Omron 2013 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2013 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

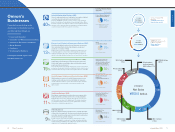

2 Omron Corporation Integrated Report 2013 3

About Omron

the establishment of a global profi t and growth

structure. Fiscal 2013 is the fi nal year of this stage,

and our goal for this year is to transform Omron

into a stronger company that realizes synergetic

relationships between growth potential, profi tability,

and responsiveness to change. As such, we will

work even harder on profi t and growth structure

reform. The economic climate is currently under-

going substantial change as the too-strong yen

depreciates. We will transform such changes into

opportunity and accelerate our growth strategies.

To Become a Company That Society Requires

Omron will remain dedicated to resolving the numer-

ous issues facing people through its business. We

will strive to make Omron a company that people

around the world require, with high expectations.

I would like to ask for your continued support.

operating processes. These steadfast efforts led

to a 0.3-percentage-point rise in the gross profi t

margin, to 37.1%.

To shareholders, we paid total annual cash divi-

dends of ¥37.00 per share, including a commemora-

tive dividend of ¥5.00 per share and up from ¥28.00

in fi scal 2011. This resulted in a dividend payout ratio

Message from the President

The Milestone of 80 Years

Omron Corporation celebrated the 80th anniversary

of its founding on May 10, 2013. Reaching this mile-

stone could not have been done without your sup-

port, for which I am most grateful.

In the 80 years since Omron’s founding, the

world has changed dramatically. In 1933, the

world’s population was around 2 billion; today, it

exceeds 7 billion. Not only that, per capita GDP has

increased by roughly four times and the average

lifespan has nearly doubled. Throughout its 80-year

history, Omron has taken on countless challenges

as it pursued technological innovation ahead of

social needs. By creating new value centered on

automation, I am confi dent that we contributed to

the sound and sustainable growth of society and

the improvement of people’s lives. Omron has

grown by leaps and bounds and is now a global

leader in the fi eld of automation with over 35,000

employees working in more than 110 countries

around the world.

Omron’s core corporate value is “Working for the

benefi t of society.” This represents our commitment

to coexist and grow in harmony with society. To

accomplish this intrepid spirit everyone will work

together to propel the Company forward to quickly

uncover latent social needs around the world and

provide products and services to contribute to the

sustainable development of society.

Fiscal 2012 Performance

and Shareholder Returns

In fi scal 2012, of our fi ve mainstay businesses, Auto-

motive Electronic Components Business (AEC),

Social Systems, Solutions and Service Business

(SSB), and Healthcare Business (HCB) saw favor-

able growth in sales. As a result, overall net sales

increased 5.0% year on year to ¥650.5 billion, and

operating income was up 13.0%, to ¥45.3 billion. In

regard to profi t structure reforms, sales and market-

ing divisions worked to increase profi tability while

production and development divisions introduced

competitive, new products and improved their

of 27.0% and a dividend on equity (DOE) ratio of

2.4%. In fi scal 2012, we raised the defi ned minimum

for the dividend payout ratio from 20% to 25%,

targeting a 2% DOE ratio in consideration of stable

dividend payments. Further, we cancelled a portion

of treasury stock and introduced a shareholder

benefi t program to enhance shareholder returns.

Pursuit of Higher Corporate Value

In pursuit of higher corporate value, we emphasize

capital effi ciency in our management. To that end,

we have been utilizing return on invested capital

(ROIC) as an internal management index. In April

2013, we disclosed our consolidated ROIC target.

In order to facilitate our efforts on this front,

we established the new position of Chief Financial

Offi cer (CFO) in fi scal 2013. This is a change that

I advocated myself based on the belief that it

would help accelerate our decision making, im-

prove the quality of management, and heighten

corporate value.

In Value Generation 2020 (VG2020), the long-term

management strategy released in July 2011,

we declare our dedication to growth. The

fi rst three years of the 10-year period

leading up to 2020 have been desig-

nated as the “GLOBE STAGE,”

during which we will target

Omron Reaches 80-Year Milestone

On its way to becoming a sustainable company that contributes to

the global society through innovative products and services

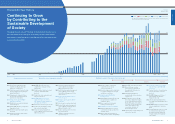

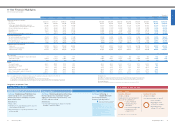

Net Sales and Gross Profi t Margin

2008 2009 2010 2011 2012

Gross Profit Margin (%)

Net Sales (Billions of yen)

627.2

524.7

617.8 619.5

650.5

34.8 35.1

37.5 37.1

36.8

700

500

600

(FY)

Dividend, Dividend Payout Ratio, and EPS

Dividend Payout Ratio (%)

Net Income per Share Attributable

to Shareholders (Yen)

Annual Dividend (Yen)

2008 2009 2010 2011 2012

25

17

30

37

106.4

16.0

24.7

121.7

37.6

74.5

27.0

137.2

25

0

50

28

(FY)

Operating Income and Operating Income Margin

2008 2009 2010 2011 2012

Operating Income Margin (%)

Operating Income (Billions of yen)

5.3

13.1

48.0

40.1

45.3

0.9

2.5

7.8 7.0

6.5

25

0

50

(FY)

July 2013

Yoshihito Yamada

President and CEO