Occidental Petroleum 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

[X] Annual Report Pursuant to Section 13 or 15(d) [ ] Transition Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934 of the Securities Exchange Act of 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2003 FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER 1-9210

OCCIDENTAL PETROLEUM CORPORATION

(Exact name of registrant as specified in its charter)

State or other jurisdiction of incorporation or organization DELAWARE

I.R.S. Employer Identification No. 95-4035997

Address of principal executive offices 10889 WILSHIRE BLVD., LOS ANGELES, CA

Zip Code 90024

Registrant's telephone number, including area code (310) 208-8800

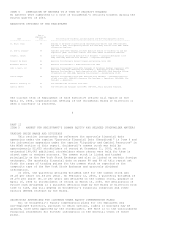

Securities registered pursuant to Section 12(b) of the Act:

TITLE OF EACH CLASS NAME OF EACH EXCHANGE ON WHICH REGISTERED

10 1/8% Senior Debentures due 2009 New York Stock Exchange

9 1/4% Senior Debentures due 2019 New York Stock Exchange

Oxy Capital Trust I 8.16% Trust Originated Preferred Securities New York Stock Exchange

Common Stock New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant (1) has filed all reports required

to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past 90 days.

[X] YES [ ] NO

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405

of Regulation S-K is not contained herein, and will not be contained, to the

best of registrant's knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. [X]

Indicate by check mark whether the registrant is an accelerated filer (as

defined in Exchange Act Rule 12b-2). [X] YES [ ] NO

The aggregate market value of the voting stock held by nonaffiliates of the

registrant was approximately $13.0 billion, computed by reference to the closing

price on the New York Stock Exchange composite tape of $33.55 per share of

Common Stock on June 30, 2003. Shares of Common Stock held by each executive

officer and director have been excluded from this computation in that such

persons may be deemed to be affiliates. This determination of affiliate status

is not a conclusive determination for other purposes.

At January 31, 2004, there were approximately 388,147,906 shares of Common Stock

outstanding.

Table of contents

-

Page 1

... name of registrant as specified in its charter) State or other jurisdiction of I.R.S. Employer Identification Address of principal executive Zip Code Registrant's telephone number, incorporation or organization No. offices including area code DELAWARE 95-4035997 10889 WILSHIRE BLVD., LOS ANGELES... -

Page 2

...registrant's definitive Proxy Statement, filed in connection with its April 30, 2004, Annual Meeting of Stockholders, are incorporated by reference into Part III. TABLE OF CONTENTS PAGE PART I ITEMS 1 AND 2 Business and Properties...General...Oil and Gas Operations...Chemical Operations...Capital... -

Page 3

...California, the Hugoton field in Kansas and Oklahoma, the Permian field in West Texas and New Mexico, and the Gulf of Mexico. International operations are located in Colombia, Ecuador, Oman, Pakistan, Qatar, Russia, United Arab Emirates and Yemen. Occidental also has exploration interests in several... -

Page 4

... production through enhanced oil recovery projects in mature and underdeveloped fields and making strategic acquisitions. Occidental focuses on operations in its core areas of the United States, the Middle East and Latin America. CHEMICAL OPERATIONS GENERAL Occidental manufactures and markets... -

Page 5

...in Georgia, Ohio, Illinois, New Jersey, Texas and Alabama). Information regarding production capacity reflects estimated annual capacity at December 31, 2003. 4 RAW MATERIALS Nearly all raw materials used in OxyChem's operations are readily available from a variety of sources. Power is provided by... -

Page 6

... market or market-related prices through short- and long-term sales agreements. No significant portion of OxyChem's business is dependent on a single third-party customer. OxyChem generally does not manufacture its products against a backlog of firm orders. COMPETITION Occidental's chemical business... -

Page 7

... Occidental Oil and Gas Corporation (OOGC) since 1999; Director since 1990; member of Executive Committee. Chief Financial Officer and Executive Vice President -- Corporate Development since 1999; 1994-1999, Executive Vice President -- Corporate Development. Executive Vice President, General Counsel... -

Page 8

... The following is a summary of the shares reserved for issuance as of December 31, 2003, pursuant to outstanding options, rights or warrants granted under Occidental's equity compensation plans: (a) Number of securities to be issued upon exercise of outstanding options, warrants and rights 23,011... -

Page 9

...OF OPERATIONS (MD&A) (INCORPORATING ITEM 7A) In this report, the term "Occidental" refers to Occidental Petroleum Corporation (OPC) and/or one or more entities in which it owns a majority voting interest (subsidiaries). Occidental is divided into two segments: oil and gas and chemical. 2003 BUSINESS... -

Page 10

... of chemical free cash flow, see "Selected Cash-Flow Information" below.) In order to ensure that its strategic objectives are reached, Occidental's management focuses on the following key business goals over the short term: >> >> Achieve top quartile performance, compared to peer companies, in... -

Page 11

... with the acquisition of the Elk Hills oil and gas field in California. The Elk Hills acquisition was followed in April 2000 by the purchase of Altura Energy in the Permian Basin in West Texas for $3.6 billion and thereafter by several smaller acquisitions. During 2003, Occidental enhanced its... -

Page 12

... BOE per day. HUGOTON Occidental owns a large concentration of gas reserves, production interests and royalty interests in the Hugoton area of Kansas and Oklahoma. The Hugoton field is the largest natural gas field discovered to date in North America. Occidental's Hugoton operations produced 138,000... -

Page 13

... and Capital Resources." As the project has not begun operation, no revenue or production costs were recorded in 2003. QATAR By introducing advanced drilling systems and applying new waterflooding and reservoir characterization techniques in the Idd El Shargi North Dome (ISND) field, Occidental has... -

