Porsche 2004 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2004 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group Notes Principles118

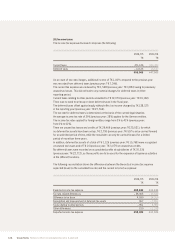

Financial instruments

Pursuant to IAS 39, a financial instrument is any contract that gives rise to a financial asset at

one entity and a financial liability or equity instrument at another entity.

If the trade date of a financial asset differs from the settlement date, the settlement date is

authoritative for initial recognition.

Initial measurement of a financial instrument is at cost. Transaction costs are included.

Subsequent measurement of financial instruments is either at fair value or amortized cost.

With respect to measurement, IAS 39 distinguishes between the following categories of

financial assets:

– Financial instruments recognized at fair value with effect on income,

– Held-to-maturity investments,

– Loans and receivables originated by the entity, and

– Available-for-sale investments.

By contrast, financial liabilities are divided into the two categories

– Financial instruments recognized at fair value with effect on income and financial instruments

held for trading, and

– Other liabilities.

Depending on the category, measurement of financial instruments is either at fair value or

amortized cost.

Fair value corresponds to market price provided the financial instruments measured are traded

on an active market. If there is no active market for a financial instrument, fair value is calculated

using appropriate actuarial methods such as recognized option price models or discounting future

cash flows with the market interest rate.

Amortized cost corresponds to costs of purchase less redemption, impairment losses and the

reversal of any difference between costs of purchase and the amount repayable upon maturity.

Primary financial instruments

Loans and receivables originated by the entity, held-to-maturity investments and

financial liabilities are measured at amortised cost unless they are associated with hedging

instruments.

In particular, these include trade receivables and payables, receivables from financial services,

other receivables and assets, held-to-maturity investments, financial liabilities and other liabilities.

Provided they are financial instruments as defined by IAS 39 and not associated with a hedging

instrument, the liabilities have been disclosed at their fair value or amortized cost. Fair value is

recognized if exercising the fair value option requires the liabilities to be recognized at fair value

with an effect on income. Amortized cost is recognized for all other liabilities as defined by IAS 39.

The liabilities from finance leases which are also disclosed under financial liabilities are recognized

at present value in accordance with IAS 17.