Porsche 2004 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2004 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group Notes Principles114

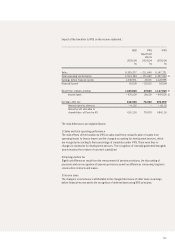

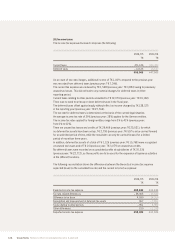

Pension provisions are measured using the projected unit credit method taking into

account future salary and pension developments. The corridor approach is used.

Non-current provisions are disclosed at present value.

Expense provisions are not recognized.

Deferred taxes are recognized using the liability method. Deferred taxes on temporary

differences that arose without effect on income are also recognized without effect on income.

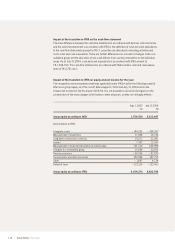

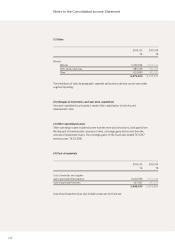

Consolidated Group

The consolidated financial statements of Porsche AG include all entities in which Porsche AG

has the power to govern the financial and operating policies, either directly or indirectly

(“control” concept).

The group of fully consolidated entities includes Porsche AG and 22 German (previous year: 22)

and 57 international (previous year: 52) subsidiaries, including special purpose securities funds

and variable interest entities.

Porsche Design Great Britain Limited, London, Porsche Design of France SARL, Serris,

Porsche Design of Italy S.R.L., Milan, CTS CarTopSystems Belgium N.V., Antwerp and

Porsche Design Asia Pacific Limited, Hong Kong, are included in the consolidated financial state-

ments of Porsche for the first time as of July 31, 2005. The changes in the consolidated group

are immaterial for the net assets, financial position and results of operations of the Group.

The complete list of equity investments of Porsche AG and the Porsche Group is filed with the

commercial register of Stuttgart district court (HRB 5211).

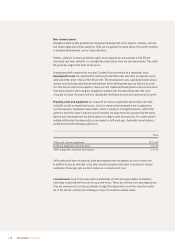

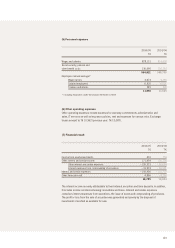

Consolidation Principles

Capital consolidation is performed in accordance with the purchase method pursuant to IFRS 3

(“Business Combinations”). Purchased assets and liabilities are measured at their fair value on

the date of acquisition. The purchase costs of the shares acquired are then offset against pro rata

revalued equity of the subsidiary. Any remaining positive difference from offsetting the purchase

price against the identified assets and liabilities is shown as goodwill.

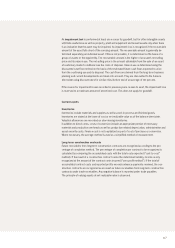

Expenses and income as well as receivables, liabilities and provisions between the consolidated

entities are offset. Intercompany profits from the disposal of assets within the Group which have

not yet been resold to third parties are eliminated. Deferred taxes are recognized for consolida-

tions with effect on income taxes. In addition, guarantees and warranties assumed by Porsche AG

or one of its consolidated subsidiaries in favor of other subsidiaries are eliminated.