Occidental Petroleum 2002 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2002 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. Continental Shelf transactions. The chemical amount includes a net charge

for the sale of certain chemical operations.

(b) The 2002, 2001 and 2000 amounts are net of $21 million, $102 million and

$106 million, respectively, of interest income on notes receivable from

Altura partners.

(c) The 2001 tax amount excludes the income tax benefit of $188 million

attributed to the sale of the entity that owns a Texas intrastate pipeline

system. The tax benefit is included in Other.

(d) The 2002 amount includes $22 million of preferred distributions to the

Altura partners. The 2001 amount includes the after-tax loss of $272

million related to the sale of the entity that owns a Texas intrastate

pipeline system, a $109 million charge for environmental remediation

expenses and $104 million of preferred distributions to the Altura

partners. The 2000 amount includes the pre-tax gain on the sale of the

CanadianOxy investment of $493 million, partially offset by preferred

distributions to the Altura partners of $107 million. The preferred

distributions are essentially offset by the interest income discussed in

(b) above.

14

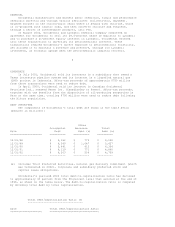

OIL AND GAS

In millions, except as indicated 2002 2001 2000

========================================= ======== ======== ========

SEGMENT SALES $ 4,634 $ 5,134 $ 4,875

SEGMENT EARNINGS $ 1,707 $ 2,845 $ 2,417

CORE EARNINGS (a) $ 1,707 $ 2,446 $ 2,417

NET PRODUCTION PER DAY

UNITED STATES

Crude oil and liquids (MBBL)

California 86 76 70

Permian 142 137 101

U.S. Other 4 -- 1

-------- -------- --------

Total 232 213 172

Natural Gas (MMCF)

California 286 303 306

Hugoton 148 159 168

Permian 130 148 119

U.S. Other -- -- 66

-------- -------- --------

Total 564 610 659

LATIN AMERICA

Crude oil & condensate (MBBL)

Colombia 40 21 37

Ecuador 13 13 17

-------- -------- --------

Total 53 34 54

MIDDLE EAST AND

OTHER EASTERN HEMISPHERE

Crude oil & condensate (MBBL)

Oman 13 12 9

Pakistan 10 7 6

Qatar 42 43 49

Yemen 37 33 32

-------- -------- --------

Total 102 95 96

Natural Gas (MMCF)

Pakistan 63 50 49

-------- -------- --------

Total 63 50 49