Qantas 2006 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2006 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

Qantas Annual Report 2006

Notes to the Financial Statements

for the year ended 30 June 2006

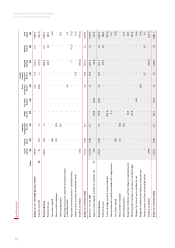

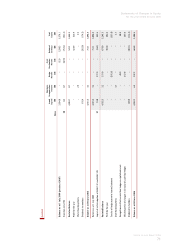

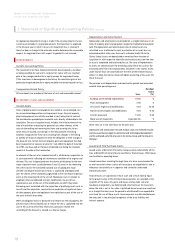

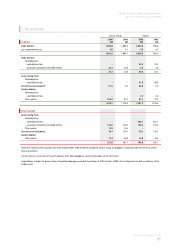

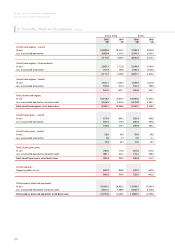

(R) PROPERTY, PLANT AND EQUIPMENT CONTINUED

Leased and Hire Purchase Assets continued

Fully prepaid leases are classified in the Balance Sheet as hire purchase

assets, to recognise that the financing structures impose certain obligations,

commitments and/or restrictions on the Qantas Group, which differentiate

these aircraft from owned assets.

Leases are deemed to be non-cancellable if significant financial penalties

associated with termination are anticipated.

With respect to any premises rented under long-term operating leases,

which are subject to sub-tenancy agreements, provision is made for any

shortfall between primary payments to the head lessor less any recoveries

from sub-tenants. These provisions are determined on a discounted cash

flow basis, using a rate reflecting the cost of funds.

Manufacturers’ credits

The Qantas Group receives credits from manufacturers in connection with

the acquisition of certain aircraft and engines. These credits are recorded as

a reduction to the cost of the related aircraft and engines. Where the

aircraft are held under operating leases, the credits are deferred and

reduced from the operating lease rentals on a straight line basis over the

period of the related lease as deferred credits.

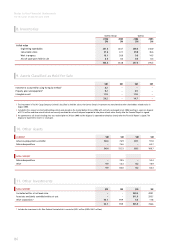

(S) INTANGIBLE ASSETS

Goodwill

Business Combinations prior to 1 July 2004

Goodwill is included on the basis of its deemed cost, which represents the

amount recorded under previous GAAP. Utilising relief available under

AASB1, the classifi cation and accounting treatment of business combinations

that occurred prior to 1 July 2003 has not been reconsidered in preparing the

Qantas Group’s opening A-IFRS Balance Sheet at 1 July 2004.

Business Combinations since 1 July 2004

All business combinations are accounted for by applying the purchase

method. Goodwill represents the difference between the cost of the

acquisition and the fair value of the net identifiable assets acquired.

Goodwill is stated at cost less any accumulated impairment losses.

Goodwill is allocated to cash generating units and is no longer amortised

but is tested annually for impairment. With respect to associates, the

carrying amount of goodwill is included in the carrying amount of the

investment in the associate.

Negative goodwill arising on an acquisition is recognised directly in profit

or loss.

Other Intangible Assets

Airport landing slots are stated at cost less any accumulated impairment

losses. Airport landing slots are allocated to the Qantas cash generating

unit and are not amortised as they are considered to have an indefinite

useful life and are tested annually for impairment.

Software

Software is stated at cost less accumulated amortisation and impairment

losses. Software development expenditure, comprised of the cost of

materials, direct labour and an appropriate proportion of overheads are

only recognised as an asset when the Qantas Group controls future

economic benefits as a result of the costs incurred, it is probable that those

future economic benefits will eventuate and the costs can be measured

reliably. Amortisation is charged to the Income Statement on a straight-line

basis over the estimated useful life of three to five years.

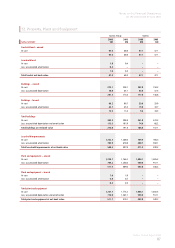

(T) PAYABLES

Liabilities for trade creditors and other amounts are carried at cost.

Deferred cash settlements are recognised at the present value of the

outstanding consideration payable discounted at prevailing commercial

borrowing rates.

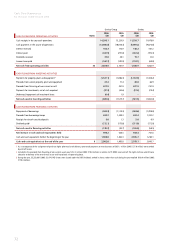

(U) FREQUENT FLYER

The Qantas Group receives revenue from the sale to third parties of rights

to have Qantas award points allocated to members of the Qantas Frequent

Flyer Program. This revenue is deferred (net of points which it is considered

will not be redeemed) and recognised in the Income Statement as net

passenger revenue when the points are redeemed and passengers uplifted.

Revenue in relation to points which it is considered will not be redeemed

are recognised as net passenger revenue on the sale of the points.

Members of the Qantas Frequent Flyer Program also accumulate points by

travelling on qualifying Qantas and partner airline services. The obligation

to provide travel rewards to members arising from these points is provided

as points are accumulated, net of estimated points that will expire. The

provision is based on the present value of the expected incremental direct

cost (being the cost of meals and passenger expenses) of providing the

travel rewards based on the forecasted weighted average cost of the reward

mix i.e. redemptions on Qantas services and on non-airline or other member

airlines. The provision is reduced to the extent surcharges and recoveries are

made and as members redeem awards or their entitlements expire. Changes

in cost estimates, breakage assumptions and passenger recoveries could

have a material impact on the fi nancial statements of Qantas.

(V) EMPLOYEE BENEFITS

Wages, Salaries, Annual Leave and Sick Leave

Liabilities for employee benefits for wages, salaries, annual leave (including

leave loading) and sick leave vesting to employees expected to be settled

within 12 months of the year end represent present obligations resulting

from employees’ services provided to balance date. The calculation of this

liability is based on remuneration wage and salary rates that the Qantas

Group expects to pay as at balance date including related on-costs, such as

workers’ compensation insurance, superannuation and payroll tax. Amounts

expected to be settled more than 12 months after year end are not

discounted to their present value.