Omron 2013 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2013 Omron annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24 Omron Corporation Integrated Report 2013 25

Where We're Headed

What are your projections for the environmental solutions business

and other businesses that address social needs?

Let me take our HCB and environmental solutions business as examples. HCB aims

to contribute to improving the health of people around the world through its products.

Presently, we are seeing a rise in the number of sufferers of respiratory illnesses in

emerging nations, where air pollution issues are growing ever graver. In addition,

changes in lifestyle environments are resulting in an increase in the number of people

with high blood pressure, diabetes, and other cardiovascular related diseases, and this

is becoming a serious social issue. In this market environment, contributing to health-

care will require higher awareness whereby people monitor and manage their health

condition at home as well as in hospitals. Should the concern for disease prevention rise

in emerging countries, it could lead to a decrease in serious event risks related to heart

attacks, strokes, or other infl ictions. To facilitate such a change, Omron is working to

foster proper understanding with regard to health issues among practitioners, such as

doctors and pharmacists, and patients alike. At the same time, we are developing and

selling easy-to-use healthcare devices to meet the local circumstances and specifi c

demand. HCB currently operates in more than 110 countries around the world, and we

are actively expanding sales channels in this business with a particular focus on emerg-

ing nations. In fi scal 2012, this focus area recorded a 30% year-on-year increase in sales

on a yen basis. In fi scal 2013, we will aggressively develop the business to increase our

contribution to addressing growing healthcare issues.

In the environmental solutions business, we are working to resolve social issues in the

clean energy fi eld through the sale of PV inverters for solar power generation systems

and DC power relays for electric vehicles.

In particular, installations of PV inverters doubled in fi scal 2012 due to the benefi ts of the

feed-in tariff scheme for renewable energy that was launched in Japan during July 2012.

We expect the market will expand in light of concerns for the depletion of fossil fuel re-

serves and environmental pollution,

such as that from CO2 emissions.

Personally, I have the highest

expectations for energy-saving busi-

nesses in the FA market. Energy

management at production sites will

be more important than ever to lead

to an expansion of business opportu-

nities for the Company. Omron itself

is vigorously advancing electricity-

saving initiatives at its plant in Kyoto.

By leveraging the knowledge gained

through this venture, we will grow

energy-saving businesses targeting

manufacturing markets around

the world.

You mentioned transforming Omron into a stronger company that

demonstrates synergies between growth potential, profi tability, and

responsiveness to change. What exactly do you mean by “responsiveness

to change”?

Put simply, it’s the ability to transform risks and changes into opportunities, and when

I say changes I am referring to both positive and negative changes.

We can't do business without taking negative changes and risks into consideration.

We must take steps to limit the impacts of risks on our business. Even an unprecedent-

ed event, such as the Great East Japan Earthquake of 2011, must be incorporated into

medium-to-long-term management plans. For example, based on what we learned from

the earthquake, we reevaluated our production sites in consideration of the risk of a

large-scale natural disaster. And we developed systems that will allow the production

operations at one site to be quickly shifted to another should that site be rendered tem-

porarily unable to produce. I believe that the ability to create benefi ts from risks is one

form of responsiveness to change.

Moreover, as a global company, we need to respond to changes on a global scale.

Over the past two years, we have placed a particular focus on making our operations

more resilient to fl uctuations in foreign exchange rates and rises in personnel expenses

in emerging nations. Faced with the strong yen, we worked to limit the impacts of for-

eign exchange on profi ts by increasing transactions in foreign currencies, procuring more

items locally, and other means. Also, we installed automation systems into our own

factories in China and other Asian countries to offset the rise in personnel expenses

in these countries.

At the same time, we recognize that positive changes represent opportunities we must

grasp. Since the introduction of the “Abenomics” economics stimulus plan, the too-high

yen became weaker and export-oriented companies in Japan are tending healthy. We are

working to quickly reap the benefi ts of these and subsequent accompanying market

changes, seeking to turn the various risks and changes that surround the Company into

opportunities so that we may transform Omron into a stronger company.

How are you pursuing increased shareholder value in management?

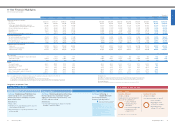

To raise corporate value, we are looking at both the quantitative and qualitative sides of

operations. For the quantitative side, we emphasize management of capital costs and

cash fl ows in our operations.

Looking at capital costs to begin with, we utilize the management index of return on

invested capital (ROIC) to ensure that each business generates returns that are appropri-

ate in consideration of their individual capital costs. This index is considered from the

stage of developing strategies for each business, and we evaluate investment projects

and propose improvement measures for asset effi ciency accordingly.

Next, we are focusing on cash fl ow management to realize growth. Currently, free

cash fl ow is positive, and net cash is trending upward. While we are of course always

considering returns to shareholders, at the moment we feel it is best to invest these

funds in future growth, through such means as M&A activities.

Finally, to further reinforce this quantitative focus, from fi scal 2013, we have established

the new position of Chief Financial Offi cer (CFO). We anticipate the CFO, by serving as

the “brain” of the fi nancial side of operations, will be a driving force in boosting both the

quality and speed of decisions related to portfolio management.

Q3

Q4

Q2

Enhancing corporate value—that’s our focus.