Porsche 2011 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2011 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240

|

|

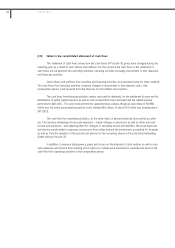

(3) the ability to use power over the investee to affect the amount of the investor's returns. All three elements

of the control concept have to be fulfilled. IFRS 10 replaces the requirements from IAS 27 “Consolidated and

Separate Financial Statements” in relation to consolidation and SIC 12 “Consolidation – Special Purpose

Entities”. The requirements in IAS 27 related to single entity financial statements are not affected and the

standard was renamed “Separate Financial Statements”.

· Pursuant to IFRS 11 “Joint Arrangements”, the accounting treatment of joint arrangements is oriented at the

rights and duties of the parties concerned rather than the legal form (substance over form). Proportionate

consolidation is no longer permitted for joint ventures. The new standard replaces IAS 31 “Interests in Joint

Ventures”. As a consequence, IAS 28 “Investments in Associates” was supplemented accordingly and

renamed “Investments in Associates and Joint Ventures”.

· IFRS 12 “Disclosure of Interests in Other Entities” is a new and comprehensive standard governing disclosure

requirements for all forms of interests in other companies, including joint arrangements, associates, special

purpose entities and other off-balance sheet vehicles. Requirements in other standards governing such

interests are being removed.

The new and amended standards are applicable for fiscal years beginning on or after 1 January 2013.

IFRS 13 “Fair Value Measurement”

IFRS 13 “Fair Value Measurement” will improve consistency and reduce complexity by providing a

precise definition of fair value for the first time, serving as a single source for fair value measurement and

prescribing disclosure requirements applicable for all IFRSs.

IFRS 13 is applicable prospectively for reporting periods beginning on or after 1 January 2013.

Amendments to IAS 1 “Financial Instruments: Presentation”

Amendments to IAS 1 “Financial Statement Presentation” require that the items of other comprehensive

income are broken down into those that are reclassified through the income statement and those items that are

not. A similar treatment is intended for income tax where the pre-tax presentation method is used. These

should also be separated into items that can and items that cannot be reclassified. The amendments to IAS 1

are mandatory for fiscal years beginning on or after 1 July 2012.

172 FINANCIALS