Occidental Petroleum 2002 Annual Report Download - page 20

Download and view the complete annual report

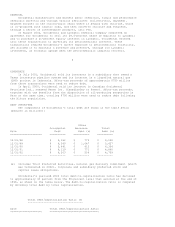

Please find page 20 of the 2002 Occidental Petroleum annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. CONSOLIDATED SUBSIDIARIES (MBOE) 492 452 440

Less: Colombia-minority interest (5) (3) (5)

Add: Russia-Occidental net interest 27 27 26

Add: Yemen-Occidental net interest 1 -- --

-------- -------- --------

TOTAL WORLDWIDE PRODUCTION 515 476 461

======== ======== ========

AVERAGE SALES PRICES

CRUDE OIL PRICES ($ per barrel)

U.S. $ 23.47 $ 21.74 $ 26.66

Latin America $ 23.14 $ 20.10 $ 26.07

Middle East and

Other Eastern Hemisphere (e) $ 24.01 $ 22.97 $ 26.92

Total consolidated subsidiaries $ 23.56 $ 21.91 $ 26.62

Other interests $ 14.80 $ 15.57 $ 18.60

Total worldwide $ 22.91 $ 21.41 $ 25.99

GAS PRICES ($ per thousand cubic feet)

U.S. $ 2.89 $ 6.40 $ 3.66

Middle East and

Other Eastern Hemisphere $ 2.08 $ 2.29 $ 1.99

Total worldwide $ 2.81 $ 6.09 $ 3.53

EXPENSED EXPLORATION (b) $ 176 $ 184 $ 94

CAPITAL EXPENDITURES

Development $ 897 $ 918 $ 582

Exploration $ 55 $ 86 $ 79

Acquisitions and other (c, d) $ 86 $ 134 $ 77

----------------------------------------- -------- -------- --------

(a) Occidental's results of operations often include the effects of significant

transactions and events affecting earnings that vary widely and

unpredictably in nature, timing and amount. Therefore, management uses a

measure called "core earnings", which excludes those items. This non-GAAP

measure is not meant to disassociate those items from management's

performance, but rather is meant to provide useful information to investors

interested in comparing Occidental's earnings performance between periods.

Core earnings is not considered to be an alternative to operating income in

accordance with generally accepted accounting principles.

(b) The 2002 amount includes a $33 million write-off for Lost Hills leases and

a $25 million write-off of the Thunderball well, both in California, and

the 2001 amount includes a $66 million write-off of the Gibraltar well in

Colombia.

(c) Includes mineral acquisitions but excludes significant acquisitions

individually discussed in this report.

(d) Includes capitalized portion of injected CO2 of $42 million, $48 million

and $44 million in 2002, 2001 and 2000, respectively.

(e) These amounts exclude implied taxes.

Occidental explores for and produces oil and natural gas, domestically and

internationally. Occidental seeks long-term growth and improvement in

profitability and cash flow through a combination of increased operating

efficiencies in core assets, enhanced oil recovery projects, focused exploration

opportunities and complementary property acquisitions.

Core earnings in 2002 were $1.7 billion compared with $2.4 billion in 2001.

The decrease in core earnings primarily reflects the impact of lower natural gas

prices and production volumes, partially offset by higher crude oil prices and

production volumes.

CHEMICAL

In millions, except as indicated 2002 2001 2000

========================================== ======== ======== ========

SEGMENT SALES $ 2,704 $ 2,968 $ 3,629

SEGMENT EARNINGS (LOSS) $ 275 $ (399) $ 141

CORE EARNINGS (a) $ 111 $ 13 $ 281