Page 14

... up a market for previously stranded gas that is associated with oil production from the Safah field. Occidental also continues its exploration program in the adjacent Block 27. In 2003, the Government of Oman approved a farm-out of a 35-percent working interest in Block 27 to Mitsui E&P Middle East... -

Page 15

... valid claim for reimbursement under applicable Ecuador tax law and the treaty. In the event of an unfavorable outcome, the potential financial statement effect would not be significant. PRODUCTION-SHARING CONTRACTS Occidental conducts its operations in Qatar, Oman and Yemen under production-sharing... -

Page 16

...-mile oil pipeline and gathering system located in the Permian Basin, which was acquired in January 2004 and will be used in corporate-directed oil and gas marketing and trading operations. In July 2001, Occidental sold its interests in a subsidiary that owned a Texas intrastate natural gas pipeline... -

Page 17

... markets. Export sales accounted for approximately 17 percent of Occidental's 2003 chemical sales. The end of the most recent recession and resultant world economic recovery is expected to improve the overall outlook. Construction of LNG terminals on the U.S. Gulf Coast could stabilize natural gas... -

Page 18

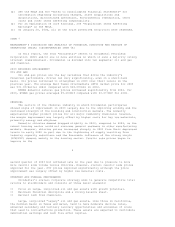

... forth the sales and earnings of each operating segment and corporate items: SEGMENT OPERATIONS In millions, except per share amounts For the years ended December 31, 2003 SALES Oil and Gas Chemical Other (a) 2002 ======== 2001 ======== $ EARNINGS(LOSS) Oil and Gas (b) Chemical (b) 6,003... -

Page 19

... SALES SEGMENT EARNINGS CORE EARNINGS (a) NET PRODUCTION PER DAY UNITED STATES Crude oil and liquids (MBBL) California Permian Horn Mountain Hugoton Total Natural Gas (MMCF) California Hugoton Permian Horn Mountain Total LATIN AMERICA Crude oil & condensate (MBBL) Colombia Ecuador Total MIDDLE EAST... -

Page 20

Oman Qatar Yemen Total OTHER EASTERN HEMISPHERE Crude oil & condensate (MBBL) Pakistan Natural Gas (MMCF) Pakistan BARRELS OF OIL EQUIVALENT (MBOE) SUBTOTAL CONSOLIDATED SUBSIDIARIES Colombia-minority interest Russia-Occidental net interest Yemen-Occidental net interest TOTAL WORLDWIDE PRODUCTION ... -

Page 21

... with generally accepted accounting principles. SIGNIFICANT ITEMS AFFECTING EARNINGS Benefit (Charge) (in millions TOTAL REPORTED EARNINGS OIL AND GAS Segment Earnings Less: Gain on sale of interest in the Indonesian Tangguh LNG Project (a) Segment Core Earnings CHEMICAL 2003 ======== $ 1,527... -

Page 22

...102 $ 223 $ 10 -------- The increase in sales in 2003, compared to 2002, primarily reflects higher crude oil, natural gas and chemical prices and higher crude oil production volumes, partially offset by lower natural gas production volumes. The decrease in sales in 2002, compared to 2001, primarily... -

Page 23

..., non-operating costs were generally higher in international operations, mainly Latin America. Higher oil and gas production taxes reflected the overall increase in worldwide production. Also, additional expense resulted from adoption of the new asset retirement obligation accounting standard... -

Page 24

... notes and medium-term notes and a subsidiary of Occidental issued $75 million of preferred stock. Occidental retains all common shares of the subsidiary and elects the majority of the directors. The subsidiary is the holding company for a number of international subsidiaries of Occidental. In the... -

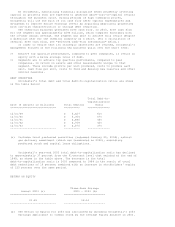

Page 25

... proceeds of $861 million from new long-term debt. Occidental paid common stock dividends of $392 million in 2003, $375 million in 2002 and $372 million in 2001. CAPITAL EXPENDITURES In millions Oil and Gas Chemical Corporate and other 2003 ======== $ 1,237 345 19 -------- 2002 ======== $ 1,038... -

Page 26

.... In addition, Occidental expects to spend $250 million to $300 million on the Dolphin Project. A majority of the capital spending will be allocated to oil and gas, with the main focus on Qatar, Elk Hills and the Permian Basin. Commitments at December 31, 2003, for major capital expenditures during... -

Page 27

... 31, 2003. As Occidental ships product using the pipeline, its overall obligations will decrease with the reduction of the pipeline company's senior project debt. ELK HILLS POWER Occidental has a 50-percent interest in Elk Hills Power LLC (EHP), a limited liability company that operates a gas-fired... -

Page 28

... has entered into various operating-lease agreements, mainly for railcars, power plants, manufacturing facilities and office space. The leased assets are used in Occidental's operations where leasing offers advantages of greater operating flexibility and generally costs less than alternative methods... -

Page 29

... Accounting Changes" below, FIN 45 requires the disclosure in Occidental's financial statements of information relating to guarantees issued by Occidental and outstanding at December 31, 2003. These guarantees encompass performance bonds, letters of credit, indemnities, commitments and other forms... -

Page 30

... in some cases, compensation for alleged property damage, punitive damages and civil penalties. Occidental manages its environmental remediation efforts through a wholly owned subsidiary, Glenn Springs Holdings, Inc. (GSH), which reports its results directly to Occidental's corporate management. 21... -

Page 31

... to $400 million beyond the amount accrued. For management's opinion, refer to the "Lawsuits, Claims, Commitments, Contingencies and Related Matters" section above. CERCLA AND EQUIVALENT SITES At December 31, 2003, OPC or certain of its subsidiaries have been named in 131 CERCLA or state equivalent... -

