Oki 2000 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2000 Oki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

(k) Income taxes

Effective the year ended March 31, 1999, the Group fully

adopted deferred tax accounting for income taxes in accor-

dance with a new accounting standard issued by the Business

Accounting Deliberation Council. This standard requires recog-

nition of income taxes by liability method. Under the liability

method, deferred tax assets and liabilities are determined based

on the difference between financial reporting and the tax basis

of the assets and liabilities and are measured using the enacted

tax rates and laws which will be in effect when the differences

are expected to reverse. The effect of this change was to

decrease net loss by ¥23,885 million for the year ended March

31, 1999 from the amount, which would have been recorded

by the method applied in the previous year. In addition, the

cumulative effect of this change was reported as “adjustment

for the cumulative effect on prior years of retroactively recog-

nizing deferred income taxes” in the consolidated statements

of shareholders’ equity.

2. U.S. dollar amounts

The translation of yen amounts into U.S. dollar amounts is

included solely for convenience and has been made, as a

matter of arithmetic computation only, at ¥106=US$1.00, the

approximate exchange rate prevailing on March 31, 2000. The

translation should not be construed as a representation that

yen have been, could have been, or could in the future be

converted into U.S. dollars at that or any other rate.

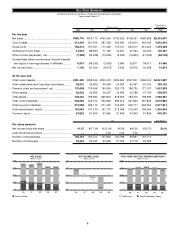

3. Marketable securities

Information with respect to the carrying value and related

market value of marketable securities at March 31, 2000 and

1999 for which market prices are available is summarized as

follows:

Thousands of

Millions of yen U.S. dollars

2000 1999 2000

Carrying value of:

Marketable equity

securities ............................ ¥41,266 ¥42,539 $389,309

Bonds ................................... 21,685 7,078 204,583

Other..................................... 1,110 14,298 10,476

.............................................. ¥64,063 ¥63,916 $604,368

Market value of marketable

equity securities .................... ¥59,319 ¥54,185 $559,616

(e) Marketable securities

Marketable securities are stated at cost determined by the

moving average method.

(f) Inventories

Inventories are principally stated at cost determined by the

following methods:

Finished goods—Moving average method

Work in process—Specific-identification method

Raw materials and supplies—Last purchase price method

(g) Property, plant and equipment, and depreciation

Property, plant and equipment is recorded at cost, except

that, as permitted by the Corporation Tax Law of Japan, the

cost of certain land and machinery and equipment has been

reduced to offset capital gains from the disposal of certain

assets.

Depreciation of property, plant and equipment is principally

computed by the declining-balance method over the estimated

useful lives of the respective assets. However, buildings (exclud-

ing leasehold improvements) acquired after April 1, 1998 by the

Group are depreciated by the straight-line method over the peri-

ods prescribed in the Corporation Tax Law. Significant renewals

and betterments are capitalized at cost. Maintenance and repairs

are charged to income.

(h) Intangible assets and amortization

Intangible assets including computer software costs capital-

ized are amortized by the straight-line method over their

estimated useful lives.

(i) Leases

Noncancelable leases are primarily accounted for as operating

leases (regardless of whether such leases are classified as operat-

ing or finance leases) except that lease agreements which

stipulate the transfer of ownership of the leased property to the

lessee are accounted for as finance leases.

( j) Severance indemnities and pension plans

The Group has severance benefits plans covering substan-

tially all their employees. An employee who terminates employ-

ment with the Company receives approximately 60% of such

benefits in the form of a lump-sum payment, or as pension

annuity payments from the pension plans with the remainder

in a lump-sum payment from the unfunded severance benefit

plan. Severance benefits are based on the compensation at the

time of termination, years of service and certain other factors.

The Group principally provides for the liabilities for severance

indemnities at 40% of the amount which would be required to

be paid if all eligible employees voluntarily terminated their

employment at the balance sheet date.

Costs with respect to the pension plans are funded as

accrued at amounts determined actuarially.

The pension fund assets at March 31, 1999, the most recent

valuation date except for certain subsidiaries, amounted to

¥138,478 million ($1,306,404 thousand).