Occidental Petroleum 2003 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2003 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. earnings applicable to common stock by the average equity balance in 2003.

(b) The Return on Equity for the three-year period was calculated as the sum of

the annual earnings applicable to common stock for each of the three years

ended 2003 divided by the sum of the ending equity balances for each year

end in the same period.

Over the past three years, Occidental has focused on improving its return

on equity. In 2003, Occidental's return on equity was 21.4 percent and the

three-year average return on equity was 18.5 percent. During the same three-year

period, Occidental's equity increased by over 41 percent.

OIL AND GAS STRATEGY

The oil and gas business strategy has three parts that, together, are

focused on adding new oil and natural gas reserves at a pace well ahead of

production, while simultaneously keeping finding and development costs among the

lowest in the industry:

>> Continue to add commercial reserves in and around Occidental's core areas,

which are the U.S., Middle East and Latin America, through a combination of

focused exploration and development programs.

>> Pursue commercial opportunities with host governments in core areas to

enhance the development of mature fields with large volumes of remaining

oil in place by applying appropriate technology and innovative

reservoir-management practices.

9

>> Maintain a disciplined approach in buying and selling assets at attractive

prices.

Over the past several years, the asset base within each of the core areas

has been strengthened. Occidental has invested in assets with higher performance

potential and sold properties with low or no current return. The results of

these changes are discussed below in "Business Review - Oil and Gas."

CHEMICAL STRATEGY

OxyChem concentrates on the chlorovinyls chain where it begins with

chlorine, which is co-produced with caustic soda, and then converts chlorine and

ethylene, through a series of intermediate products, into PVC. OxyChem mainly

focuses on being a low-cost producer to maximize its cash flow generation.

BUSINESS REVIEW

OIL AND GAS

Occidental's overall performance during the past several years reflects the

successful implementation of its oil and gas business strategy, beginning with

the acquisition of the Elk Hills oil and gas field in California. The Elk Hills

acquisition was followed in April 2000 by the purchase of Altura Energy in the

Permian Basin in West Texas for $3.6 billion and thereafter by several smaller

acquisitions. During 2003, Occidental enhanced its industry leading position in

the Permian Basin by making several complementary acquisitions.

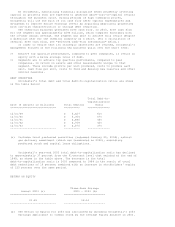

At the end of 2003, the Elk Hills and Permian Basin assets made up 65

percent of Occidental's worldwide proven oil reserves and 45 percent of its

proven gas reserves. On a BOE basis, they accounted for 62 percent of

Occidental's worldwide reserves. In 2003, the combined production from these

assets averaged approximately 265,000 BOE per day, which represents 48 percent

of Occidental's total worldwide production. These businesses also contributed

approximately 56 percent of oil and gas segment earnings.

ELK HILLS

Occidental operates the Elk Hills oil and gas field in the southern portion

of California's San Joaquin Valley with an approximate 78-percent interest. The

field was acquired in 1998 for $3.5 billion and is the largest producer of gas

in California. Production in 2003 was approximately 94,000 BOE per day. Since

the acquisition date, Elk Hills has generated total net pre-tax cash flow of

approximately $3.5 billion, after subtracting $871 million of capital