Page 32

... Western New York. ACTIVE FACILITIES Certain subsidiaries of OPC are currently addressing releases of substances from past operations at 13 active facilities. Four facilities -- certain oil and gas properties in the southwestern United States, a chemical plant in Louisiana, a chemical plant in Texas... -

Page 33

... of the Board of Directors. OIL AND GAS PROPERTIES Occidental uses the successful efforts method to account for its oil and gas properties. Under this method, costs of acquiring properties, costs of drilling successful exploration wells and development costs are capitalized. Annual lease rentals... -

Page 34

... critical accounting policy affecting Occidental's chemical assets is the determination of the estimated useful lives of its property, plant and equipment. Occidental's chemical plants are depreciated using either the unit-of-production or straight-line method based upon the estimated useful life of... -

Page 35

.... The environmental reserves are based on management's estimate of the most likely cost to be incurred and are reviewed periodically and adjusted as additional or new information becomes available. For the years ended December 31, 2003 and 2002, Occidental has not accrued any reimbursements or... -

Page 36

...Listed below are significant changes in Occidental's accounting principles. SFAS NO. 132 REVISED In December 2003, the FASB issued a revision to SFAS No. 132, "Employers Disclosures about Pensions and Other Postretirement Benefits" to improve financial statement disclosures for defined benefit plans... -

Page 37

...assets, benefit obligations, cash flows and other relevant information, such as plan assets by category. A description of investment policies and strategies for these asset categories and target allocation percentages or target ranges are also required 25 in financial statements. This statement is... -

Page 38

...had two major types of oil and gas revenues: (1) revenues from its equity production; and (2) revenues from the sale of oil and gas produced by other companies, but purchased and resold by Occidental, referred to as revenue from trading activities. Both types of sales involve physical deliveries and... -

Page 39

... SFAS No. 143, "Accounting for Asset Retirement Obligations." SFAS No. 143 addresses financial accounting and reporting for obligations associated with the retirement of tangible long-lived assets and the associated asset retirement costs. Under SFAS No. 143, companies are required to recognize the... -

Page 40

.... In general, the fair value recorded for derivative instruments is based on quoted market prices, dealer quotes and the Black-Scholes or similar valuation models. ACCOUNTING FOR DERIVATIVES AND DEFINITIONS Occidental applies either fair value or cash flow hedge accounting when transactions meet... -

Page 41

...to Chemical Market Associates, Inc., December 2003 average contract prices were: chlorine--$203/ton, caustic soda--$133/ton, PVC--$0.44/lb and EDC--$228/ton. MARKETING AND TRADING OPERATIONS Occidental periodically uses different types of derivative instruments to achieve the best prices for oil and... -

Page 42

... oil and gas production during 2003 or 2002 and no cash flow hedges were used for the sale of production in 2003. QUANTITATIVE INFORMATION Occidental uses value at risk to estimate the potential effects of changes in fair values of commodity-based derivatives and commodity contracts used in trading... -

Page 43

... exposure relative to credit limits, and manages credit-enhancement issues. Credit exposure for each customer is monitored for outstanding balances, current month activity, and forward mark-to-market exposure. FOREIGN CURRENCY RISK Several of Occidental's foreign operations are located in countries... -

Page 44

... at levels necessary for operating purposes. Generally, international crude oil sales are denominated in U.S. dollars. Additionally, all of Occidental's oil and gas foreign entities have the U.S. dollar as the functional currency. However, in one foreign chemical subsidiary where the local currency... -

Page 45

... oil and gas development projects; the supply/demand considerations for Occidental's products; any general economic recession or slowdown domestically or internationally; regulatory uncertainties; and not successfully completing, or any material delay of, any development of new fields, expansion... -

Page 46

... data reported by Occidental and its subsidiaries. Fulfilling this responsibility requires the preparation and presentation of consolidated financial statements in accordance with generally accepted accounting principles. Management uses internal accounting controls, corporate-wide policies and... -

Page 47

... Los Angeles, California February 13, 2004 32 CONSOLIDATED STATEMENTS OF OPERATIONS In millions, except per-share amounts For the years ended December 31 REVENUES Net sales Interest, dividends and other income Gains on disposition of assets, net Occidental Petroleum Corporation and Subsidiaries... -

Page 48

... maturities of long-term debt and capital lease liabilities Accounts payable Accrued liabilities Dividends payable Domestic and foreign income taxes Trust preferred securities TOTAL CURRENT LIABILITIES Occidental Petroleum Corporation and Subsidiaries 2003 ========== 2002 ========== $ 23 909... -

Page 49

... of these financial statements. 35 CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY In millions Occidental Petroleum Corporation and Subsidiaries BALANCE, DECEMBER 31, 2000 Net income Other comprehensive loss, net of tax Dividends on common stock Issuance of common stock Exercises of options... -

Page 50

... (decrease) in accounts payable and accrued liabilities Increase in current domestic and foreign income taxes Other operating, net Operating cash flow from continuing operations Operating cash flow from discontinued operations Occidental Petroleum Corporation and Subsidiaries 2003 ========== 2002... -

Page 51

... "Occidental" or "the company" refers to Occidental Petroleum Corporation and/or one or more entities where it owns a majority voting interest. The company's proportionate share of oil and gas exploration and production ventures, where it has a direct working interest, is accounted for by reporting... -

Page 52

... receive compensation in the event of nationalization. Since Occidental's major products are commodities, significant changes in the prices of oil and gas and chemical products may have a significant impact on Occidental's results of operations for any particular year. Also, see "Property, Plant and... -

