Occidental Petroleum 2003 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2003 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.plans.

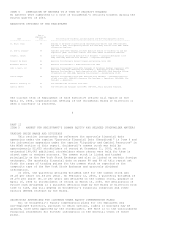

The following is a summary of the shares reserved for issuance as of

December 31, 2003, pursuant to outstanding options, rights or warrants granted

under Occidental's equity compensation plans:

(a) Number of (b) Weighted- (c) Number of securities

securities to be average remaining available

issued upon exercise price for future issuance

exercise of out- of outstanding under equity

standing options, options, compensation plans

warrants and warrants and (excluding securities

rights rights in column (a))

---------------------- ------------------- --------------------------

23,011,923 $26.53 13,101,112 *

* Includes, with respect to the 1995 Incentive Stock Plan, 1,369,796 shares

at maximum target level (684,898 at target level) reserved for issuance

pursuant to outstanding performance stock awards, including 717,876 shares

at maximum target level (358,938 at target level) eligible for

certification in February 2004, and 1,188,596 deferred performance and

restricted stock awards and, with respect to the 2001 Incentive

Compensation Plan, 1,192,018 shares at maximum target level (596,009 at

target level) reserved for issuance pursuant to outstanding performance

stock awards, 1,737,874 shares reserved for issuance pursuant to restricted

stock awards and 3,971 shares reserved for issuance as dividend equivalents

under the 2001 Incentive Compensation Plan. Of the remaining 7,608,857

shares, 7,574,285 shares are available under the 2001 Incentive

Compensation Plan, all of which may be issued or reserved for issuance for

options, rights and warrants as well as performance stock awards,

restricted stock awards, stock bonuses and dividend equivalents and 34,572

shares are available for issuance under the Restricted Stock Plan for

nonemployee directors.

7

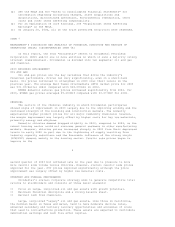

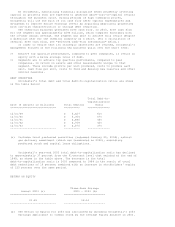

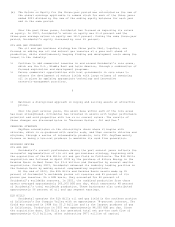

ITEM 6 SELECTED FINANCIAL DATA

FIVE-YEAR SUMMARY OF SELECTED FINANCIAL DATA

Dollar amounts in millions, except per-share amounts

For the years ended December 31, 2003 2002 2001 2000 1999

=============================================================== ======== ======== ======== ======== ========

RESULTS OF OPERATIONS (a)

Net sales $ 9,326 $ 7,338 $ 8,102 $ 8,504 $ 5,594

Income from continuing operations $ 1,595 $ 1,163 $ 1,179 $ 1,557 $ 461

Net income $ 1,527 $ 989 $ 1,154 $ 1,570 $ 448

Earnings applicable to common stock $ 1,527 $ 989 $ 1,154 $ 1,571 $ 442

Basic earnings per common share from

continuing operations $ 4.16 $ 3.09 $ 3.16 $ 4.22 $ 1.28

Basic earnings per common share $ 3.98 $ 2.63 $ 3.10 $ 4.26 $ 1.24

Diluted earnings per common share $ 3.93 $ 2.61 $ 3.09 $ 4.26 $ 1.24

Core earnings (b) $ 1,635 $ 999 $ 1,246 $ 1,349 $ 37

FINANCIAL POSITION (a)

Total assets $ 18,168 $ 16,548 $ 17,850 $ 19,414 $ 14,125

Long-term debt, net $ 3,993 $ 3,997 $ 4,065 $ 5,185 $ 4,368

Trust preferred securities (c) $ 453 $ 455 $ 463 $ 473 $ 486

Common stockholders' equity $ 7,929 $ 6,318 $ 5,634 $ 4,774 $ 3,523

CASH FLOW

Cash provided by operating activities $ 3,074 $ 2,100 $ 2,566 $ 2,348 $ 1,004

Capital expenditures $ (1,601) $ (1,236) $ (1,308) $ (892) $ (557)

Cash (used) provided by all other investing activities, net $ (420) $ (460) $ 657 $ (2,152) $ 2,189

DIVIDENDS PER COMMON SHARE $ 1.04 $ 1.00 $ 1.00 $ 1.00 $ 1.00

BASIC SHARES OUTSTANDING (thousands) 383,943 376,190 372,119 368,750 355,073

--------------------------------------------------------------- -------- -------- -------- -------- --------