Occidental Petroleum 2003 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2003 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.barrels of oil per day in 2003.

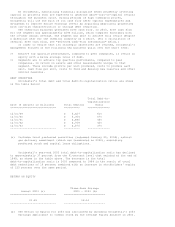

MIDDLE EAST

DOLPHIN PROJECT

In 2002, Occidental purchased a 24.5-percent interest in the Dolphin

Project for $310 million. This investment includes a 24.5-percent interest in

Dolphin Energy Limited (Dolphin Energy), the operator of the Dolphin Project.

The Dolphin Project consists of two parts: (1) a development and production

sharing agreement with Qatar to develop and produce natural gas and condensate

in Qatar's North Field for 25 years, with a provision to request a 5-year

extension; and (2) the rights for Dolphin Energy to build, own and operate a

260-mile-long, 48-inch export pipeline to transport 2 billion cubic feet per day

of dry natural gas from Qatar to markets in the United Arab Emirates (UAE) for

the life of the Dolphin Project and longer. The pipeline will have capacity to

transport up to 3.2 billion cubic feet per day, which will allow for additional

business opportunities.

Several important milestones have been reached since Occidental joined the

Dolphin Project. In 2002, two development wells were drilled and tested,

providing sufficient information to complete the field development plan. In

October 2003, Dolphin Energy signed two 25-year contracts to supply

approximately one BCF of natural gas per day to two entities in the UAE. A third

supply contract with the Emirate of Dubai is currently being negotiated. In

addition, other markets for natural gas and hydrocarbon liquids are being

pursued. In December 2003, the Government of Qatar approved the final field

development plan for the Dolphin Project. Based on the foregoing developments,

Occidental recorded 107 million BOE of proved undeveloped oil and gas reserves

in 2003.

Most recently, in January 2004, Dolphin Energy awarded engineering,

procurement and construction contracts for the gas processing and compression

plant at Ras Laffan in Qatar as well as for two offshore gas production

platforms. The plant will receive wet gas from Dolphin's facilities in Qatar's

North Field and will remove hydrocarbon liquids, including condensate and

natural gas liquids, for further processing and sale. The resulting dry gas will

be compressed and transported to the UAE through Dolphin Energy's pipeline. The

projected start-up date for production is in 2006.

The Dolphin Project is expected to cost approximately $4.0 billion in

total. Occidental expects to invest approximately $1 billion for its

24.5-percent share in the Dolphin Project over the next three years. A portion

of the project costs may be project financed. During 2004, Occidental expects to

invest approximately $250 to $300 million, which is expected to be provided by

Occidental's operating cash flow. This investment is in addition to Occidental's

expected 2004 capital expenditures of $1.4 billion that are discussed under

"Liquidity and Capital Resources."

As the project has not begun operation, no revenue or production costs were

recorded in 2003.

QATAR

By introducing advanced drilling systems and applying new waterflooding and

reservoir characterization techniques in the Idd El Shargi North Dome (ISND)

field, Occidental has increased production and recoverable reserves from the

field.

Occidental is moving forward with a second phase under its existing

agreement in the development of ISND. The new phase is targeting the development

and recovery of additional reserves from ISND.

Occidental is also engaged in full-field development of the Idd El Shargi

South Dome (ISSD) field which, as a satellite to the North Dome, reduces the

overall capital requirement of the two projects.

Combined production from the two fields averaged 45,000 barrels per day,

net to Occidental, in 2003.

Also, see the Dolphin Project discussed above.

YEMEN

In Yemen, Occidental owns direct working interests in the Masila field in

Block 14 (38 percent) and a 40.4-percent interest in the East Shabwa field,

comprising a 28.6-percent direct-working interest and a 11.8-percent equity

interest in an unconsolidated entity. Occidental's net production averaged

37,000 barrels of oil per day in 2003, with 31,000 coming from the Masila field

and the remainder from East Shabwa.