Oki 2000 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2000 Oki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

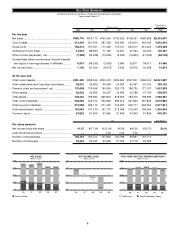

CONSOLIDATED STATEMENTS OF OPERATIONS

Thousands of

Millions of yen U.S. dollars (Note 2)

2000 1999 1998 2000

Common stock:

Balance at beginning of the year ........................................................................... ¥(67,849 ¥(67,849 ¥67,849 $(640,089

Increase due to conversion of convertible bonds ............................................. 12 —— 121

Balance at end of the year .................................................................................. ¥(67,862 ¥(67,849 ¥67,849 $(640,210

Additional paid-in capital:

Balance at beginning of the year ........................................................................... ¥(71,138 ¥(71,138 ¥71,138 $(671,114

Increase due to conversion of convertible bonds ............................................. 12 —— 121

Balance at end of the year .................................................................................. ¥(71,150 ¥(71,138 ¥71,138 $(671,235

Special reserves (Note 9):

Balance at beginning of the year ........................................................................... ¥(13,436 ¥(20,311 ¥23,191 $(126,756

Decrease due to recognition of deferred income taxes .................................... —(9,685) — —

Balance at end of the year, as adjusted ............................................................ 13,436 10,626 23,191 126,756

Transfer from retained earnings ............................................................................. 142 6,261 1,708 1,343

Transfer to retained earnings ................................................................................. (1,990) (3,451) (4,588) (18,782)

Balance at end of the year .................................................................................. ¥(11,587 ¥(13,436 ¥20,311 $(109,316

Retained earnings (accumulated deficit):

Balance at beginning of the year ........................................................................... ¥(11,142) ¥(37,817 ¥50,729 $(105,120)

Increase (decrease) at beginning of the year of initially consolidated

subsidiaries ....................................................................................................... (6) (499) 109 (58)

Decrease due to exclusion of an affiliate from the equity method.................... —(2,565) (3,378) —

Adjustment for the cumulative effect on prior years of retroactively

recognizing deferred income taxes .................................................................. —(3,111) — —

Increase due to recognition of deferred income taxes ...................................... —9,685 — —

Balance at beginning of the year, as adjusted .................................................. (11,149) 41,325 47,460 (105,179)

Net income (loss) ................................................................................................ 1,146 (47,421) (8,074) 10,814

Increase due to merger of a consolidated subsidiary with

unconsolidated subsidiaries............................................................................. 136 ——1,284

Cash dividends paid ........................................................................................... —(2,142) (4,285) —

Bonuses to directors and statutory auditors ..................................................... (18) (93) (164) (170)

Transfer to special reserves................................................................................ (142) (6,261) (1,708) (1,343)

Transfer from special reserves ........................................................................... 1,990 3,451 4,588 18,782

Balance at end of the year .................................................................................. ¥0(8,036) ¥(11,142) ¥37,817 $0(75,811)

The accompanying notes are an integral part of these statements.

Thousands of

Millions of yen U.S. dollars (Note 2)

2000 1999 1998 2000

Net sales ..................................................................................................................... ¥669,776 ¥673,170 ¥764,596 $6,318,647

Cost of sales ............................................................................................................... 513,402 551,619 587,332 4,843,418

Gross profit ............................................................................................................ 156,374 121,551 177,263 1,475,228

Selling, general and administrative expenses ........................................................... 142,570 159,848 166,083 1,345,000

Operating income (loss)....................................................................................... 13,804 (38,297) 11,180 130,227

Other income (expenses):

Interest expense ..................................................................................................... (12,291) (13,305) (14,494) (115,956)

Interest and dividend income ................................................................................. 2,625 2,733 2,723 24,769

Foreign exchange (loss) gain, net .......................................................................... (5,030) (1,311) (1,888) (47,459)

Other, net ................................................................................................................ 7,407 (18,354) 453 69,883

......................................................................................................................... (7,288) (30,238) (13,206) (68,762)

Income (loss) before income taxes, minority interests and equity in earnings

of affiliates ................................................................................................................ 6,515 (68,535) (2,026) 61,465

Income taxes (benefit) (Note 8):

Current .................................................................................................................... 2,429 2,434 6,187 22,920

Deferred .................................................................................................................. 2,626 (23,853) — 24,780

......................................................................................................................... 5,056 (21,418) 6,187 47,701

Income (loss) before minority interests and equity in earnings of affiliates.............. 1,458 (47,116) (8,213) 13,763

Minority interests in earnings of consolidated subsidiaries ...................................... (257) (221) (230) (2,428)

Equity in (losses) earnings of affiliates....................................................................... (55) (83) 369 (521)

Net income (loss) (Note 16) .............................................................................. ¥001,146 ¥ (47,421) ¥0 (8,074) $0,010,814

The accompanying notes are an integral part of these statements.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

Oki Electric Industry Company, Limited and consolidated subsidiaries

Years ended March 31, 2000, 1999 and 1998

Oki Electric Industry Company, Limited and consolidated subsidiaries

Years ended March 31, 2000, 1999 and 1998