Oki 2000 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2000 Oki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

Net deferred tax assets are included in the consolidated

balance sheets as follows:

Thousands of

Millions of yen U.S. dollars

Other current assets ................................... ¥09,845 $092,886

Other assets ............................................... 9,115 85,996

Other current liabilities ............................... 1 12

Other long-term liabilities ........................... 6 58

Net deferred tax assets .............................. ¥18,954 $178,812

Total income tax benefits for the year ended March 31, 2000

resulted in an effective tax benefit rate of 78.3%. The difference

between the aggregate statutory rate in Japan (42.0%) and the

effective rates on pretax income is summarized as follows:

Statutory rate ...................................................................... 42.0%

Addition (deduction) in income taxes resulting from:

Increase in valuation allowance recognized

on loss of subsidiaries .................................................. 17.8%

Intercompany profit in excess of taxable income .......... 14.2%

Permanent differences nondeductible such as

entertainment expense ................................................. 10.3%

Permanent differences unrecognized for tax purpose

such as dividends received .......................................... (8.1%)

Other, net ......................................................................... 2.1%

Effective tax rate................................................................. 78.3%

9. Special reserves

Special reserves are stated in accordance with the Special

Taxation Measures Law and the Commercial Code of Japan.

The reserves are deducted from taxable income when provided

and reversed to taxable income in subsequent years, which

results in a deferral of income tax payments.

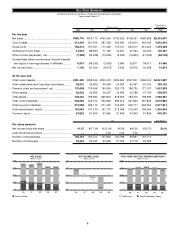

10. Depreciation

The provision for depreciation of property, plant and equip-

ment for the years ended March 31, 2000, 1999 and 1998 was

as follows:

Thousands of

Millions of yen U.S. dollars

2000 1999 1998 2000

¥37,771 ¥42,910 ¥60,018 $356,335

11. Research and development expenses

Research and development expenses for the years ended

March 31, 2000, 1999 and 1998, were as follows:

Thousands of

Millions of yen U.S. dollars

2000 1999 1998 2000

¥29,509 ¥40,912 ¥42,380 $278,389

Convertible bonds, unless previously redeemed, are convert-

ible into shares of common stock of the Company at the

following conversion prices:

Conversion

price

per share Conversion period

2.2% bonds in

yen due 2004 .................. ¥1,050.00 November 1, 1988

.......................................... to March 30, 2004

1.8% bonds in

yen due 2001 .................. ¥1,145.00 November 1, 1989

.......................................... to September 27, 2001

3.5% bonds in

U.S. dollars due 1999 ..... ¥0,766.70 October 1, 1984

.......................................... to September 22, 1999

The bonds are redeemable at the Company’s option, in whole

or in part, at the following redemption prices together with the

accrued interest to the date of redemption:

Redemption price

(% of the

principal amount) Redeemable on or after

2.2% bonds due 2004 ..... 106%–100% April 1, 1997

1.8% bonds due 2001 ..... 105%–100% October 1, 1995

3.5% bonds in

U.S. dollars due 1999 .... 104%–1001/2% September 30, 1987

Under the terms of the issues, the conversion prices of the

convertible bonds are subject to adjustment in certain cases

which include stock splits.

A sufficient number of shares of common stock is reserved

for the conversion of all outstanding convertible bonds.

The aggregate annual maturities of long-term debt subsequent

to March 31, 2000 are summarized as follows:

Thousands of

Year ending March 31 Millions of yen U.S. dollars

2001 ........................................................... ¥038,166 $0,360,063

2002 ........................................................... 48,084 453,623

2003 ........................................................... 27,368 258,193

2004 ........................................................... 23,402 220,782

2005 and thereafter ................................... 156,813 1,479,373

................................................................ ¥293,835 $2,772,036

8. Income taxes

Deferred tax assets (liabilities) at March 31, 2000 consisted of

the following:

Thousands of

Millions of yen U.S. dollars

Deferred tax assets:

Loss carryforwards .................................. ¥30,281 $285,673

Nondeductible accrued bonuses ............ 2,320 21,889

Nondeductible severance indemnities .... 1,940 18,304

Elimination of intercompany profit ........... 1,654 15,612

Other ........................................................ 2,407 22,713

Gross deferred tax assets ........................... 38,604 364,194

Less: Valuation allowance ........................... (11,594) (109,386)

Total deferred tax assets ............................. 27,009 254,807

Deferred tax liabilities

Tax purpose reserve (special reserve) ....... (7,539) (71,130)

Other ........................................................... (515) (4,864)

Gross deferred tax liabilities ....................... (8,055) (75,995)

Net deferred tax assets............................... ¥18,954 $178,812