Pentax 2010 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2010 Pentax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

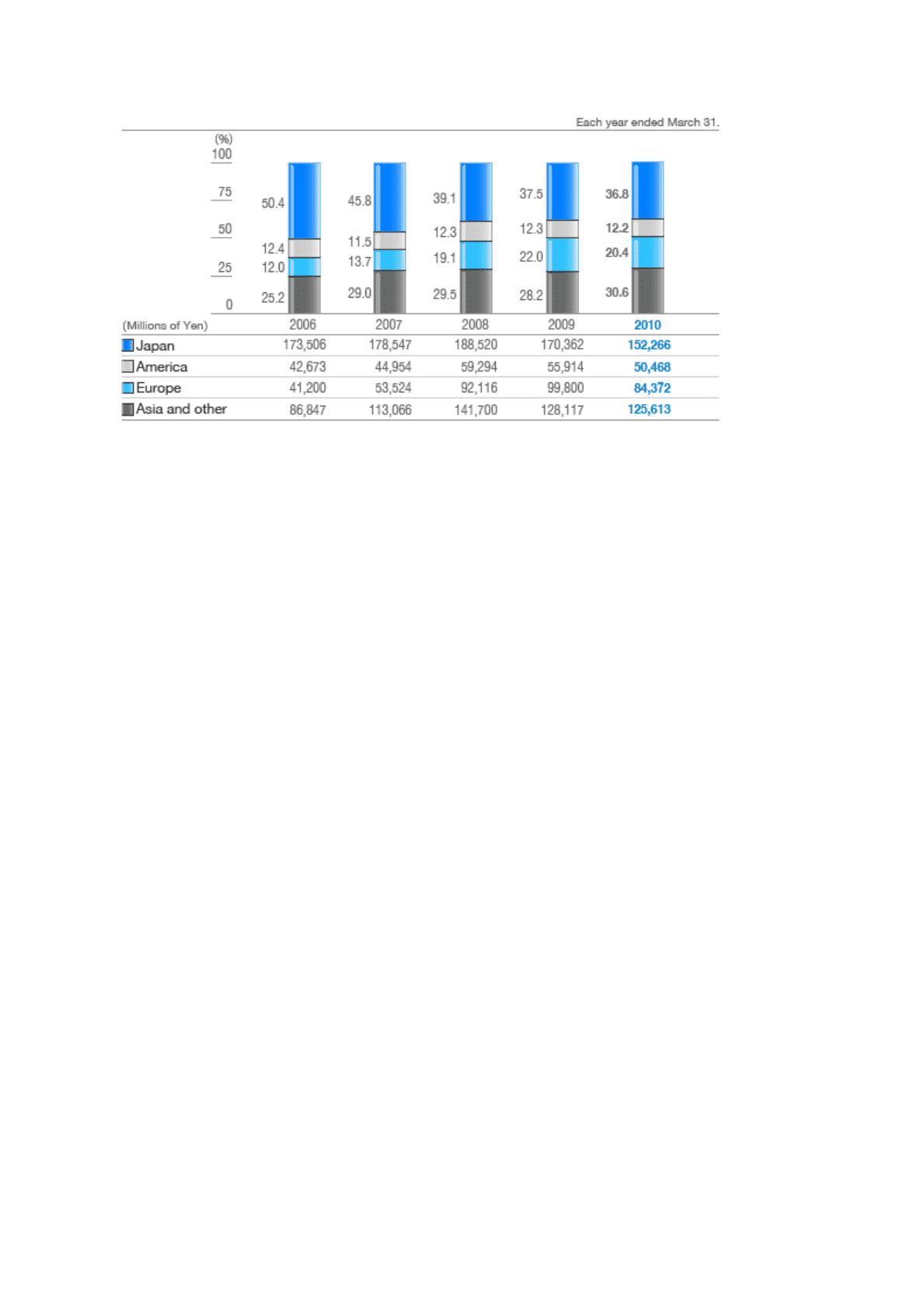

Sales by Region(Based on the office location)

Income

Although net sales fell year on year due to declining product prices, the impact of the strong yen

and other factors, efforts at cost reduction centered around fixed costs resulted in a lower cost

of sales. Gross profit margin improved 1.8 percentage points from 41.8% in the previous year to

43.6%. Selling, general and administrative expenses decreased 11.2% to ¥116,121 million, with

the ratio of SG&A expenses to net sales falling 0.8 percentage points, from 28.8% to 28.0%. As

a result, operating income increased 8.9%, to ¥64,327 million, and the operating margin rose

2.6 percentage points, to 15.6%.

Although income in the Electro-Optics Division declined as a result of lower shipment volumes

and a significant decrease in sales due to falling product prices, which could not be offset by

efforts to reduced fixed costs, earnings were up in the Vision Care Division and Health Care

Division, and at Pentax profitability moved into the black from the significant loss in the previous

year due to the effects of structural reform.

Ordinary income fell 18.7% year on year, to ¥57,805 million. This was attributable to a foreign

exchange loss of ¥6,488 million, as compared to a foreign exchange gain of ¥7,151 million in

the previous fiscal year.

Net income was 50.8% higher year on year, at ¥37,875 million. Contributing factors included

the following. In the previous year, the Company recorded a ¥9,704 million gain on sales of

investment securities from the partial transfer of part of Hoya's equity interest in an equity-

method affiliate, and an extraordinary gain of ¥3,200 million representing commission fees

received for prior years as a result of a review of a licensing contract. During the fiscal year

under review, this commission fee fell to ¥1,013 million. Also in the previous fiscal year, Hoya

recorded an asset impairment loss of ¥30,458 million in each of the Pentax divisions and

others; in the fiscal year under review this asset impairment loss was reduced to ¥833 million.

Return on assets (ROA) was 6.6%, and return on owners' equity (ROE) was 11.1%, both

representing year-on-year improvements.

29