Qantas 2000 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2000 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

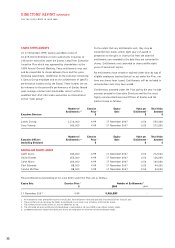

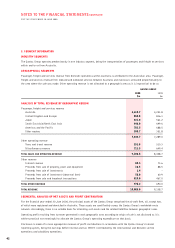

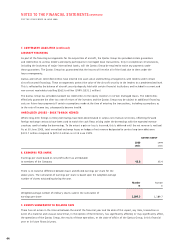

1. BASIS OF PREPARATION OF THE CONCISE FINANCIAL REPORT

The Concise Financial Report has been prepared in accordance with the Corporations Law, Accounting Standard AASB 1039

Concise Financial Reports and applicable Urgent Issues Group Consensus Views. The Concise Financial Statements and specific

disclosures required by AASB 1039 have been derived from the Qantas Group’s Financial Report for the financial year. Other

information included in the Concise Financial Report is consistent with the Qantas Group’s full Financial Report. The Concise

Financial Report does not, and cannot be expected to, provide as full an understanding of the financial performance, financial

position and financing and investing activities of the Qantas Group as the Financial Report.

This Report has been prepared on the basis of historical costs and except where stated, does not take into account changing money

values or current valuations of non-current assets.

These accounting policies have been consistently applied by each entity in the Qantas Group and, except where there is a change in

accounting policy, are consistent with those of the prior year.

Where necessary, comparative information has been reclassified to achieve consistency in disclosure with current financial year

amounts and other disclosures.

A full description of the accounting policies adopted by the Qantas Group may be found in the Qantas Group Financial Report for

the financial year.

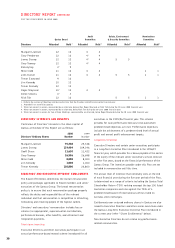

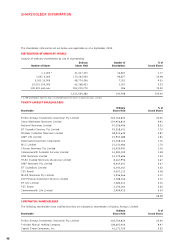

QANTAS GROUP

2000 1999

$m $m

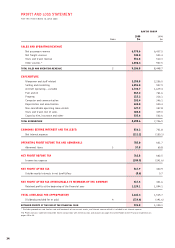

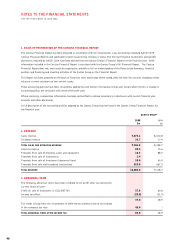

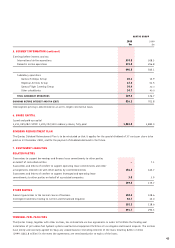

2. REVENUE

Sales revenue 9,072.1 8,430.8

Dividend revenue 34.7 17.9

TOTAL SALES AND OPERATING REVENUE 9,106.8 8,448.7

Interest revenue 88.5 73.6

Proceeds from sale of property, plant and equipment 10.3 88.5

Proceeds from sale of investments 2.4 –

Proceeds from sale of investment (abnormal item) 58.0 60.9

Proceeds from sale and leaseback transactions 819.0 467.0

TOTAL REVENUE 10,085.0 9,138.7

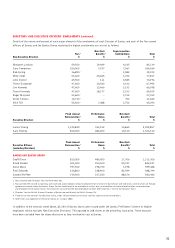

3. ABNORMAL ITEMS

The following abnormal items have been credited to net profit after tax during the

current financial year:

Profit on sale of investment in EQUANT NV 57.8 60.8

Income tax effect (20.8) (21.9)

37.0 38.9

Tax credit arising from the restatement of deferred tax balances due to the change

in the company tax rate 45.0 –

TOTAL ABNORMAL ITEMS AFTER INCOME TAX 82.0 38.9

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2000