Occidental Petroleum 2003 Annual Report Download - page 4

Download and view the complete annual report

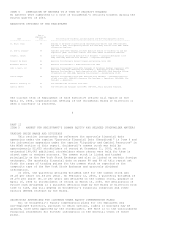

Please find page 4 of the 2003 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 2003 2002 2001

======================== ============================== =============================== ===============================

OIL (a) GAS TOTAL (b) Oil (a) Gas Total (b) Oil (a) Gas Total (b)

------- ------- ------- ------- ------- ------- ------- ------- -------

U.S. Reserves 1,500 1,826 1,805 1,452 1,821 1,755 1,371 1,962 1,698

International Reserves 538 768 666 518 228 556 526 106 543

------- ------- ------- ------- ------- ------- ------- ------- -------

2,038 2,594 2,471(c) 1,970 2,049 2,311(c) 1,897 2,068 2,241(c)

======= ======= ======= ======= ======= ======= ======= ======= =======

U.S. Production 93 194 125 85 206 119 78 223 115

International Production 70 27 75 65 23 69 55 18 59

------- ------- ------- ------- ------- ------- ------- ------- -------

163 221 200 150 229 188 133 241 174

======================== ======= ======= ======= ======= ======= ======= ======= ======= =======

(a) Includes natural gas liquids and condensate.

(b) Natural gas volumes have been converted to equivalent barrels based on

energy content of 6,000 cubic feet (one thousand cubic feet is referred to

as an "Mcf") of gas to one barrel of oil.

(c) Stated on a net basis and after applicable royalties. Includes reserves

related to production-sharing contracts, other economic arrangements and

Occidental's share of reserves from equity investees. Proved reserves from

production-sharing contracts in the Middle East and from other economic

arrangements in the U.S. were 437 million barrels of oil equivalent (MMBOE)

and 90 MMBOE in 2003, 324 MMBOE and 94 MMBOE in 2002 and 321 MMBOE and 99

MMBOE in 2001, respectively.

3

COMPETITION AND SALES AND MARKETING

As a producer of crude oil and natural gas, Occidental competes with

numerous other domestic and foreign producers. Crude oil and natural gas are

commodities that are sensitive to prevailing global conditions of supply and

demand and are sold at "spot" or contract prices or on futures markets to

refiners and other market participants. Occidental competes by developing and

producing its worldwide oil and gas reserves cost-effectively and acquiring

contracts to explore in areas with known oil and gas deposits. Occidental also

competes by increasing production through enhanced oil recovery projects in

mature and underdeveloped fields and making strategic acquisitions. Occidental

focuses on operations in its core areas of the United States, the Middle East

and Latin America.

CHEMICAL OPERATIONS

GENERAL

Occidental manufactures and markets basic chemicals, vinyls and performance

chemicals directly and through various affiliates (collectively, OxyChem).

OxyChem's operations are affected by cyclical economic factors and by specific

chemical-industry conditions. For additional information regarding Occidental's

chemical segment, see the information under the captions "Business Review -

Chemical" and "2004 Outlook - Chemical" in the MD&A section of this report.

PRODUCTS AND PROPERTIES

OxyChem, which is headquartered in Dallas, Texas, operates chemical

manufacturing plants at 26 sites in the United States. Many of the larger

facilities are located in the Gulf Coast region of Texas and Louisiana. In

addition, OxyChem operates two chemical-manufacturing plants in Canada and one

in Chile. All of OxyChem's manufacturing plants are owned. A number of

additional facilities process, blend and store products. OxyChem owns and leases

an extensive fleet of railcars. OxyChem also has a 50-percent equity investment

in a Brazilian corporation that owns a chlor-alkali plant.

BASIC CHEMICALS

OxyChem's basic chemicals consist of chlorine, caustic soda, potassium

chemicals and their derivatives.

Chlorine is used for chemical manufacturing in the chlorovinyl chain and

for water treatment. OxyChem produces chlorine in Alabama, Delaware, Louisiana,