Oki 2000 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2000 Oki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

15. Contingent liabilities

At March 31, 2000, the Company and its consolidated

subsidiaries had the following contingent liabilities:

Thousands of

Millions of yen U.S. dollars

As endorsers of trade notes discounted

and endorsed ....................................... ¥00,680 $006,421

As guarantors of indebtedness of:

Unconsolidated subsidiaries and

affiliates ............................................. 4,286 40,438

Other.................................................... 5,686 53,650

............................................................. ¥10,654 $100,510

16. Amounts per share

Basic net income (loss) per share shown below is based on

the weighted average number of shares of common stock out-

standing during each year. Diluted net income (loss) per share

is based on the weighted average number of shares of common

stock outstanding each year after giving effect to the dilutive

potential of common shares to be issued upon the conversion

of convertible bonds.

Net assets per share are based on the number of shares of

common stock outstanding at each balance sheet date.

Yen

U.S. dollars

2000 1999 1998 2000

Net income (loss) :

Basic ............................ ¥001.87.¥ (77.46.) ¥(13.18.)$0.01.

Diluted.......................... ————

Yen

U.S. dollars

2000 1999 1998 2000

Net assets ....................... ¥232.86.¥230.77.¥321.98.$2.19.

Diluted net income (loss) per share for each year has not

been presented because there would have been no dilutive

effect on any assumed conversion of convertible bonds for the

year ended March 31, 2000 and because net loss was recorded

for the years ended March 31, 1999 and 1998.

17. Subsequent event

On June 29, 2000, the shareholders of the Company approved

the following disposal of accumulated deficit, which has not

been reflected in the accompanying financial statements for the

year ended March 31, 2000:

Thousands of

Millions of yen U.S. dollars

Reversal of special reserve .................... ¥1,590 $15,002

Provision for special reserve .................. (978) (9,233)

18. Segment information

The Company and its consolidated subsidiaries are engaged

in the manufacture and sale of products in Japan and foreign

countries in one business segment—telecommunications,

information systems and electronic devices.

The geographical segment information of the Company and

its consolidated subsidiaries for the years ended March 31,

2000, 1999 and 1998 is outlined as follows:

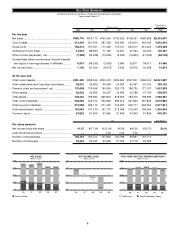

Year ended Millions of yen

March 31, 2000

Japan North America Other Total Eliminations Consolidated

Sales to third

parties ........... ¥526,986 ¥073,623 ¥069,166 ¥669,776 ¥ —.¥669,776

Interarea sales

and transfers .. 102,842 377 42,275 145,494 (145,494) —

Total sales ....... 629,829 74,001 111,441 815,271 (145,494) 669,776

Operating

expenses ....... 615,176 75,231 109,835 800,243 (144,270) 655,972

Operating

income (loss) ... ¥((14,652 ¥0((1,230) ¥001,605 ¥015,028 ¥00(1,224) ¥013,804

Total assets ..... ¥759,709 ¥045,627 ¥060,412 ¥865,749 ¥(117,317) ¥748,432

Year ended Millions of yen

March 31, 1999

Japan North America Other Total Eliminations Consolidated

Sales to third

parties ........... ¥520,511 ¥075,854 ¥076,805 ¥673,170 ¥ —.¥673,170

Interarea sales

and transfers .. 102,435 3,306 38,135 143,877 (143,877) —

Total sales ....... 622,946 79,161 114,940 817,048 (143,877) 673,170

Operating

expenses ....... 657,257 83,100 114,440 854,798 (143,330) 711,468

Operating

income (loss) ... ¥)(34,310) ¥0((3,939) ¥000,499 ¥((37,750) ¥000,(547) ¥)(38,297)

Total assets ..... ¥801,817 ¥038,864 ¥056,840 ¥897,523 ¥0(97,628) ¥799,894

Year ended Millions of yen

March 31, 1998

Japan North America Other Total Eliminations Consolidated

Sales to third

parties ........... ¥585,905 ¥093,458 ¥(085,231 ¥764,596 ¥ —.¥764,596

Interarea sales

and transfers .. 102,360 6,433 40,628 149,422 (149,422) —

Total sales ....... 688,265 99,892 125,860 914,018 (149,422) 764,596

Operating

expenses ....... 676,848 106,304 120,379 903,532 (149,029) 754,502

Operating

income (loss) .. ¥011,417 ¥(0(6,412) ¥(005,480 ¥010,486 ¥0000(392) ¥010,093

Total assets ..... ¥823,725 ¥045,958 ¥(059,986 ¥929,671 ¥(0(92,826) ¥836,844

Year ended Thousands of U.S. dollars

March 31, 2000

Japan North America Other Total Eliminations Consolidated

Sales to third

parties ........... $4,971,570 $694,563 $ 652,513 $6,318,647 $(0,000,0—.$6,318,647

Interarea sales

and transfers .. 970,213 3,559 398,820 1,372,593 (1,372,593) —

Total sales ....... 5,941,784 698,122 1,051,333 7,691,240 (1,372,593) 6,318,647

Operating

expenses ....... 5,803,553 709,727 1,036,185 7,549,466 (1,361,046) 6,188,419

Operating

income (loss) ... $0,138,230 $((11,604) $ 15,148 $0,141,774 $0,0(11,546) $0,130,227

Total assets ..... $7,167,070 $430,450 $0,569,930 $8,167,452 $(1,106,770) $7,060,681

Overseas sales, which include export sales of the Company

and its domestic consolidated subsidiaries and sales (other

than exports to Japan) of the foreign consolidated subsidiaries,

totaled ¥163,887 million ($1,546,112 thousand), ¥171,064 mil-

lion and ¥203,191 million, or 24.5%, 25.4% and 26.6% of con-

solidated net sales for the years ended March 31, 2000, 1999

and 1998, respectively.