Occidental Petroleum 2002 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2002 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.New York Stock Exchange and quarterly dividend information.

In 2002, the quarterly dividend rate for the common stock was $.25 per

share. On December 10, 2002, a dividend of $.26 per share was declared on the

common stock, payable on April 15, 2003 to stockholders of record on March 10,

2003. The declaration of future cash dividends is a business decision made by

the Board of Directors from time to time, and will depend on Occidental's

financial condition and other factors deemed relevant by the Board.

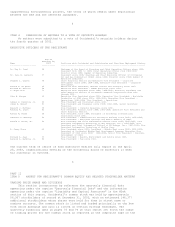

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

Occidental has three equity compensation plans for its employees that were

approved by the stockholders, pursuant to which options, rights or warrants may

be granted and one equity compensation plan for its nonemployee directors that

was approved by the stockholders. See Note 11 to the Consolidated Financial

Statements for further information on the material terms of these plans.

Occidental has no other equity compensation plans pursuant to which options,

rights or warrants could be granted.

The following is a summary of the shares reserved for issuance as of

December 31, 2002, pursuant to outstanding options, rights or warrants granted

under Occidental's equity compensation plans:

(a) Number of (b) Weighted- (c) Number of securities

securities to be average remaining available

issued, upon exercise price for future issuance

exercise of out- of outstanding under equity

standing options, options, compensation plans,

warrants and warrants and excluding securities in

rights rights column (a)

---------------------- ------------------- -------------------------

26,971,625 $24.2191 8,202,122 *

* Includes, with respect to the 1995 Incentive Stock Plan, 2,231,700 shares

at maximum target level (1,115,850 at target level) reserved for issuance

pursuant to outstanding performance stock awards, including 855,372 shares

at maximum target level (427,686 at target level) eligible for

certification in February 2003, and 313,276 deferred performance and

restricted stock awards and, with respect to the 2001 Incentive

Compensation Plan, 623,094 shares at maximum target level (311,547 at

target level) reserved for issuance pursuant to outstanding performance

stock awards, 923,224 shares reserved for issuance pursuant to restricted

stock awards and 2,025 shares reserved for issuance as dividend equivalents

under the 2001 Incentive Compensation Plan. Of the remaining 4,108,803

shares, 4,049,638 shares are available under the 2001 Incentive

Compensation Plan, all of which may be issued or reserved for issuance for

options, rights and warrants as well as performance stock awards,

restricted stock awards, stock bonuses and dividend equivalents and 59,165

shares are available for issuance under the Restricted Stock Plan for

nonemployee directors.

7

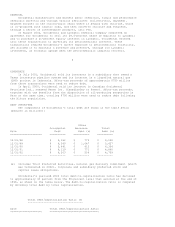

ITEM 6 SELECTED FINANCIAL DATA

FIVE-YEAR SUMMARY OF SELECTED FINANCIAL DATA

Dollar amounts in millions, except per-share amounts

For the years ended December 31, 2002 2001 2000 1999 1998

============================================================== ========== ========== ========== ========== ==========

RESULTS OF OPERATIONS(a)