Page 53

... are valued at the lower of cost or market. Natural gas trading inventory was valued at market prior to January 1, 2003 (see "Accounting Changes" in Note 4). For the chemical segment, in countries where allowable, Occidental generally values its inventories using the last-in, first-out (LIFO... -

Page 54

... the estimated useful lives of Occidental's chemical plants include higher or lower product prices, which are particularly affected by both domestic and foreign competition, feedstock costs, energy prices, environmental regulations, competition and technological changes. Occidental is required to... -

Page 55

... the required remediation results. Occidental generally assumes that the remedial objective can be achieved using the most cost-effective technology reasonably expected to achieve that objective. Such technologies may include air sparging or phyto-remediation of shallow groundwater, or limited... -

Page 56

...accrued over their operating lives. Such costs were calculated at unit-of-production rates based upon estimated proved recoverable reserves and were taken into account in determining depreciation, depletion and amortization. Occidental assumed that the salvage value of the oil and gas property would... -

Page 57

... 12. Occidental accounts for those Plans under APB No. 25, "Accounting for Stock Issued to Employees", and related interpretations. Occidental's policy is to recognize compensation expense for the Plans over the vesting period of the award. Had compensation expense for those Plans been determined... -

Page 58

... and the Black-Scholes or similar valuation models. 43 COMMODITY PRICE RISK GENERAL Occidental's results are sensitive to fluctuations in crude oil and natural gas prices. MARKETING AND TRADING OPERATIONS Occidental periodically uses different types of derivative instruments to achieve the best... -

Page 59

... at levels necessary for operating purposes. Generally, international crude oil sales are denominated in U.S. dollars. Additionally, all of Occidental's oil and gas foreign entities have the U.S. dollar as the functional currency. However, in one foreign chemical subsidiary where the local currency... -

Page 60

...Energy awarded engineering, procurement and construction contracts for the gas processing and compression plant at Ras Laffan in Qatar as well as for two offshore gas production platforms. The projected start-up date for production is in 2006. In August 2002, Occidental and Lyondell Chemical Company... -

Page 61

... financial statement disclosures for defined benefit plans. The standard requires that companies provide more details about their plan assets, benefit obligations, cash flows and other relevant information, such as plan assets by category. A description of investment policies and strategies for... -

Page 62

...had two major types of oil and gas revenues: (1) revenues from its equity production; and (2) revenues from the sale of oil and gas produced by other companies, but purchased and resold by Occidental, referred to as revenue from trading activities. Both types of sales involve physical deliveries and... -

Page 63

... SFAS No. 143, "Accounting for Asset Retirement Obligations." SFAS No. 143 addresses financial accounting and reporting for obligations associated with the retirement of tangible long-lived assets and the associated asset retirement costs. Under SFAS No. 143, companies are required to recognize the... -

Page 64

...units and tested for goodwill impairment. All three of these businesses are components of the chemical segment. The fair value of each of the three reporting units was determined through third party appraisals. The appraisals determined fair value to be the price that the assets could be sold for in... -

Page 65

...-to-market adjustments due to fair-value hedges. Amount is classified as non-current since Occidental does not expect debt holders to put the debt on August 1, 2004. If the debt were put to Occidental, it would refinance this amount on a long-term basis using available lines of long-term bank credit... -

Page 66

... facilities, office space, railcars and tanks, frequently include renewal and/or purchase options and require Occidental to pay for utilities, taxes, insurance and maintenance expense. At December 31, 2003, future net minimum lease payments for capital and operating leases (excluding oil and gas and... -

Page 67

... in some cases, compensation for alleged property damage, punitive damages and civil penalties. Occidental manages its environmental remediation efforts through a wholly owned subsidiary, Glenn Springs Holdings, Inc. (GSH), which reports its results directly to Occidental's corporate management. The... -

Page 68

...treatment plant in Western New York. Certain subsidiaries of OPC are currently addressing releases of substances from past operations at 13 active facilities. Four facilities -- certain oil and gas properties in the southwestern United States, a chemical plant in Louisiana, a chemical plant in Texas... -

Page 69

... 4, FIN 45 requires the disclosure in Occidental's financial statements of information relating to guarantees issued by Occidental and outstanding at December 31, 2003. These guarantees encompass performance bonds, letters of credit, indemnities, commitments and other forms of guarantees provided... -

Page 70

... sale of the investment in Equistar. The credit for deferred state and local income taxes in 2001 reflects a benefit of $70 million related to the settlement of a state tax issue, deferred tax reversing due to the sale of the entity owning pipelines in Texas that were leased to a former subsidiary... -

Page 71

For the years ended December 31 U.S. federal statutory tax rate Operations outside the United States (a) Benefit from sale of subsidiary stock State taxes, net of federal benefit Other Tax rate provided by Occidental 2003 ======== 35 % 8 -1 (1) -------43 % ======== 2002 ======== 35 % 12 (21) -1... -

Page 72

...STOCK Occidental has authorized 50,000,000 shares of preferred stock with a par value of $1.00 per share. At December 31, 2003, 2002 and 2001, Occidental had no outstanding shares of preferred stock...STOCK OPTIONS Number of anti-dilutive options (in millions) Price range Expiration range 2003 ... -

Page 73

... awards. The company has also established the 1996 Restricted Stock Plan for non-employee directors, where non-employee directors receive awards of restricted stock as additional compensation for their services as members of the Board of Directors. A maximum of 150,000 shares of stock may be awarded... -

Page 74

... award grants assume a 100-percent payout on the date of grant. 57 NOTE 13 RETIREMENT PLANS AND POSTRETIREMENT BENEFITS Occidental has various defined benefit and defined contribution retirement plans for its salaried, domestic union and nonunion hourly, and certain foreign national employees... -

