Porsche 2011 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2011 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

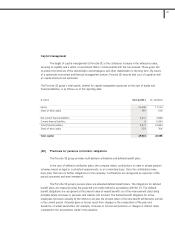

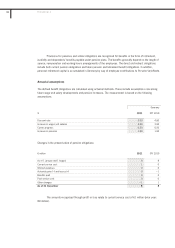

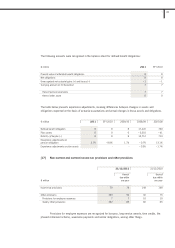

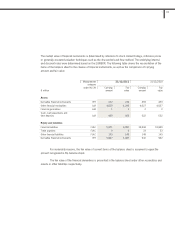

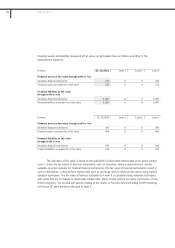

[21] Financial risk management and financial instruments

1 Hedging guidelines and financial risk management principles

The principles and responsibilities for managing and controlling the risks that could arise from financial

instruments are defined by the executive board and monitored by the supervisory board. The risk management

processes are clearly defined in the Porsche SE group. The processes govern in particular the ongoing

monitoring of the liquidity situation in the Porsche SE group, the monitoring of the enterprise value of Porsche

Zwischenholding GmbH and Volkswagen AG, the development of interest levels on the capital markets and

monitoring of the financial ratios. Any concentrations of risk within the Porsche SE group are also analyzed

using these processes. The processes are based on statutory requirements. The risks are identified, analyzed

and monitored using suitable information systems.

The guidelines and the supporting systems are checked regularly and brought into line with current

market development. The Porsche SE group manages and monitors these risks primarily via its business

operations and financing activities and, where necessary, by using derivative financial instruments. The

derivative financial instruments used were mainly entered into to manage interest rate risks. Without using such

instruments, the group would have been exposed to higher financial risks. In addition, the group entered into

derivative financial instruments for the sale of the remaining shares in Porsche Zwischenholding GmbH held by

Porsche SE.

For further details on risks relating to financial instruments, reference is made to the “Opportunities

and risks of future development” section in Porsche SE’s group management report.

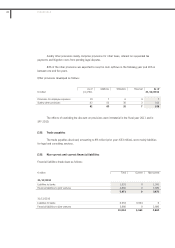

2 Credit and default risk

The credit and default risk arising from financial assets involves the risk of default by counterparties,

and therefore comprises at a maximum the amount of the positive fair values of claims against them. In

addition, there is a credit and default risk at the amount of financial guarantees issued. The default risk of

financial assets is generally taken into account through adequate valuation allowances considering collateral

that has already been provided. Various measures are taken into account to reduce the default risk for non-

derivative financial instruments, such as requesting hold harmless agreements or remuneration for the

assumption of liability. The contracting partners for monetary investments, capital investments and derivative

financial instruments are German and, to a lesser extent, international counterparties. Derivative financial

instruments are entered into in accordance with standardized guidelines, and are continuously monitored.

There are no significant concentrations of risk that are not evident from the notes to the financial

statements and management report.

Other notes

193

3