Porsche 2004 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2004 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Group Notes Principles112

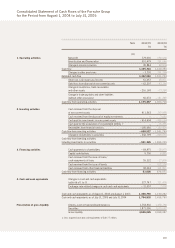

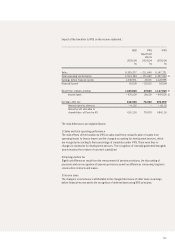

Impact of the transition to IFRS on the cash flow statement

The main difference between the cash flow statement in accordance with German commercial law

and the cash flow statement in accordance with IFRS is the definition of cash and cash equivalents.

In the cash flow statement pursuant to IAS 7, securities are allocated to investing activities and

not to cash and cash equivalents. There are further differences on account of changes in the con-

solidated group and the allocation of non-cash effects from currency translation to the individual

areas. As of July 31, 2004, cash and cash equivalents in accordance with IFRS amount to

T€ 1,458,790. The cash flow statement in accordance with HGB contains cash and cash equiva-

lents of T€ 2,791,412.

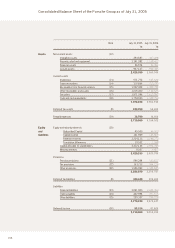

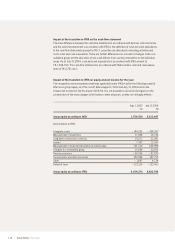

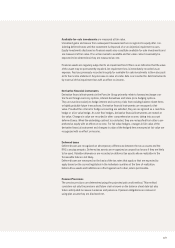

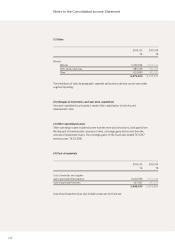

Impact of the transition to IFRS on equity and net income for the year

The recognition and measurement methods applicable under IFRS result in the following material

effects on group equity as of the cut-off dates August 1, 2003 and July 31, 2004 and on the

Group’s net income for the fiscal year 2003/04. It is not possible to reconcile the figures to the

presentation of the main changes in the balance sheet structure, as they are all equity effects:

Aug. 1, 2003 July 31, 2004

T€ T€

Group equity according to HGB 1,754,530 2,323,467

Reconciliation to IFRS:

Intangible assets – 144,025 – 108,357

Measurement of inventories 11,848 12,734

Long-term construction contracts 14,271 21,081

Leases 7,352 13,037

Measurement of financial instruments at market value 721,012 646,998

Changes to consolidated group 15,088 20,922

Pension provisions – 98,586 – 87,875

Tax provisions and other provisions 156,994 197,715

Other – 1,697 4,134

Deferred taxes – 132,514 – 123,060

Group equity according to IFRS 2,304,273 2,920,796