Page 75

... in 2003, $91 million in 2002 and $82 million in 2001. Pension costs for Occidental's defined benefit pension plans, determined by independent actuarial valuations, are generally funded by payments to trust funds, which are administered by independent trustees. A December 31 measurement date is used... -

Page 76

... monitored by Occidental's Investment Committee in its role as fiduciary. The Investment Committee, consisting of senior executives of the company, selects and employs various external professional investment management firms to manage specific assignments across the spectrum of asset classes. The... -

Page 77

... the Moody's Aa Corporate Bond Index. The weighted average rate of increase in future compensation levels is consistent with Occidental's past and anticipated future compensation increases for employees participating in retirement plans that determine benefits using compensation. The long-term rate... -

Page 78

... Energy, the operator of the Dolphin Project, and other various partnerships and joint ventures, discussed below. Equity investments paid dividends of $81 million, $22 million and $27 million to Occidental in 2003, 2002 and 2001, respectively. Cumulative undistributed earnings since acquisition... -

Page 79

...31, 2003. As Occidental ships product using the pipeline, its overall obligations will decrease with the reduction of the pipeline company's senior project debt. Occidental has a 50-percent interest in Elk Hills Power LLC (EHP), a limited liability company that operates a gas-fired, power-generation... -

Page 80

... of their operations. They are managed as separate business units because each requires and is responsible for executing a unique business strategy. The oil and gas segment explores for, develops, produces and markets crude oil and natural gas domestically and internationally. The chemical segment... -

Page 81

... 74 percent, 77 percent and 60 percent of net oil and gas sales for the periods ended December 31, 2003, 2002 and 2001, respectively. (b) Total product sales for the chemical segment were as follows: Basic Chemicals YEAR ENDED DECEMBER 31, 2003 Year ended December 31, 2002 Year ended December 31... -

Page 82

... revenue from an electricity co-generation facility in Taft, Louisiana. GEOGRAPHIC AREAS In millions For the years ended December 31 United States Qatar Colombia Yemen Ecuador Canada Oman Pakistan United Arab Emirates Other Foreign Total Net sales (a 2003 2002 2001 6,805 691 489 472 220 206... -

Page 83

... in oil and gas property acquisition, exploration and development activities, whether capitalized or expensed, were as follows: In millions DECEMBER 31, 2003 Acquisition of properties Proved Unproved Exploration costs Development costs Consolidated Subsidiaries Other United Latin Middle Eastern... -

Page 84

... Oil ($/bbl.) Natural gas ($/Mcf) Barrel of oil equivalent ($/bbl.)(b,c) Production costs Exploration expenses Other operating expenses Depreciation, depletion and amortization PRETAX INCOME Income tax expense Consolidated Subsidiaries Other United Latin Middle Eastern States America East... -

Page 85

... to volumetric production payments for the years 2003, 2002 and 2001, respectively. 68 2003 QUARTERLY FINANCIAL DATA (Unaudited) In millions, except per-share amounts Three months ended Segment net sales Oil and gas Chemical Other MARCH 31 Occidental Petroleum Corporation and Subsidiaries JUNE... -

Page 86

... QUARTERLY FINANCIAL DATA (Unaudited) In millions, except per-share amounts Three months ended Segment net sales Oil and gas Chemical MARCH 31 Occidental Petroleum Corporation and Subsidiaries JUNE 30 SEPTEMBER 30 DECEMBER 31 $ 958 565 1,523 $ 1,165 702 1,867 $ 1,224 739 1,963... -

Page 87

.... In many cases, activity-based cost models for a reservoir are utilized to project operating costs as production rates and the number of wells for production and injection vary. A team consisting of the Chief Engineer of Worldwide Reservoir Characterization, the Chief Petrophysicist, the Manager of... -

Page 88

... in Russia and Yemen, partially offset by minority interests for a Colombian affiliate. All Middle East reserves are related to production-sharing contracts. 71 GAS RESERVES In billions of cubic feet In millions Consolidated Subsidiaries Other United Latin Middle Eastern States America East... -

Page 89

... case in the past. Other assumptions of equal validity would give rise to substantially different results. The year-end prices used to calculate future cash flows vary by producing area and market conditions. For the 2003, 2002 and 2001 disclosures, the West Texas Intermediate oil prices used were... -

Page 90

...bbl.) Gas -- Average sales price ($/Mcf) Average oil and gas production cost ($/bbl.) (b 2001 Oil -- Average sales price ($/bbl.) Gas -- Average sales price ($/Mcf) Average oil and gas production cost ($/bbl.) (b Consolidated Subsidiaries Other United Latin Middle Eastern States America(a) East... -

Page 91

... and wells capable of production). The numbers in parentheses indicate the number of wells with multiple completions. Wells at December 31, 2003 Oil -- Gross (a) Net (b) Gas -- Gross (a) Net (b Consolidated Subsidiaries Other United Latin Middle Eastern States America East Hemisphere Total 17... -

Page 92

...California Permian Horn Mountain Hugoton TOTAL Natural Gas (MMCF) California Hugoton Permian Horn Mountain TOTAL Latin America Crude oil (MBL) Colombia Ecuador TOTAL Middle East Crude oil (MBL) Oman Qatar Yemen TOTAL Other Eastern Hemisphere Crude oil (MBL) Pakistan Natural Gas (MMCF) Pakistan 2003... -

Page 93

... Yemen - Occidental net interest 520 (5) 30 2 ---------547 ========== 492 (5) 27 1 ---------515 ========== 452 (3) 27 ----------476 ========== Total worldwide production 77 SCHEDULE II - VALUATION AND QUALIFYING ACCOUNTS In millions Occidental Petroleum Corporation and Subsidiaries 2003... -

