Pitney Bowes 2005 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2005 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

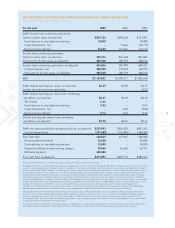

33

For the year 2005 2004 2003

GAAP income from continuing operations

before income taxes, as reported $867,124 $699,448 $721,091

Contributions to charitable foundations 10,000 – 10,000

Legal settlements, net – 19,666 (10,117)

Restructuring charges 53,650 157,634 116,713

Income from continuing operations

before income taxes, as adjusted 930,774 876,748 837,687

Provision for income taxes, as adjusted 305,948 282,749 268,216

Income from continuing operations, as adjusted 624,826 593,999 569,471

Interest expense, net 208,258 173,469 168,573

Provision for income taxes, as adjusted 305,948 282,749 268,216

EBIT $1,139,032 $1,050,217 $1,006,260

GAAP diluted earnings per share, as reported $2.27 $2.05 $2.11

Income from discontinued operations – – (0.01)

GAAP diluted earnings per share from continuing

operations, as reported $2.27 $2.05 $2.10

Tax charge 0.24 ––

Contributions to charitable foundations 0.03 – 0.03

Legal settlements, net – 0.05 (0.03)

Restructuring charges 0.16 0.43 0.32

Diluted earnings per share from continuing

operations, as adjusted $2.70 $2.54 $2.41

GAAP net cash provided by operating activities, as reported $539,593 $944,639 $851,261

Capital expenditures (291,550) (316,982) (285,681)

Free cash flow 248,043 627,657 565,580

Pension plan investment 76,508 – 50,000

Contributions to charitable foundations 10,000 – 10,000

Payments related to restructuring charges 78,544 66,055 62,751

IRS bond payment 200,000 ––

Free cash flow, as adjusted $613,095 $693,712 $688,331

The sum of the earnings per share amounts may not equal the totals above due to rounding.

Management believes this presentation provides a reasonable basis on which to present the adjusted financial information, and is provided to assist in

investors’ understanding of the company’s results of operations. The company’s financial results are reported in accordance with generally accepted

accounting principles (GAAP). However, the earnings per share and free cash flow results are adjusted to exclude the impact of special items such as

restructuring charges and write-downs of assets, which materially impact the comparability of the company’s results of operations. Restructuring

charges often reflect retooling of the business in an episodic way. Although they represent actual expenses to the company, these episodic charges

might mask the periodic income associated with our business had there not been a retooling. The use of free cash flow has limitations. GAAP cash

flow has the advantage of including all cash available to the company after actual expenditures for all purposes. Free cash flow permits a shareholder

insight into the amount of cash that management could have available for discretionary uses if it made different decisions about employing its cash.

It adjusts for long-term commitments such as capital expenditures, as well as special items like cash used for restructuring charges and

contributions to its pension funds. Of course, these items use cash that is not otherwise available to the company and are important expenditures.

Management compensates for these limitations by using a combination of GAAP cash flow and free cash flow in doing its planning.

The adjusted financial information and certain financial measures such as EBIT are intended to be more indicative of the ongoing operations and

economic results of the company. EBIT excludes interest payments and taxes, both cash items, and as a result, has the effect of showing a greater

amount of earnings than net income. The company uses EBIT, in addition to net income, for purposes of measuring the performance of its unit

management team. The interest rates and tax rates applicable to the company generally are outside the control of management, and it can be useful

to judge performance independent of those variables.

The adjusted financial information should be viewed as a supplement to, rather than a replacement for, the financial results reported in accordance

with GAAP. Further, our definition of this adjusted financial information may differ from similarly titled measures used by other companies.

Reconciliation of Reported Consolidated Results to Adjusted Results

Dollars in thousands, except per share amounts