Polaris 2015 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2015 Polaris annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SHAREHOLDER LETTER

towards our goal of a $1+billion Motorcycle

business, we also expect to be on a path to

meet or surpass company-average margins.

Steve Menneto has built a talented team,

and their best eorts will be required to

win in an increasingly competitive global

Motorcycle market: a task made easier by

significant upgrades to our paint and delivery

capabilities that will allow us to introduce

new bikes and improve our cost position.

Craig Scanlon has led a successful eort to

remove weight and cost from Slingshot, and

is using innovative marketing techniques

to drive much-needed improvements

inproduct awareness. Expectations and

excitement remain high for Slingshot as

weenter yeartwo.

Profitability is also a primary focus for our

International business, which saw operating

profit decline significantly in2015, largely

driven by the strengthening U.S.dollar, but

also hurt by weak markets in Russia and the

Middle East. Mike Dougherty was promoted

to President of International last year, and

his wealth of experience in both creating

organic growth, and developing partnerships

and acquisitions, will lead us towards our

long-term goal of generating a third of our

sales from International markets.

Two areas where inorganic growth has,

and will have, a substantial impact are our

Parts, Garments and Accessories (PG&A)

and Global Adjacent Markets businesses.

Steve Eastman and his PG&A team continue

to move one of our fastest-growing

businesses forward, most recently adding

509 to our broad and deep lineup of apparel

and accessories. While light snowfall and

diminished ORV volume impacted 2015

sales, there is a lot of runway for Steve’s

business in2016 and beyond. Similar

potential exists for Global Adjacent Markets,

where we actively seek opportunities to

augment our range of non-Powersports

vehicles and accessories. Aixam delivered

outstanding performance in2015, and

theirongoing success, along with the launch

of our first-ever, all-new GEM vehicle, has

us excited about the potential of our Work&

Transportation portfolio. Polaris Defense

continues to gain traction with our vast

array of military equipment, with especially

high interestin—andopportunitiesfor—

ourDAGOR vehicle.

Most of our military sales support

U.S.Special Operations Command (SOCOM),

where performance and reliability can be

life-or-death concerns. SOCOM’s consistent

success in dicult and often treacherous

environments is largely attributable

tooutstanding leadership and incredible

discipline in planning, training and

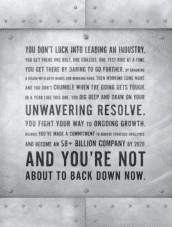

execution. The battles we fight at Polaris

unfold on a less consequential stage, but

our commitment to strong leadership and

improved execution is equally steadfast.

Wehave an unwavering resolve to begreat—

forour customers, our employees, our

shareholders and all other stakeholders.

Sincerely,

Scott W. Wine

Chairman and Chief Executive Ocer