Page 94

... caption "Election of Directors" in Occidental's definitive proxy statement filed in connection with its April 30, 2004, Annual Meeting of Stockholders (2004 Proxy Statement). See also the list of Occidental's executive officers and related information under "Executive Officers of the Registrant" in... -

Page 95

... and each of its directors and certain executive officers (filed as Exhibit B to the Proxy Statement of Occidental for its May 21, 1987, Annual Meeting of Stockholders, File No. 1-9210). Occidental Petroleum Corporation Split Dollar Life Insurance Program and Related Documents (filed as Exhibit 10... -

Page 96

... Occidental Petroleum Corporation Senior Executive Survivor Benefit Plan, dated February 28, 2002 (filed as Exhibit 10.2 to the Quarterly Report on Form 10-Q of Occidental for the quarterly period ended March 31, 2002, File No. 1-9210). Occidental Petroleum Corporation 1995 Incentive Stock Plan, as... -

Page 97

...10.27* 33-64719). Form of Incentive Stock Option Agreement under Occidental Petroleum Corporation 1995 Incentive Stock Plan (filed as Exhibit 10.2 to the Current Report on Form 8-K of Occidental, dated January 6, 1999 (date of earliest event reported), filed January 6, 1999, File No. 1-9210, amends... -

Page 98

... for Nonqualified Stock Option Award under Occidental Petroleum Corporation 2001 Incentive Compensation Plan (July 2003 version) (filed as Exhibit 10.4 to the Quarterly Report on Form 10-Q of Occidental for the quarterly period ended June 30, 2003, File No. 1-9210). Incorporated herein by... -

Page 99

... counseling program. Description of group excess liability insurance program. Securities Purchase Agreement, dated as of July 8, 2002, by and between Lyondell Chemical Company and Occidental Chemical Holding Corporation (incorporated by reference to Exhibit 10.1 to the Current Report on Form... -

Page 100

... authorized. OCCIDENTAL PETROLEUM CORPORATION March 1, 2004 By: /s/ RAY R. IRANI Ray R. Irani Chairman of the Board of Directors and Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf... -

Page 101

... Chazen /s/ SAMUEL P. DOMINICK, JR. ------------------------------Samuel P. Dominick, Jr. /s/ RONALD W. BURKLE ------------------------------Ronald W. Burkle Executive Vice President Corporate Development and Chief Financial Officer Vice President and Controller (Chief Accounting Officer) Director... -

Page 102

... of shares) under Occidental Petroleum Corporation 2001 Incentive Compensation Plan (December 2003 version - Occidental Chemical). Description of financial counseling program. Description of group excess liability insurance program. Statement regarding the computation of total enterprise ratios of... -

Page 103

-

Page 104

... to time by the Board of Directors and stated in the notice of the meeting or in a duly executed waiver of notice thereof. The Chairman of such meetings shall have plenary power and authority with respect to all matters relating to the conduct thereof including, without limitation, the authority to... -

Page 105

...otherwise prescribed by law or by the Certificate of Incorporation, Special Teetings of Stockholders, for any purpose or purposes, may be called by the Board of Directors or the Chairman of the Board. Written notice of a Special Teeting stating the place, date and hour of the meeting and the purpose... -

Page 106

SECTION 5. Voting. Unless otherwise required by law, the Certificate of Incorporation or these By-laws, any question brought before any meeting of stockholders shall be decided by the affirmative vote of a majority of the shares present in person or by proxy at the meeting for the purposes of ... -

Page 107

..., (iii) the class or series and number of shares of capital stock of the Corporation which are owned beneficially or of record by the person, and (iv) any other information relating to the person that is required to be disclosed in solicitations for proxies for election of directors pursuant to the... -

Page 108

... such powers of the Corporation and do all such lawful acts and things as are not by statute or by the Certificate of Incorporation or by these By-laws directed or required to be exercised or done by the stockholders. SECTION 5. Teetings. The Board of Directors of the Corporation may hold meetings... -

Page 109

... the Board of Directors in the management of the business and affairs of the Corporation. Teetings of any committee may be called by the Chairman of such committee, if there be one, or by any two members thereof other than such Chairman. Notice thereof stating the place, date and hour of the meeting... -

Page 110

.... ARTICLE IV OFFICERS SECTION 1. General. The officers of this Corporation shall be chosen by the Board of Directors and shall be a Chairman of the Board, who shall be the Chief Executive Officer, any number of Vice Chairmen, a President, a Senior Operating Officer, any number of Executive Vice... -

Page 111

...all books, reports, statements, certificates and other documents and records required by law to be kept or filed are properly kept or filed, as the case may be. SECTION 10. Treasurer. Subject to the direction of the Chief Financial Officer, the Treasurer shall have the custody of the corporate funds... -

Page 112

..., every holder of stock of any class or series in the Corporation shall be entitled to have a certificate signed by, or in the name of the Corporation (i) by the Chairman or Vice Chairman of the Board of Directors, or the President, an Executive Vice President or a Vice President and (ii) by... -

Page 113

... the Board of Directors may fix a new record date for the adjourned meeting. SECTION 6. Beneficial Owners. The Corporation shall be entitled to recognize the exclusive right of a person registered on its books as the owner of shares to receive dividends, and to vote as such owner, and to hold liable... -

Page 114

... by Corporation. Powers of attorney, proxies, waivers of meeting, consents and other instruments relating to securities owned by the Corporation may be executed in the name and on behalf of the Corporation by the Chairman of the Board, or such other officer or officers as the Board of Directors or... -

Page 115

... under this Article VIII (unless ordered by a court) shall be made by the Corporation only as authorized in the specific case upon a determination that indemnification of the director, officer, employee or agent is proper in the circumstances because he has met the applicable standard of conduct set... -

