Porsche 2004 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2004 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The renewed improvement in the earnings situation was also expressed

by a higher profit per share.

Porsche Stock28

Outstanding Long-Term Increase in Value

Long-term performance of Porsche stock has been exceptionally

good. If the quoted price is examined for the past ten fiscal years,

that is to say on the last day of each annual period from July 31,1995

to July 31, 2005, it will be seen to have risen from 33.75 Euro to

654 Euro, an increase of 1,838 percent compared with a rise in the

Dax index of only 120 percent.

The increase in the value of a Porsche stockholding in the same ten-

year period has been equally positive: if the sum of 10,000 Euro had

been invested on July 31, 1995, it would have been worth – including

dividends – 203,296 Euro on July 31, 2005.

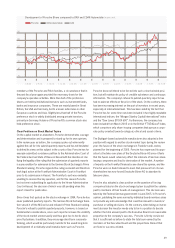

Increase Profit per Share

Porsche AG’s earnings situation has improved yet again, as reflected in

the increased profit per share (calculated for the first time according to

IFRS accounting rules). The result rose in the review year to 44.68 Euro

per share of common stock (previous year: 39.63 Euro), and 44.74

Euro per share of prefered stock (previous year: 39.69 Euro).

There will also be an increase in dividends. For the 2004/05 fiscal

year, the Annual General Meeting will be invited to recommend the

payment of a dividend of 4.94 Euro per share of common stock

(previous year: 3.94 Euro) and 5.00 Euro (previous year: 4.00 Euro)

per share of preference stock. The total dividend payable in respect

of the past fiscal year on both types of stock will thus be 87.0 million

Euro (previous year: 69.5 million Euro).

Intensive Investor Relations

In recent years, there has been a distinct increase in the amount of

information called for by those active on financial markets. Porsche

accordingly devoted close attention to investors and financial analysts

in the 2004/05 fiscal year. This communication took the form on

the one hand of regular, comprehensive reporting in the media, and

on the other of direct contacts with financial market participants in

the course of numerous individual discussions and at road shows,

car presentations and trade fairs. In all such contacts the company

attached great importance to “speaking with one voice”, that is to

say to unified communication with both the general public and the

financial world.

The current figures and corporate strategy were explained to analysts

at several conferences held specifically for this purpose, in some

cases during active new-model driving sessions, for example presen-

tation of the new Boxster in Austria, the 911 Carrera Cabriolet in

Spain and the Cayman S in Italy. In addition, analysts’ conferences

were held when the annual accounts were presented in December

2004 and on the occasion of the German International Motor Show

(the “IAA”) in September 2005. Furthermore, during the fiscal year

a large number of personal discussions were held with institutional

investors and analysts at the company’s headquarters in Zuffenhausen.

Locally held company presentations continued to play an important

role in Porsche’s contacts with institutional investors. Such events

took place at a wide variety of financial centers in the USA, Germany,

Great Britain, France, Italy, Switzerland and also Scandinavian

countries, and were very well received.

Last but not least, there was an active exchange of information with

private investors who submitted questions to the company’s Investor

Relations staff. Porsche AG also undertook presentations at a number

of stock market forums to which private investors were invited by

investment associations and banks. The annual general meeting for

the 2003/04 fiscal year was held in January 2005 in Stuttgart and

was well attended by some 3,000 stockholders and guests.

Stable Stockholders’ Structure

In turbulent economic periods in particular, a stable circle of stock-

holders represents a corporate asset that should not be underesti-

mated and a firm foundation on which to develop a growth-based

corporate strategy. Frequent changes in ownership, on the other

hand, make it difficult for business activities develop consistently in

the long term. Porsche AG attaches great value to this stability,

with an unchanged distribution of its equity of 45.5 million Euro into

8,750,000 common-stock shares and the same number of stock-

exchange listed preference shares. The common stock is held by

Earnings per Preferred Share in Euro

*Now calculated according to IFRS, previously by the DVFA/SG formula.

00 ⁄ 01 01 ⁄ 02 02 ⁄ 03 03 ⁄ 04* 04 ⁄ 05*

40

30

20

10