Oki 2000 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2000 Oki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

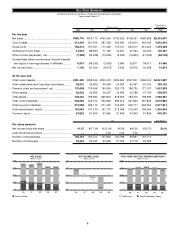

Long-term debt at March 31, 2000 and 1999 is summarized

as follows:

Thousands of

Millions of yen U.S. dollars

2000 1999 2000

Loans from banks, insurance

companies and government

agencies, due through 2022

at rates of up to 8.0%:

Secured ................................. ¥003,000 ¥003,179 $0,028,301

Unsecured ............................ 112,704 111,702 1,063,253

............................................. 115,704 114,882 1,091,555

Unsecured convertible bonds:

2.2% bonds in

yen due 2004 ...................... 32,188 32,688 303,660

1.8% bonds in

yen due 2001 ...................... 17,543 20,000 165,500

3.5% bonds in

U.S. dollars due 1999 ......... —25 —

Unsecured bonds in yen:

6.5% bonds due 2000 .......... —26,460 —

2.45% bonds due 2001 ........ 9,500 10,000 89,622

3.05% bonds due 2003 ........ 10,000 10,000 94,339

3.05% bonds due 2002 ........ 20,000 20,000 188,679

3.15% bonds due 2006 ........ 20,000 20,000 188,679

2.175% bonds due 2002 ...... 9,900 10,000 93,396

2.65% bonds due 2007 ........ 10,000 10,000 94,339

Floating rate*

bonds due 2004................... 5,000 5,000 47,169

2.625% bonds due 2001 ...... 9,000 10,000 84,905

3.00% bonds due 2005 ........ 10,000 10,000 94,339

2.82% bonds due 2004 ........ 10,000 10,000 94,339

2.00% bonds due 2001 ........ 5,000 5,000 47,169

2.59% bonds due 2001 ........ 5,000 5,000 47,169

2.37% bonds due 2002 ........ 5,000 5,000 47,169

............................................. 293,835 324,405 2,772,036

Less: Current portion............... (38,166) (33,460) (360,063)

............................................. ¥255,669 ¥290,595 $2,411,973

*represents a rate linked to yen interest rate swap for 10 years (1.858% at the date of

issuance of the bonds).

At March 31, 2000, short-term and long-term debt aggregat-

ing ¥3,500 million ($33,018 thousand) were collateralized by

property, plant and equipment which amounted to ¥15,457 million

($145,820 thousand).

As is customary in Japan, both short-term and long-term

bank loans are made under general agreements which provide

that collateral and guarantees (or additional collateral or guar-

antees, as appropriate) with respect to present and future

indebtedness will be given at the request of a lending bank,

and that the bank shall have the right, as the obligations

become due, or in the event of default, to offset any cash

deposited against such obligations.

4. Inventories

Inventories at March 31, 2000 and 1999 were as follows:

Thousands of

Millions of yen U.S. dollars

2000 1999 2000

Finished goods ................. ¥046,941 ¥052,705 $0,442,841

Work in process ................ 51,236 75,758 483,359

Raw materials and

supplies .......................... 42,467 35,428 400,636

....................................... ¥140,644 ¥163,892 $1,326,836

5. Investments in and advances to unconsolidated

subsidiaries and affiliates

Investments in and advances to unconsolidated subsidiaries

and affiliates at March 31, 2000 and 1999 were as follows:

Thousands of

Millions of yen U.S. dollars

2000 1999 2000

Investments stated:

By the equity method .... ¥3,643 ¥04,495 $34,376

At cost or less ............... 4,400 5,804 41,516

Advances .......................... 1,003 2,828 9,464

....................................... ¥9,047 ¥13,128 $85,357

6. Other investments in securities

Information with respect to the carrying value and related mar-

ket value of other investments in securities at March 31, 2000

and 1999 for which market prices are available is summarized

as follows:

Thousands of

Millions of yen U.S. dollars

2000 1999 2000

Carrying value of:

Marketable equity

securities ..................... ¥00,368 ¥00,380 $003,477

Other stocks and

securities ..................... 15,774 14,139 148,817

....................................... ¥16,143 ¥14,519 $152,295

Market value of

marketable equity

securities ........................ ¥00,398 ¥00,313 $003,757

7. Short-term borrowings and long-term debt

Short-term borrowings are generally unsecured and represent

notes. The weighted average interest rates for the years ended

March 31, 2000 and 1999 were approximately 1.3% and 1.5%,

respectively.