Page 116

... expert competence. The term "another enterprise" as used in this Section 4 shall mean any other corporation or any partnership, joint venture, trust or other enterprise of which such person is or was serving at the request of the Corporation as a director, officer, employee or agent. The provisions... -

Page 117

...or was serving at the request of such constituent corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, shall stand in the same position under the provisions of this Article VIII with respect to the resulting or surviving... -

Page 118

... of the Plan is to provide a tax-deferred opportunity for key management and highly compensated employees of the Occidental Petroleum Corporation and its Affiliates (as defined below) to accumulate additional retirement income through deferrals of compensation. ARTICLE II DEFINITIONS Whenever the... -

Page 119

...Plan pursuant to Article III. Company. "Company" means Occidental Petroleum Corporation, or any successor thereto, and any Affiliates. Company Management. "Company Management" means the Chairman of the Board, President or any Executive Vice President of Occidental Petroleum Corporation. Compensation... -

Page 120

... Payment Date Subaccount" means any subaccount of a Participant's DCP Deferral Account established to separately account for deferred Compensation (and interest credited thereto) that is subject to an Early Payment Benefit election. Eligible Employee. "Eligible Employee" means each key management... -

Page 121

... the Occidental Petroleum Corporation Medical Plan on the date of the Participant's termination of employment. Retirement Benefit. "Retirement Benefit" means the payment to a Participant of the value of the Participant's Deferral Accounts pursuant to Section 5.1 following Retirement. Retirement Plan... -

Page 122

... credited to a Participant's Savings Plan Restoration Account pursuant to Section 4.6. SEDCP. "SEDCP" means the Occidental Petroleum Corporation Senior Executive Deferred Compensation Plan under which certain Company executives deferred compensation. SEDCP Deferral Account. "SEDCP Deferral Account... -

Page 123

...the Executive Compensation and Human Resources Committee of the Board deems such an event to not be a Termination Event for the purposes of this Plan. Years of Service. "Years of Service" means the number of full years credited to a Participant under the Retirement Plan for vesting purposes. ARTICLE... -

Page 124

... Election Form filed pursuant to Section 4.1(a), an Eligible Employee may irrevocably elect to receive the 8 Compensation deferred pursuant to that election in a lump sum payment or in annual installments over two (2) to five (5) years commencing prior to Retirement on an Early Payment Date. If... -

Page 125

... January 1, 2003, amounts of deferred Compensation that are credited to a Deferral Account and amounts of Savings Plan Restoration Contributions that are credited to a Savings Plan Restoration Account prior to the end of a calendar month shall accrue interest from the date of crediting, computed on... -

Page 126

... days after the close of each Plan Year, a statement in such form as the Committee deems desirable, setting forth the Participant's Deferral Account(s). ARTICLE V BENEFITS 5.1 Termination of Employment for a Reason Other Than Death. (a) Form and Time of Benefit. Except as otherwise provided in this... -

Page 127

... Benefits. (a) If a Participant dies while employed by the Company prior to becoming eligible for Retirement, the Company shall pay to the Participant's Beneficiary in a single lump sum an amount equal to the value of the Participant's DCP Deferral Account and Savings Plan Restoration Account... -

Page 128

... shall pay to the Participant, as soon as practicable following such determination, an amount up to the balance of the Participant's Deferral Accounts that is necessary to meet the emergency ("Emergency Benefit"). Such payment shall come first from the amounts not credited to any Early Payment Date... -

Page 129

...of the vested balance of the Participant's Deferral Accounts, reduced by a penalty, which shall be forfeited to the Company, equal to 10% of the amount withdrawn from the Participant's Deferral Accounts. Such payment shall come first from the amounts not credited to any Early Payment Date Subaccount... -

Page 130

... the Company credits to a Participant's Deferral Accounts. (c) The tax withholding and reporting rules described in this subsection shall apply to payments made under the Plan pursuant to a Qualified Divorce Order, shall be subject to any applicable superceding guidance promulgated by the Internal... -

Page 131

...'s probate estate. 16 ARTICLE VII CLAIMS PROCEDURE All applications for benefits under the Plan shall be submitted to: Occidental Petroleum Corporation, Attention: Deferred Compensation Plan Committee, 10889 Wilshire Blvd., Los Angeles, CA 90024. Applications for benefits must be in writing... -

Page 132

... appeal, or (b) 365 days after an applicant's original application for benefits. ARTICLE VIII AMENDMENT AND TERMINATION OF PLAN 8.1 Amendment. The Board may amend the Plan in whole or in part at any time for any reason, including but not limited to, tax, accounting or other changes, which may result... -

Page 133

... shall not be effective prior to the date that is two years after the date the Board adopts a resolution to terminate the Plan, unless the termination of the Plan is required by a change in the tax or other applicable laws or accounting rules. Notwithstanding the foregoing, following a Termination... -

Page 134

... is made by mail, as of the date shown on the postmark on the receipt for registration or certification. 9.10 Applicable Law. The Plan shall be governed by and construed in accordance with the laws of the State of California to the extent such laws are not preempted by the Employee Retirement Income... -

Page 135

20 IN WITNESS WHEREOF, the Company has executed this document this ___ day of _____, 2003. OCCIDENTAL PETROLEUM CORPORATION By Richard W. Hallock Executive Vice-President, Human Resources 21 -

Page 136

...Delaware corporation ("Occidental") and, with its subsidiaries, (the "Company"), and the Eligible Employee receiving this Award (the "Grantee"). 1. GRANT OF RESTRICTED SHARE UNITS. In accordance with these Terms and Conditions and the Occidental Petroleum Corporation 2001 Incentive Compensation Plan... -

