Occidental Petroleum 2003 Annual Report Download - page 9

Download and view the complete annual report

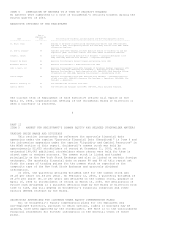

Please find page 9 of the 2003 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(a) See the MD&A and the "Notes to Consolidated Financial Statements" for

information regarding accounting changes, asset acquisitions and

dispositions, discontinued operations, environmental remediation, other

costs and other items affecting comparability.

(b) For an explanation of core earnings, see "Significant Items Affecting

Earnings" in the MD&A.

(c) On January 20, 2004, all of the trust preferred securities were redeemed.

ITEM 7

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS (MD&A) (INCORPORATING ITEM 7A)

In this report, the term "Occidental" refers to Occidental Petroleum

Corporation (OPC) and/or one or more entities in which it owns a majority voting

interest (subsidiaries). Occidental is divided into two segments: oil and gas

and chemical.

2003 BUSINESS ENVIRONMENT

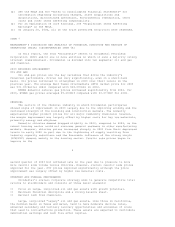

OIL AND GAS

Oil and gas prices are the key variables that drive the industry's

financial performance. Prices can vary significantly, even on a short-term

basis. Oil prices continued to strengthen in 2003 over their levels in the

previous year. The average West Texas Intermediate (WTI) market price for 2003

was $31.03/barrel (bbl) compared with $26.08/bbl in 2002.

NYMEX domestic natural gas prices increased significantly from 2002. For

2003, NYMEX gas prices averaged $5.26/Mcf compared with $3.07/Mcf for 2002.

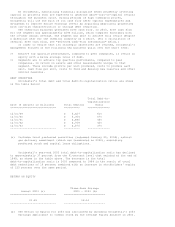

CHEMICAL

The sectors of the chemical industry in which Occidental participates

showed signs of improvement in 2003 largely due to the improving economy and the

continued strength of the building and construction markets. The industry

experienced higher product prices for all major commodity chemicals; however,

the margin improvement was largely offset by higher costs for key raw materials,

primarily energy and ethylene.

Domestic chlorine demand dropped slightly in 2003, compared to 2002, as the

robust housing sector could not overcome general weakness in other manufacturing

markets. However, chlorine prices increased sharply in 2003 from their depressed

levels in early 2002 in part due to the tightening of supply resulting from

industry capacity reductions and the favorable influence of the strong vinyls

(VCM/PVC) demand, mainly in the housing sector. Caustic soda prices began to

improve in the

8

second quarter of 2003 but softened late in the year due to pressure to move

more caustic soda volume versus chlorine. However, overall caustic soda prices

improved for the year. PVC prices improved significantly although the price

improvement was largely offset by higher raw material costs.

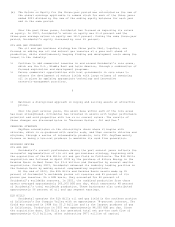

STRATEGY AND OVERALL PERFORMANCE

Occidental's overall corporate strategy aims to generate competitive total

returns to stockholders and consists of three basic elements:

>> Focus on large, long-lived oil and gas assets with growth potential.

>> Maintain financial discipline and a strong balance sheet.

>> Harvest cash from chemicals.

Large, long-lived "legacy" oil and gas assets, like those in California,

the Permian Basin in Texas and Qatar, tend to have moderate decline rates,

enhanced secondary and tertiary recovery opportunities and economies of scale

that lead to cost-effective production. These assets are expected to contribute

substantial earnings and cash flow after capital.