Porsche 2011 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2011 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Gross liquidity, i.e., cash, cash equivalents

and time deposits of the Porsche SE group, de-

creased from 622 million euro in the prior year to

469 million euro. Liabilities to banks fell due to the

capital increase in April 2011 and the associated

partial repayment from 6,964 million euro as of

31 December 2010 to 1,991 million euro as of

31 December 2011.

The net liquidity of the Porsche SE group,

i.e., cash, cash equivalents and time deposits less

liabilities to banks, thus came to minus 1,522 million

euro as of 31 December 2011 (31 December 2010:

minus 6,342 million euro).

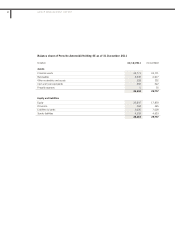

Net assets

The total assets of Porsche SE group in-

creased by 3,299 million euro compared to

31 December 2010 to 32,965 million euro as of

31 December 2011.

The non-current assets of the Porsche SE

group totaling 32,261 million euro (31 December

2010: 28,733 million euro) essentially pertain to the

shares in Porsche Zwischenholding GmbH and Volks-

wagen AG accounted for at equity. The investments

accounted for at equity have increased by a total of

3,750 million euro to 28,008 million euro, mainly due

to the positive business development of both invest-

ments. While the carrying amount of the investment

in Volkswagen AG accounted for at equity increased

by 3,563 million euro to 24,272 million euro, the

carrying amount of the investment in Porsche

Zwischenholding GmbH accounted for at equity rose

by 187 million euro to 3,736 million euro. Other non-

current receivables and assets as of the end of the

reporting period of 4,253 million euro (31 December

2010: 4,475 million euro) relate primarily to receiv-

ables from loans granted to Porsche Zwischenhold-

ing GmbH and Porsche AG. In addition, the other non-

current receivables and assets contain a positive fair

value totaling 232 million euro (31 December 2010:

459 million euro) for the put option Porsche SE

received from Volkswagen under the basic agree-

ment for the remaining shares that it holds in Por-

sche Zwischenholding GmbH. It is calculated based

on a 100 percent theoretical probability of exercise

of the options; in other words, there is a 100 percent

probability that the merger will fail within the frame-

work and timeframe of the basic agreement

(31 December 2010: 50 percent).

Non-current assets expressed as a percent-

age of total assets increased from 96.9 percent at

the end of the comparative period to 97.9 percent at

the end of the fiscal year 2011.

Current assets fell to 704 million euro in

comparison to the end of the last reporting date

(31 December 2010: 933 million euro). This figure

mainly contains cash and cash equivalents of Por-

sche SE and its subsidiaries as well as income tax

receivables that primarily relate to reimbursement

claims for tax on investment income from dividends

received. As a percentage of total assets, current

assets fell from 3.1 percent in the prior year to 2.1

percent as of 31 December 2011.

As of 31 December 2011, the equity of the

Porsche SE group increased, mostly on account of

the capital increase performed in April 2011, to

21,645 million euro (as of 31 December 2010:

17,214 million euro). The equity ratio (taking hybrid

capital into account) increased from 58.0 percent in

the prior year to 65.7 percent as of 31 December

2011, with total assets rising.

Current and non-current provisions de-

creased from 247 million euro at the end of SFY

2010 to 195 million euro as of 31 December 2011.

This decrease is mainly driven by the decrease in

income tax provisions.

Compared to 31 December 2010, non-

current and current financial liabilities decreased by a

total of 4,973 million euro to 5,871 million euro as of

the reporting date. This decrease is attributable to

the partial repayment of the liabilities to banks pre-

sented in current financial liabilities in a nominal total

amount of 5,000 million euro, which was undertaken

using the issue proceeds from the capital increase in

April 2011 as well as using other available liquidity. In

October 2011, the remaining liability to banks in a

nominal amount of 2,000 million euro was refinanced

57

2