Pentax 2010 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2010 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

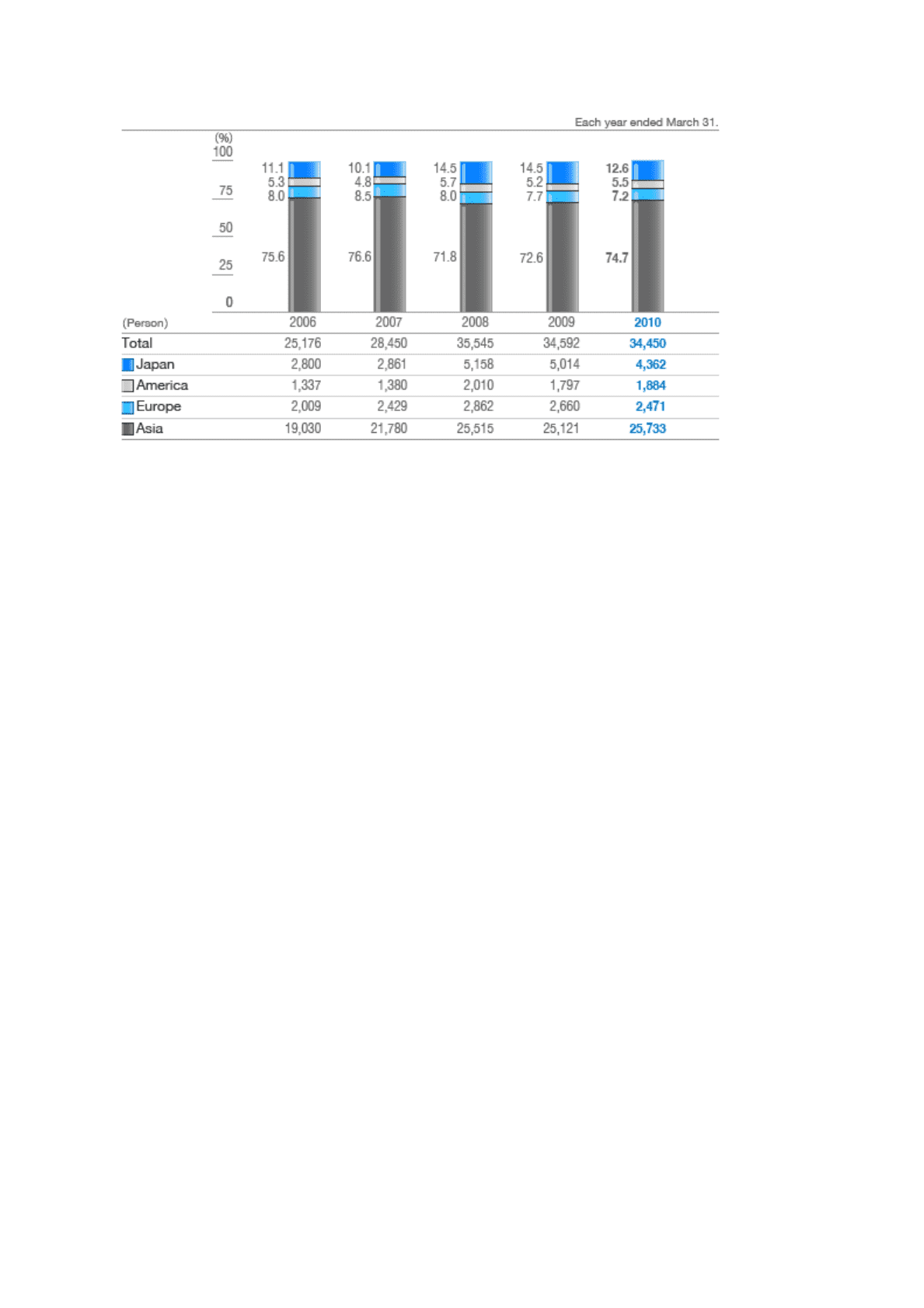

Group Employees by Region

Financial Position

Total assets as of March 31, 2010 stood at ¥549,736 million, a ¥41,360 million or 7.0%

decrease compared with a year earlier. Current assets declined ¥39,218 million, or 10.2% year

on year, to ¥345,247 million. Within this, cash and cash equivalents were down ¥41,233 million

from a year earlier, to ¥173,307 million, while notes and accounts receivable-trade increased

¥10,738 million to ¥93,612 million and inventories (total of products, finished goods, work in

progress, materials and stored items) decreased ¥9,791 million to ¥61,466 million.

Non-current assets decreased ¥2,141 million, or 1.0%, from the previous fiscal year-end to

¥204,489 million, due in part to a decrease of ¥8,360 million in machinery and transportation

equipment.

Total liabilities were down ¥54,822 million from the previous fiscal year-end, to ¥198,264

million. Although notes and accounts payable-trade increased by ¥3,571 million, commercial

paper declined by ¥41,978 million and long-term debt (including long-term debt with current

maturities) declined by ¥8,983 million.

Total interest-bearing debt, including short-term loans, long-term debt with current maturities,

commercial paper, other long-term debt, and corporate bonds and other, amounted to ¥107,034

million, resulting in a 19.5% rate of leverage, an improvement of 7.5 percentage points from the

previous year.

Total equity rose ¥13,463 million year on year, to ¥351,472 million due to increases of ¥9,619

million in retained earnings, ¥3,026 million in treasury stock (less capital portion), and foreign

currency translation adjustments of ¥6,695 million. Owners' equity, total equity less stock

subscription rights and minority interests, amounted to ¥349,052 million, for an owners' equity

ratio of 63.5%, an improvement of 6.8 percentage points year on year.

33