Qantas 2000 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2000 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

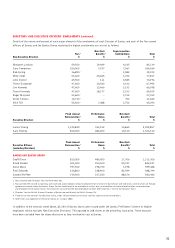

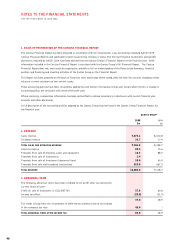

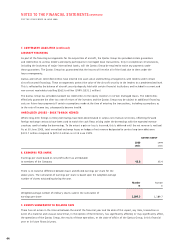

4. DIVIDENDS

Dividends proposed or paid by Qantas are:

Total Franked Tax Percentage

Cents Amount Rate Franked

Type per Share $m Date of Payment % %

2000 Interim ordinary 11.0 133.3 29 March 2000 36 100

2000 Final ordinary 11.0 133.3 4 October 2000 34 100

2000 Special 37.0 448.0 13 December 2000 34 100

59.0 714.6

1999 Interim ordinary 8.0 95.0 31 March 1999 36 100

1999 Final ordinary 11.0 133.2 1 December 1999 36 100

1999 Special 13.5 163.4 1 December 1999 36 100

32.5 391.6

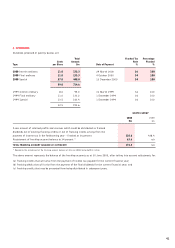

QANTAS GROUP

2000 1999

$m $m

Gross amount of retained profits and reserves which could be distributed as franked

dividends out of existing franking credits or out of franking credits arising from the

payment of income tax in the forthcoming year – franked at 36 percent 110.6 438.4

Restatement of franking account balance to 34 percent * 63.6 n/a

TOTAL FRANKING ACCOUNT BALANCE AT 34 PERCENT 174.2 n/a

* Represents the restatement of the franking account balance at 30 June 2000, being $690.3 million.

The above amount represents the balance of the franking accounts as at 30 June 2000, after taking into account adjustments for:

(a) franking credits that will arise from the payment of income tax payable for the current financial year;

(b) franking debits that will arise from the payment of the final dividends for the current financial year; and

(c) franking credits that may be prevented from being distributed in subsequent years.