Oki 2000 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2000 Oki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

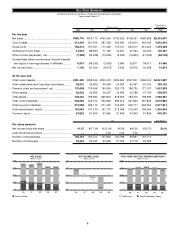

12. Supplementary cash flow information

The following table represents a reconciliation between cash

and cash equivalents at March 31, 1999 in accordance with the

definition of cash equivalents before and after the adoption of

the new accounting standard:

Millions of yen

Cash and cash equivalents at March 31, 1999

in accordance with the definition of after the

adoption of the new accounting standard .............. ¥091,423

Money Management Fund ........................................ 11,207

Other .......................................................................... 5,870

Cash and cash equivalents at March 31, 1999

in accordance with the definition of before the

adoption of the new accounting standard .............. ¥108,501

13. Derivative and hedging activities

The Company and its subsidiaries primarily utilize comprehen-

sive forward foreign exchange and currency swap contracts to

hedge their exposure to foreign exchange fluctuations arising

from operating receivables and payable. The Company and its

subsidiaries also utilize interest swap contracts to avoid risks of

interest rate fluctuations and to equalize financial costs for each

financial year regarding short-term and long-term debt with vari-

able interest rates. As a matter of policy, the Company and its

subsidiaries do not speculate in derivative transactions, which

may have any huge fluctuations of their market values. The

Company and its subsidiaries do not anticipate credit risk result-

ing from nonperformance by any of the counterparties because

all such counterparties are financial institutions with high credit

ratings. The Company and its subsidiaries have principally their

internal rules for the derivative transactions, which prescribe man-

agers’ duties, management of transactions and reporting sys-

tem. The derivative transactions on a daily basis are controlled

by the financial section, which has the internal control system to

supervise the procedures and transaction limits, and are con-

firmed to financial institutions by the accounting section.

Information with respect to the contract amount, fair value of

and unrealized gain or loss on derivatives:

March 31, 2000 Millions of yen

Contract amount

Non-current Fair Unrealized

Total portion value gain (loss)

Currency related:

Forward exchange contracts:

Sold:

U.S. dollars ¥08,024 ¥ — ¥(8,097 0,0¥(73)

Deutsche marks 1,691 — 1,578 113

Pounds sterling 21 — 20 —

Interest related:

Interest rate swap:

Receipts fixed/

Payments floating 2,000 2,000 117 117

Payments fixed/

Receipts floating 69,591 47,591 (1,644) (1,644)

Thousands of U.S. dollars

Contract amount

Non-current Fair Unrealized

Total portion value gain (loss)

Currency related:

Forward exchange contracts:

Sold:

U.S. dollars $75,700 $ — $76,394 $(693)

Deutsche marks 15,962 — 14,890 1,071

Pounds sterling 200 — 196 4

Interest related:

Interest rate swap:

Receipts fixed/

Payments floating 18,867 18,867 1,111 1,111

Payments fixed/

Receipts floating 656,518 448,971 15,513 15,513

Notes: 1.Forward exchange contracts are valued at the quotations in the forward foreign

exchange market.

2. Excluded from the above table are forward foreign exchange contracts which hedge

foreign-currency-denominated receivables and payables carried at forward exchange

rates whose final settlement amounts are fixed.

3. Interest rate swap contracts are valued at the price quoted by the counterparty financial

institutions. The interest rate swap transaction with receipts fixed/payments floating for

the notional amount of ¥2,000 million ($18,867 thousand) is offset against the

corresponding amount with payments fixed/receipts floating.

14. Leases

Lease payments relating to finance leases accounted for as

operating leases in the accompanying consolidated financial

statements amounted to ¥6,124 million ($57,778 thousand),

¥7,998 million and ¥9,800 million for the years ended March 31,

2000, 1999 and 1998, respectively.

Leased assets under finance leases accounted for as operating

leases were as follows:

Thousands of

Year ending March 31 Millions of yen U.S. dollars

2000 2000

Machinery and equipment...................... ¥21,533 $203,143

Other ....................................................... 6 61

Less: Accumulated amortization............ (9,897) (93,369)

............................................................. ¥11,642 $109,834

Amortization is computed by applying the straight-line

method over the estimated useful lives of the related assets

and assuming that the Company guarantees a nil residual value

at the end of the term of each of the leases.

The following is a schedule of the future minimum lease pay-

ments under finance leases accounted for as operating leases:

Thousands of

Year ending March 31 Millions of yen U.S. dollars

2001 ........................................................ ¥04,670 $044,057

2002 and thereafter ................................ 6,972 65,776

................................................................ ¥11,642 $109,834

The minimum rental payments subsequent to March 31, 2000

required under operating leases with noncancelable lease terms

in excess of one year are summarized as follows:

Thousands of

Year ending March 31 Millions of yen U.S. dollars

2001 ........................................................ ¥048 $458

2002 and thereafter ................................ 55 527

............................................................. ¥104 $986