Qantas 2000 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2000 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

THE SPIRIT OF AUSTRALIA

RECORD RETURNS FOR SHAREHOLDERS

Chairman’s Report

It gives me great pleasure to present

to you my first Annual Report as

Chairman of Qantas. The airline achieved

another record result for the year ended

30 June 2000 with a net profit before

tax of $762.8 million (1999: $662.5

million), representing an increase

of 15.1 percent over the previous year.

It was the fifth year of sustained

profit increases for the company since

privatisation in 1995. Net profit after

tax of $517.9 million (1999: $420.9

million) was up 23 percent on the

previous year and included $82 million

from two abnormal items. Operating

profit before tax and abnormal items

increased by $103.3 million from

$601.7 million to $705 million.

DIVIDENDS

The Board declared fully franked

ordinary dividends totalling 22 cents

per share for the year and a special

dividend of 37 cents per share.

The special dividend was declared to

maximise your returns by distributing

accumulated franking credits in a year

when they have more value to you.

Following the reintroduction of the

Dividend Reinvestment Plan (DRP),

the fully franked special dividend will

be paid in December. The DRP gives you

the option of receiving the fully franked

special dividend in cash or reinvesting

in Qantas shares.

THE YEAR IN REVIEW

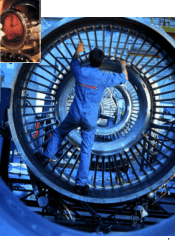

Qantas maintained its commitment to

the highest standards of safety, aircraft

maintenance and flight operations. During

the 1999/2000 financial year, the airline

invested more in core airline maintenance

and recruited additional staff for the

Engineering and Maintenance division.

Qantas established a new industry

benchmark when it commissioned

a completely new facility for seals

and bearings maintenance at its

Mascot Jetbase.

The airline also continued to invest in

new aircraft and took delivery of three

new Boeing 747-400s, one new

Boeing 767-300 and the first of seven

Boeing 767-300s being leased from

British Airways, to provide further

capacity for increased services and to

allow for additional maintenance time.

Work continued on the assessment of

aircraft types being proposed for the

Qantas fleet by both Airbus and Boeing.

Both manufacturers are proposing new

Very Large Aircraft (VLAs) and options

for 300-seat aircraft for the core fleet.

Qantas continued to expand its route

network during the 1999/2000 financial

year. In October, the airline returned to

New York after an absence of 26 years,

through the introduction of direct

services from Sydney. It also became

the first airline to fly non-stop scheduled

services between Los Angeles and

Melbourne. In March, Qantas extended

the first-ever franchise of its brand to

another airline. The Qantas brand is

now visible in the New Zealand domestic

market through the franchise.

Australian domestic capacity increased

during the year with the introduction of

Boeing 767 aircraft on key domestic

routes.

PRODUCT

In March 2000, Qantas announced an

investment of $400 million in product

and service improvements over the next

two years.

These improvements include:

"

a new inflight entertainment and

communication system in its

international long-haul fleet of

747-400 aircraft

"

the introduction of cuisine inspired

by Sydney chef and restaurateur,

Neil Perry, to the airline’s domestic

network

"

improvements to a number of Qantas

Club lounges around the network.

E-COMMERCE

The airline continued planning its

e-commerce business strategy and will

soon launch additional internet-based

offerings for corporate customers

and travel partners. New purchasing

partnerships are also starting to

take shape.

BOARD AND MANAGEMENT

CHANGES

I would like to formally acknowledge

the significant contribution of the

previous Chairman, Gary Pemberton, who

retired in August 2000 after chairing the

Qantas Board for more than seven years.

I would also like to acknowledge

Directors who have retired since the

last Annual Report – Bob Ayling, John

Ducker and Gary Toomey – and welcome

new Directors who have been appointed –

Lord Marshall (1 July 2000), Geoff

Dixon (1 August 2000), Peter Gregg

(13 September 2000) and Dr John

Schubert (23 October 2000).

In September 2000, the Board

announced that Deputy Chief Executive

Officer, Geoff Dixon, would succeed Chief

Executive, James Strong, when he

retires, as previously announced, in 2001.

The Board plans to continue the

strategies that have served Qantas well

and will manage carefully the asset base,

maintain the emphasis on productivity

and efficiency and meet the competition

in a vigorous manner.

On behalf of the Qantas Board, I would

like to thank management and staff for

their commitment during the year and

congratulate them on their outstanding

contribution to the 2000 result.

MARGARET JACKSON

Chairman