Pitney Bowes 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

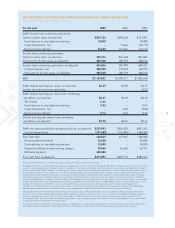

Financial Highlights From Our CFO

In most respects, we enjoyed

a very good year in 2005.

We achieved excellent

financial results, continued

our successful acquisition

program, returned substantial

cash to stockholders, and

strengthened our risk

management processes.

We grew our revenue by 10.8 percent to $5.5 billion.

Excluding the impact of strategic transactions

and currency translation, we grew our revenue by

5.6 percent, which is consistent with our annual

target of 4 to 6 percent.

We also achieved our earnings and cash flow

objectives, including broad-based profit

improvement across our businesses. In addition to

revenue growth, the improved operating margins

reflected the impact of our various productivity

programs, including shared services, Six Sigma,

outsourcing, and reengineering. We are serving our

customers more effectively and more efficiently.

We estimate that our restructuring program

contributed an incremental $50 million of benefits

in 2005, which brings the annualized total for the

2003–2005 program to $120 million.

We consummated 12 acquisitions during the year,

involving a net investment of $294 million. While

most of these acquisitions were relatively small

transactions, they also included Imagitas, which

gives us a platform into life-event direct marketing,

and Compulit, which gives us capabilities in

litigation support. Also, in early 2006 we acquired

Emtex, which broadens our offerings of software

products for large mailers.

Our acquisition program is helping to expand our

products and services across the mailstream,

giving us greater customer penetration and

enhanced long-term growth potential. It’s also having

a positive impact on our near-term results. We

estimate that our acquisitions since 2000 contributed

about 18 cents to our earnings per share in 2005.

We repurchased $259 million of shares during the

year at an average price of $43.53. This more than

offset the dilution due to option exercises and other

stock programs, producing a 1.6 percent decline

in shares outstanding from the prior year-end.

Over the past five years, we have reduced shares

outstanding by 8.9 percent.

We paid $284 million of dividends to our stock-

holders in 2005, and in early 2006, our Board of

Directors authorized an increase in our annualized

dividend rate to $1.28 per share. This makes the

24th straight year of dividend increases — a record

of consistency that we are committed to continuing.

We strengthened our processes to monitor and

mitigate our risk exposures throughout the

company. In addition to our continued efforts with

respect to Sarbanes-Oxley, we have instituted an

enterprise risk management program. Like many

companies, we are finding that this program is

helping us to focus not only on potential financial

exposures, but also on fundamental business

issues (e.g., brand value, contract liabilities, supply

chain, etc.).

Given our excellent results in 2005, we were deeply

disappointed with our stock price performance and

are committed to delivering better stockholder

returns in 2006. To that end, we expect to enjoy

another strong financial year. We have positive

momentum throughout most of our businesses and

we have programs to produce further improvements

in our margins.

We also expect to accomplish the exit from our

capital services business during the year. This will

help to simplify our investment story and remove a

drag on our revenue, earnings, and cash flow growth.

We look forward to continuing our mailstream growth

strategies and are confident that we have the financial

capabilities to deliver both consistency and growth to

our stockholders for the foreseeable future.

Bruce P. Nolop

Executive Vice President and

Chief Financial Officer