Sustainability Statistics and Notes continued

A detailed definition, methodology

and reconciliation of Underlying PBT

to Statutory PBT is contained in Note 2

to the Financial Statements on page 80

of the Financial Report.

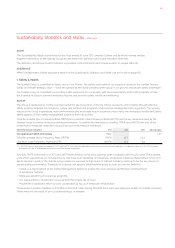

Net Underlying Unit Cost

The Net Underlying Unit Cost of the

Group, which is the Underlying PBT less

Passenger Revenue, fuel and Frequent

Flyer change in accounting estimate,

divided by the Group’s Available Seat

Kilometres (ASKs). Net underlying

expenditure is derived from total

passenger revenue less Underlying PBT.

Free Cash Flow

Free cash flow is a measure of financial

performance calculated as operating

cash flows net of investing cash flows.

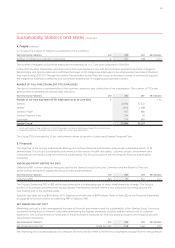

Scope:

The Consolidated Financial Statements

for the year ended 30 June 2012 comprise

Qantas and its controlled entities and the

Qantas Group’s interest in associates and

jointly controlled entities.

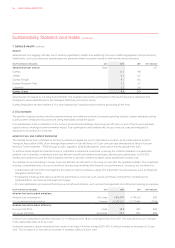

Average fleet age – scheduled

passenger fleet

The average age of the Group’s

scheduled passenger fleet based

on manufacturing dates.

Scope:

The scheduled passenger fleet of the

Qantas Group, including both owned

and leased aircraft. The Qantas Group’s

scheduled passenger fleet does not

include dedicated freighters and

Network Aviation fleet.

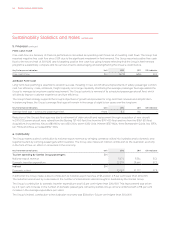

COMMUNITY

National export revenue

National export revenue is calculated

as the number of inbound visitors

brought to Australia by Qantas, Jetstar

and Jetstar Asia for the 12 months to

31 May (latest available data as at

30 June) multiplied by the estimated

average visitor expenditure of $3,313.

(Source: Tourism Australia’s March 2012

International Visitor Survey (latest available

data)) (2011: $3,315 (Source: Tourism

Australia’s March 2011 International Visitor

Survey)). This amount does not include

the value of airfare and freight charges

that accrue to the Qantas Group from

overseas sources. These also represent

export revenue.

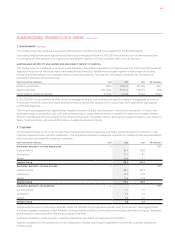

Domestic traveller expenditure

Domestic traveller expenditure is

calculated as the number of Qantas

Group domestic passengers for the

financial year multiplied by the estimated

average expenditure per visitor of $681

(Source: Tourism Australia’s March 2012

National Visitor Survey (latest available

data)) (2011: $620 (Source: Tourism

Australia’s March 2011 National Visitor

Survey)). This amount includes the value

of related airfares. As it is not possible to

disaggregate the data, the calculation

should be viewed as indicative only, e.g.

the figure may include some international

visitor expenditure (where domestic

flights are purchased after arrival in

Australia) or understate the expenditure

associated with domestic flights which

are ‘round trip’.

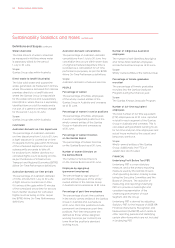

Economic output

This measure is calculated as the Qantas

Group total revenue multiplied by a

Qantas Group economic multiplier of 2.1

(as calculated by Access Economics

in 2008). The multiplier is derived from

Australian Bureau of Statistics input/

output tables of the Australian economy.

Access Economics is an economic

advisory company which provides

expertise in analysis, modelling and

forecasting. Access Economics was

commissioned by Qantas to gain a better

understanding of the Group’s contribution

to the Australian economy. A multiplier

of 2.1 suggests that a $1 million increase

in demand for Qantas’ services leads

to a $2.1 million increase in output from

all sectors in the economy, including air

transportation. In other words, the flow-

on effect outside of the Qantas Group for

every $1 million of revenue is $1.1 million.

Definitions and Scopes continued

151