Page 137

... the terms and conditions of the Occidental Petroleum Corporation Deferred Stock Program as such Program may be amended from time to time ("the Deferral Program"). The administration of the Deferral Program is governed by the Executive Compensation and Human Resources Committee, whose decision on... -

Page 138

... purpose of implementing, administering and managing the Grantee's participation in the Plan. The Company holds or may receive from any agent designated by the Company certain personal information about the Grantee, including, but not limited to, the Grantee's name, home address and telephone -

Page 139

number, date of birth, social insurance number or other identification number, salary, nationality, job title, any shares of stock or directorships held in Occidental, details of this Restricted Share Unit award or any other entitlement to shares of stock awarded, canceled, exercised, vested, ... -

Page 140

... calculated for each peer company using the average of its last reported sale price per share of common stock on the New York Stock Exchange - Composite Transactions for the last ten trading days of 2003 and the average of its last reported sale price per share of common stock on the New York Stock... -

Page 141

...'s certification of the attainment of the Performance Goals or the Change in Control Event, as the case may be. 6. CREDITING AND PAYMENT OF DIVIDEND EQUIVALENTS. With respect to the number of Target Performance Shares listed above, the Grantee will be credited on the books and records of Occidental... -

Page 142

...any life insurance plan covering employees of the Company. Additionally, the Target Performance Shares are not part of normal or expected compensation or salary for any purposes, including, but not limited to calculation of any severance, resignation, termination, redundancy, end of service payments... -

Page 143

...and managing the Grantee's participation in the Plan. The Company holds or may receive from any agent designated by the Company certain personal information about the Grantee, including, but not limited to, the Grantee's name, home address and telephone number, date of birth, social insurance number... -

Page 144

... not in breach of local labor laws) and the Grantee irrevocably releases the Company from any such claim that may arise; if, notwithstanding the foregoing, any such claim is found by a court of competent jurisdiction to have arisen, then, by accepting these Terms and Conditions, the Grantee shall be... -

Page 145

... the purposes of these Terms and Conditions, Total Shareholder Return shall be calculated for each peer company using the average of its last reported sale price per share of common stock on the New York Stock Exchange - Composite Transactions for the last ten trading days of 2003 and the average of... -

Page 146

...'s certification of the attainment of the Performance Goals or the Change in Control Event, as the case may be. 6. CREDITING AND PAYMENT OF DIVIDEND EQUIVALENTS. With respect to the number of Target Performance Shares listed above, the Grantee will be credited on the books and records of Occidental... -

Page 147

...life insurance plan covering employees of the 3 Company. Additionally, the Target Performance Shares are not part of normal or expected compensation or salary for any purposes, including, but not limited to calculation of any severance, resignation, termination, redundancy, end of service payments... -

Page 148

...and managing the Grantee's participation in the Plan. The Company holds or may receive from any agent designated by the Company certain personal information about the Grantee, including, but not limited to, the Grantee's name, home address and telephone number, date of birth, social insurance number... -

Page 149

..., the Grantee is not, and will not be considered, an employee of Occidental but the Grantee is a third party (employee of a subsidiary) to whom this Target Performance Share award is granted; (ii) the Grantee's participation in the Plan is voluntary; (iii) the future value of any Common shares... -

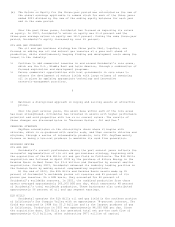

Page 150

10% 9% 8% 7% 6% 100% 75% 50% 25% 0% If actual ROA falls between stated ROA's, payout percentages will be interpolated. 6 -

Page 151

... Chief Executive Officer; the President; Chairman, President and Chief Executive Officer of Occidental Oil and Gas; and the Chief Financial Officer and Executive Vice President Corporate Development and their direct reports. Under the Program, the Company pays for covered financial planning services... -

Page 152

... CORPORATION GROUP EXCESS LIABILITY INSURANCE PROGRAM Certain executives of Occidental Petroleum Corporation and its subsidiaries are selected to participate in Occidental's Group Excess Liability Insurance Program. Occidental pays the premium for the insurance. The insurance is an umbrella policy... -

Page 153

...OCCIDENTAL PETROLEUM CORPORATION AND SUBSIDIARIES COMPUTATION OF TOTAL ENTERPRISE RATIOS OF EARNINGS TO FIXED CHARGES (Amounts in millions, except ratios) For the years ended December 31 Income from continuing operations Add: Minority interest (a) Adjusted income from equity investments (b) 2003... -

Page 154

... International Exploration and Production Company Occidental International Holdings Ltd. Occidental International Oil and Gas Ltd. Occidental Mexico Holdings, Inc. Occidental of Elk Hills, Inc. Jurisdiction of Formation Texas Delaware Delaware Texas Delaware Delaware Delaware Chile New York... -

Page 155

...-104827) on Forms S-3 and S-8 of Occidental Petroleum Corporation of our report dated February 13, 2004, with respect to the consolidated balance sheets of Occidental Petroleum Corporation as of December 31, 2003 and 2002, and the related consolidated statements of operations, stockholders' equity... -

Page 156

CERTIFICATIONS I, Ray R. Irani, certify that: EXHIBIT 31.1 1. I have reviewed this annual report on Form 10-K of Occidental Petroleum Corporation; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the ... -

Page 157

... I. Chazen, certify that: EXHIBIT 31.2 1. I have reviewed this annual report on Form 10-K of Occidental Petroleum Corporation; 2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made... -

Page 158

...Annual Report on Form 10-K of Occidental Petroleum Corporation (the "Company") for the fiscal period ended December 31, 2003, as filed with the Securities and Exchange Commission on March 1, 2004 (the "Report"), Ray R. Irani, as Chief Executive Officer of the Company, and Stephen I. Chazen, as Chief...