Qantas 2006 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2006 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

Qantas Annual Report 2006

Notes to the Financial Statements

for the year ended 30 June 2006

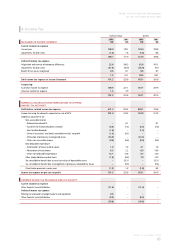

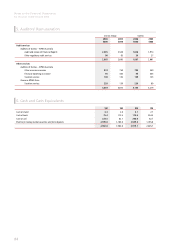

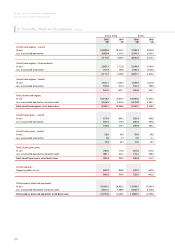

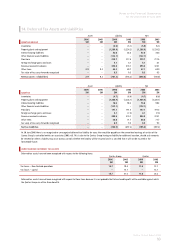

4. Income Tax

Qantas Group Qantas

2006

$M

2005

$M

2006

$M

2005

$M

RECOGNISED IN INCOME STATEMENT

Current income tax expense

Current year 190.9 170.1 129.4 103.0

Adjustments for prior years (1.2) 1.8 (1.8) 0.8

189.7 171.9 127.6 103.8

Deferred income tax expense

Origination and reversal of temporary differences 22.6 109.3 62.6 107.1

Adjustments for prior years (21.9) (56.9) (23.9) (9.7)

Benefit of tax losses recognised 0.8 0.7 0.8 0.7

1.5 53.1 39.5 98.1

Total income tax expense in Income Statement 191.2 225.0 167.1 201.9

Comprising:

Australian income tax expense 189.6 221.1 167.1 201.9

Overseas income tax expense 1.6 3.9 ––

191.2 225.0 167.1 201.9

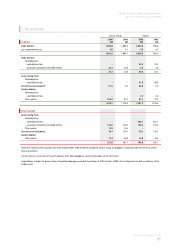

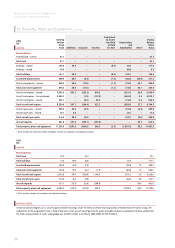

NUMERICAL RECONCILIATION BETWEEN INCOME TAX EXPENSE

AND PRE-TAX NET PROFIT

Profi t before related income tax expense 671.2 914.3 559.1 725.8

Income tax using the domestic corporate tax rate of 30% 201.4 274.3 167.8 217.8

Add/(less) adjustments for:

Non-assessable income

– Deferred lease benefits –0.1 –0.1

– Tax offset for franked dividends received (8.9) (7.2) (4.3) (3.0)

– Non-taxable dividends (1.4) –(1.2) –

– Share of associates’ and jointly controlled entities’ net profit (1.5) (0.5) ––

– Utilisation of previously unrecognised losses (14.5) –(14.5) –

– Other non-assessable income (0.6) (0.8) (0.4) (0.6)

Non-deductible expenditure

– Amortisation of lease residual values 1.0 1.8 2.1 1.8

– Write-down of investments 6.3 2.2 6.9 16.9

– Other non-deductible expenditure 12.1 15.8 5.5 14.9

Other (deductible)/assessable items (1.5) (0.8) 7.0 14.9

Tax consolidation benefit due to reset tax values of depreciable assets –(52.1) –(52.1)

Tax consolidation benefit due to recognition of previously unbooked tax losses –(9.6) –(9.6)

(Over)/under provision in prior years (1.2) 1.8 (1.8) 0.8

Income tax expense on pre-tax net profi t 191.2 225.0 167.1 201.9

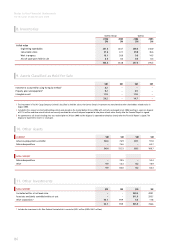

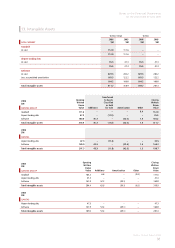

DEFERRED INCOME TAX RECOGNISED DIRECTLY IN EQUITY

Current income tax expense

Other financial (assets)/liabilities (11.4) –(11.4) –

Deferred income tax expense

Relating to revaluation of property, plant and equipment 0.8 –––

Other financial (assets)/liabilities (8.2) –(8.2) –

(18.8) –(19.6) –