Porsche 2004 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2004 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

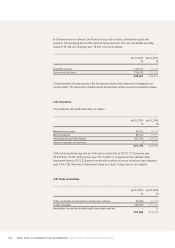

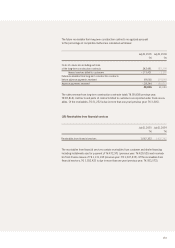

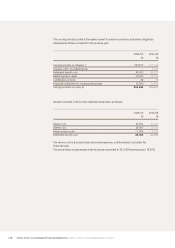

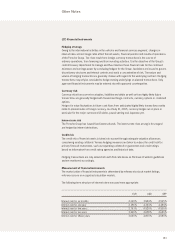

Notes to the Consolidated Financial Statements Notes to the Consolidated Balance Sheet

140

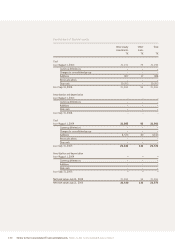

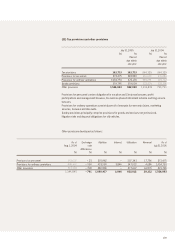

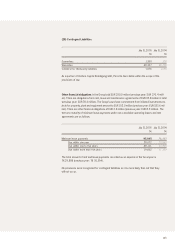

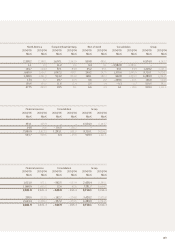

(23) Financial liabilities

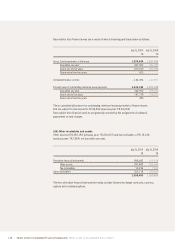

Financial liabilities break down as follows:

The following items are reported under bonds:

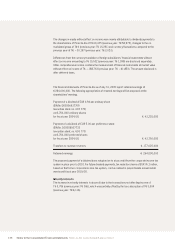

The bonds are exclusively fixed-interest instruments. They are recorded at fair value with an effect

on income. To hedge the risk of interest rate fluctuation, interest hedges were concluded which

were also recognized at fair value.

Liabilities to banks serve short-term financing purposes. The nominal interest rate varies

from 0.25% to 4.5% depending on the currency, maturity and contractual terms and conditions

(previous year: 0.25% to 5.25%). They are recognized at amortized cost.

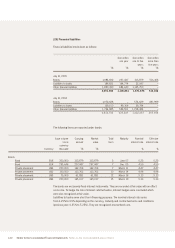

Due within Due within Due within

one year one to five more than

years five years

T€ T€ T€ T€

July 31, 2005

Bonds 1,084,692 257,447 313,879 513,366

Liabilities to banks 186,821 164,774 22,047 –

Other financial liabilities 1,820,390 684,640 1,135,750 –

3,091,903 1,106,861 1,471,676 513,366

July 31, 2004

Bonds 1,072,628 – 574,629 497,999

Liabilities to banks 129,150 99,366 29,784 –

Other financial liabilities 1,744,985 526,501 1,218,484 –

2,946,763 625,867 1,822,897 497,999

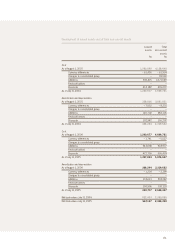

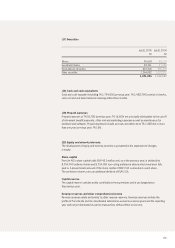

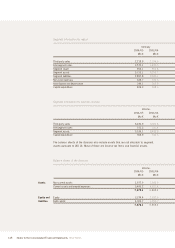

Issue volume Carrying Market Total Maturity Nominal Effective

Local amount value term interest rate interest rate

currency

Currency thousand T€ T€ % %

Bonds

Bond EUR 300,000 313,879 313,879 5 June 07 5.25 5.25

Bond EUR 255,646 257,447 257,447 7 Dec. 05 4.50 4.50

Private placement USD 200,000 162,706 162,706 7 March 11 4.47 4.47

Private placement USD 150,000 123,762 123,762 10 March 14 4.98 4.98

Private placement USD 75,000 61,881 61,881 12 March 16 5.13 5.13

Private placement USD 200,000 165,017 165,017 15 March 19 5.33 5.33