Porsche 2011 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2011 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

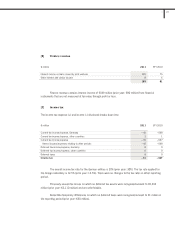

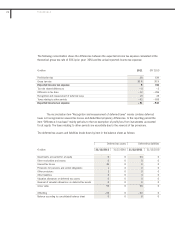

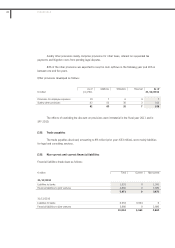

Receivables from joint ventures are due from companies in the Porsche Zwischenholding GmbH group.

These receivables are counterbalanced by financial liabilities to these companies of €3,880 million (prior year:

€3,880 million).

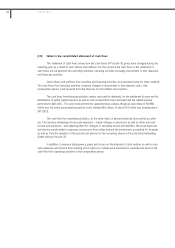

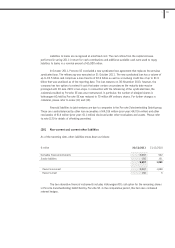

Porsche Zwischenholding GmbH has a lien on a loan due from itself amounting to €2,703 million (prior

year: €2,703 million). This lien serves as collateral on a liability of the same amount due from Porsche SE to

Porsche Zwischenholding GmbH and is presented within financial liabilities to joint ventures. Porsche

Zwischenholding GmbH may exercise its right of lien if Porsche SE is in arrears with payments as they fall due

for the secured liability due to Porsche Zwischenholding GmbH.

Offsetting is not permitted during the term of the loan unless any mandatory or optional grounds for

insolvency have arisen at Porsche SE. Permission to offset the loan can be given when it falls due for

repayment. Volkswagen AG will assume the loan obligations of this company due to Porsche SE in the event of

insolvency of Porsche Zwischenholding GmbH provided it would have been possible to offset the obligations

against claims against Porsche SE had the company not become insolvent.

Volkswagen AG has a corresponding obligation to settle a loan receivable due from Porsche AG of

€1,313 million (prior year: €1,313 million) in the case of insolvency of Porsche AG. The loan agreement

contains a premature repayment clause in the event of Porsche AG’s insolvency. Offsetting with the liability to

Porsche AG amounting to €1,177 million (prior year: €1,177 million) is not permitted unless any mandatory or

optional grounds for insolvency have arisen at Porsche AG.

The loan receivables from the Porsche Zwischenholding GmbH group thus exceed the corresponding

financial liabilities by a total of €136 million (prior year: €136 million). There is neither a guarantee by

Volkswagen AG for the partial amount nor can it be offset.

Compensation of €1 million (prior year: €2 million) for the assumption of liability from financial

guarantees has been recognized under other receivables and assets.

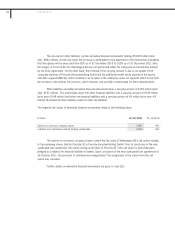

Collateral is generally accounted for when the contract is concluded and derecognized when the

contract expires.

Valuation allowances are recognized to take account of default risks. The maximum default risk

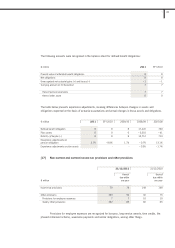

corresponds to the carrying amounts of the other receivables and assets. The current other receivables and

assets are non-interest-bearing. The non-current other receivables and assets contain derivative financial

instruments totaling €232 million (prior year: €459 million).

Other receivables and assets excluding derivative financial instruments have a carrying amount of

€4,042 million (prior year: €4,041 million). This value comprises other financial receivables with a carrying

amount of €4,029 million (prior year: €4,027 million), financial guarantees with a carrying amount of €1 million

(prior year: €2 million) and non-financial other receivables and assets with a carrying amount of €12 million

(prior year: €12 million). The non-financial other receivables and assets mainly contain prepaid expenses.

183

3