Polaris 2015 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2015 Polaris annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

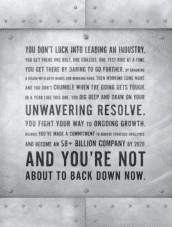

Dear Shareholder,

Adverse times both test and develop

leadership, and for Polaris, 2015 qualified

on each of those points. Despite delivering

our sixth straight year of record sales and

earnings, we were disappointed inour

performance and results, as we were

tested by external forces such as declining

currencies and weakening market demand,

internal failures such as our Spirit Lake paint

system debacle, and ineective forecasting.

While this was a dicult and expensive

education, we accept accountability and will

use these lessons to develop into a stronger

company as we enter 2016. We remain

confident and committed to our Strategy

and 2020Objectives, and are setting two

key priorities in2016 to regain momentum:

We will pursue an All-Out Assault on Costs

and rededicate ourselves to Making Growth

Happen. Throughout our history, we have

endeavored to be better, innovate faster and

reward our stakeholders. We hold to these

ideals with unwavering resolve as we look

tothefuture.

An essential part of our future is building and

constantly improving our “Lean Enterprise.”

A core tenet of this system is that customer

demand drives production, and this is

paramount for Polaris. Slowing RANGER

and RZR demand in Fourth Quarter exposed

the limitations of our Max Velocity Program

(MVP) tools, underscoring the need to fully

implement our Retail Flow Management

(RFM) dealer replenishment system in our

O-Road Vehicle (ORV) business. While

we cut shipments to meet our year-end

commitments for overall dealer inventory,

we should never have been in the position

towarrant such a significantreduction.

We are improving our tools and processes

to better manage dealer deliveries and

inventory in2016, and with our new

Huntsville plant coming online in a few

months, we will take a major leap forward

in being able to “make to demand.”

Subsequently, Executive Vice President

of Operations, Engineering and Lean, Ken

Pucel and his team will drive that operating

system back through our plant network

to ensure this dealer inventory issue will

neverreoccur.

Quality and Delivery must also improve as

we progress along our Lean journey. While

an important commitment will always be

to build the best vehicles, we know that

winning in the future will require more than

horsepower and suspension travel. With our

multi-year global investment in assembly

plants in its final stages—from Spirit Lake

and Opole all the way to Jaipur and Shanghai

—we are prepared to deliver higher-quality

vehicles and shorter lead times to customers

all over the world. We also anticipate a future

of consistent margin expansion, as our Lean

tools and Lean leaders drive productivity

and value throughout our operations and

supply chain.

Productivity is aided by volume, as well. To

earn more customers and retain our valued

owners, we are making significant front-

end investments. Tim Larson, Senior Vice

President of Global Customer Excellence

leads Sales and Customer Service, as well as

our consumer-facing digital operations. He

is investing in talent and technology that is

driving improvements at each stage of the

consumer experience and in support of our

SHAREHOLDER LETTER

>> Polaris Executive Management (left to right): Michael Speetzen, Executive Vice President of Finance and Chief Financial Officer;

Kenneth Pucel, Executive Vice President of Operations, Engineering and Lean; Scott Wine, Chairman and Chief Executive Officer;

Bennett Morgan, President and Chief Operating Officer; Stacy Bogart, Senior Vice President–General Counsel and Secretary;

James Williams, Senior Vice President and Chief Human Resources Officer