Oki 2000 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2000 Oki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

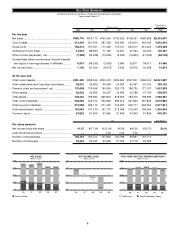

Operating Results

In fiscal 2000, ended March 31, 2000, Japan’s economy

continued in a slump as consumer confidence remained

stagnant, despite signs of a slight rebound in the second half,

supported by increased private-sector capital investment.

Financial institutions and telecommunications companies

avoided capital expenditures, owing to industrial realignment

and companies looking to stay clear of any innate problems

related to the year 2000 issue.

Reflecting these deterrents, which countered any benefits

received from brisk demand for logic device and non-PC

memories, Oki Electric’s consolidated net sales slipped 0.5%

in comparison with fiscal 1999, to ¥669,776 million. Sales of

telecommunications systems declined 6.9%, to ¥166,609 mil-

lion, owing to the rapid growth of Internet usage and the shift

from fixed-line/voice networks to mobile and IP networks. Sales

of information systems declined 6.9%, to ¥322,543 million.

Performance in this segment was also positively affected by the

Internet, which produced beneficial structural changes by user

industries. Sales of electronic devices rose 27.7%, to ¥159,178

million. On a year-end average basis, net sales per employee

slipped to ¥26.3 million, from ¥28.7 million in fiscal 1999 and

¥31.9 million in fiscal 1998. Total assets turnover, on a year-end

average basis, inched up to 0.89 times, from 0.84 times in fiscal

1999, and dropped compared to 0.91 times in 1998.

Cost of sales edged down 6.9%, to ¥513,402 million, and rep-

resented 76.7% of net sales, versus 81.9% in fiscal 1999 and

76.8% in fiscal 1998. Gross profit advanced 28.6%, to ¥156,374

million, with the gross profit margin at 23.3%, compared to

18.1% and 23.2% in the two previous years.

Selling, general and administrative (SG&A) expenses decreased

10.8%, to ¥142,570 million, and amounted to 21.2% of net sales,

compared with 23.8% in fiscal 1999 and 21.9% in fiscal 1998.

R&D expenses (included cost of sales and SG&A) totaled

¥29,509 million, a 23.1% decrease from the previous period.

The Company posted operating income of ¥13,804 million,

compared with the prior year’s operating loss of ¥38,297 million.

Other expenses exceeded other income by ¥7,288 million, an

improvement over the previous term’s ¥30,238 million. Interest

expense was ¥12,291 million, ¥1,014 million less than a year

earlier. Reflecting the above results, the Company could post

income of ¥6,515 million before income taxes, minority interests

and equity in earnings of affiliates, compared with a loss in the

prior year of ¥68,535 million.

After incurring income taxes amounting to ¥5,056 million, the

Company recorded net income for the year of ¥1,146 million,

against a net loss of income ¥47,421 million in fiscal 1999. This

was equivalent to net income per share of ¥1.87, versus a net

loss per share of ¥77.46 a year earlier. Despite the plus figures,

the Company chose to shelve its dividend for the second

consecutive year.

Financial Position

At the fiscal year-end, total assets were down 6.4%, to

¥748,432 million, primarily because of decreases in inventories,

investments in and advances to unconsolidated subsidiaries

and affiliates, and a large drop in cash and cash equivalents.

Total current assets fell 8.9%, to ¥481,450 million, and com-

prised 64.3% of total assets, up from 66.1% in fiscal 1999 and

1998. Property, plant and equipment, net, dropped 5.1%, to

¥170,408 million, with a 0.4% rise in accumulated depreciation,

to ¥520,549 million. Total investments and long-term receivables

declined 5.6%, to ¥28,210 million.

Total liabilities dipped 8.1%, to ¥599,724 million, primarily

owing to a reduction in short-term borrowings and long-term

debt. Total current liabilities declined 5.2%, to ¥326,465 million,

and represented 54.4% of total liabilities, compared with 52.8%

in fiscal 1999 and 56.7% in fiscal 1998. Reflecting the decrease

in long-term debt, total long-term liabilities decreased 11.3%, to

¥273,258 million. The current ratio was 1.47, down from 1.53 in

fiscal 1999 and 1998.

Total shareholders’ equity rose 0.9%, to ¥142,563 million. The

equity ratio rose to 19.1%, from 17.7% in fiscal 1999 and 23.6%

in fiscal 1998. The debt-to-equity ratio was 4.2:1, as against

4.6:1 in fiscal 1999 and 3.2:1 in fiscal 1998.

Cash Flows

The Company recorded net cash provided by operating activi-

ties of ¥55,919 million, compared with net cash of ¥9,561 million

used in such activities a year before. The major component of

the increase was the vast improvement recorded in net income

to ¥1,146 million, from a net loss of ¥47,421 million a year

before.

Net cash used in investing activities totaled ¥43,463 million,

compared with ¥20,485 million in the previous period. Cash

used for purchases of property, plant and equipment decreased

32.3%, to ¥28,119 million.

Net cash used in financing activities was ¥54,508 million,

compared to ¥35,626 million provided by financing activities in

the previous term. Short-term borrowings decreased by ¥23,451

million, while the Company issued long-term debt of ¥11,749

million and reduced long-term debt by ¥42,755 million. Cash

and cash equivalents at the end of the year were ¥66,776 mil-

lion, down ¥24,646 million from ¥91,423 million a year before.

Year 2000 Compliance

Oki Electric recognized the year 2000 (Y2K) problem as a key

management issue and took decisive steps to ensure its ability

to cope with the problem throughout the Group.

As 2000 is a leap year, ATMs previously supplied to the

Ministry of Posts and Telecommunications, malfunctioned on

February 29, 2000, but aside from this we have not experienced

any difficulties.

However, we continue to remain alert and have not experi-

enced any problems with our information infrastructure, main

system, production facilities and supply procurement routes.

FINANCIAL REVIEW