Qantas 2000 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2000 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

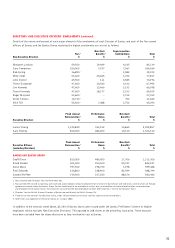

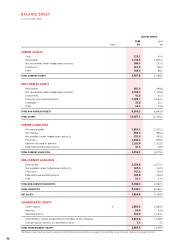

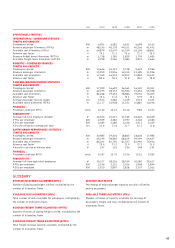

DISCUSSION AND ANALYSIS OF THE BALANCE SHEET

AS AT 30 JUNE 2000

The net assets of the Qantas Group decreased by 6.4 percent

to $2,864.4 million during the past financial year.

Major items are discussed below.

REVIEW OF ASSETS

• Current receivables reduced by 6.1 percent, largely as a

result of the prior year including US$350 million of proceeds

from the issue of unsecured notes. Trade debtors increased

in line with increased revenue.

• Net receivables/payables under hedge/swap contracts

increased by 15.3 percent to $1,306.3 million primarily

due to the movement in foreign exchange rates. Net

receivables/payables under hedge/swap contracts represents:

– cross-currency swaps used to hedge long-term foreign

currency borrowings;

– deferred gains/losses on forward foreign exchange

contracts used to hedge capital expenditure; and

– net deferred losses associated with hedges of foreign

currency revenue relating to future transportation services

designated to service long-term debt.

• Inventory levels increased by 11.5 percent due to higher

expenditure on engineering expendables and consumable

stores supporting the growth in fleet numbers.

• Property, plant and equipment increased by 6.8 percent,

reflecting capital expenditure on aircraft acquisitions and

refinancings, aircraft reconfigurations and terminal

and lounge improvements.

REVIEW OF LIABILITIES

• Accounts payable and total borrowings increased by

8.4 percent due to increased activity and commercial paper

issues offset by debt repayments made during the year.

• Provisions increased by 14.0 percent as a result of higher

dividends, higher tax payable due to increased profitability

and increases in employee entitlement provisions, reflecting

wage increases.

• Revenue received in advance reflects passenger and freight

forward sales which are taken to revenue when the tickets

are utilised or the freight uplifted. This balance increased

by 16.6 percent due to a higher level of forward sales

compared to last year, in part due to higher activity.

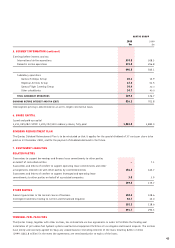

REVIEW OF SHAREHOLDERS’ EQUITY

• A total of 5.7 million new shares were issued during the

year under the Qantas Profitshare Scheme.

GEARING

Qantas Group gearing (including the notional capitalisation of

non-cancellable leases) on a hedged basis at 30 June 2000 was

44:56 compared to 40:60 at 31 December 1999 and 39:61 at

30 June 1999. The increase in gearing is primarily due to the

special dividend and the inclusion of all aircraft leases.

The Qantas Dividend Reinvestment Plan is to be reinstated

prior to the payment of the special dividend in December

2000. This reinstatement is to assist in providing equity to

fund future capital expenditure while maintaining gearing at

an acceptable level.

Gearing is determined by dividing the book value of the

Qantas Group’s net debt (short and long-term debt plus the

present value of non-cancellable operating leases less related

hedge receivables and cash and cash equivalents) by the same

amount plus the book value of total shareholders’ equity.

37